Question: Using traditional costing, using direct labours as a cost driver, calculate: -Total direct labour hours -calculate Overhead Absorption Rate (OAR)per labour hour -calculate overhead cost

-

Using traditional costing, using direct labours as a cost driver, calculate:

-Total direct labour hours

-calculate Overhead Absorption Rate (OAR)per labour hour

-calculate overhead cost allocated per Product A, B and C

-calculate overhead cost per unit for Product A, B and C

-

Using Activity Based Costing, calculate:

-Overhead absorption rate for each cost driver

-calculate overhead cost allocated per Product A, B and C

-calculate overhead cost per unit for Product A, B and C

-

Do a profitability analysis for all products using : Traditional method and ABC method

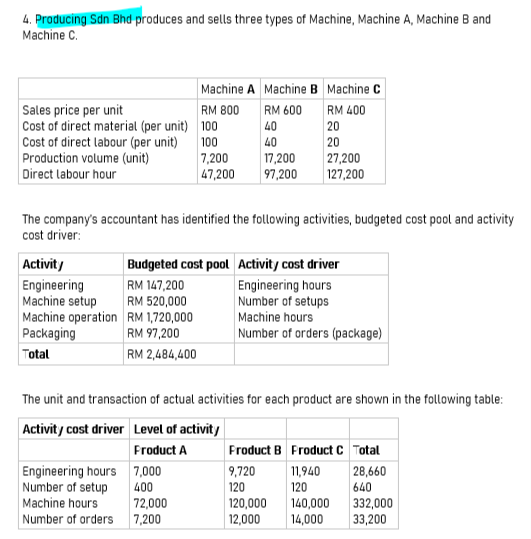

4. Producing Sdn Bhd produces and sells three types of Machine, Machine A, Machine B and Machine C Machine A Machine B Machine C Sales price per unit RM 800 RM 600 RM 400 Cost of direct material (per unit) 100 40 20 Cost of direct labour (per unit) 100 40 20 Production volume (unit) 7,200 17,200 27,200 Direct labour hour 47,200 97,200 127,200 The company's accountant has identified the following activities, budgeted cost pool and activity cost driver: Activity Budgeted cost pool Activity cost driver Engineering RM 147,200 Engineering hours Machine setup RM 520,000 Number of setups Machine operation RM 1,720,000 Machine hours Packaging RM 97,200 Number of orders (package) Total RM 2,484,400 The unit and transaction of actual activities for each product are shown in the following table: Activity cost driver Level of activit/ Froduct A Product B Product C Total Engineering hours 7,000 9,720 11,940 28,660 Number of setup 400 120 120 640 Machine hours 72,000 120,000 140,000 332,000 Number of orders 7,200 12,000 14,000 33,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts