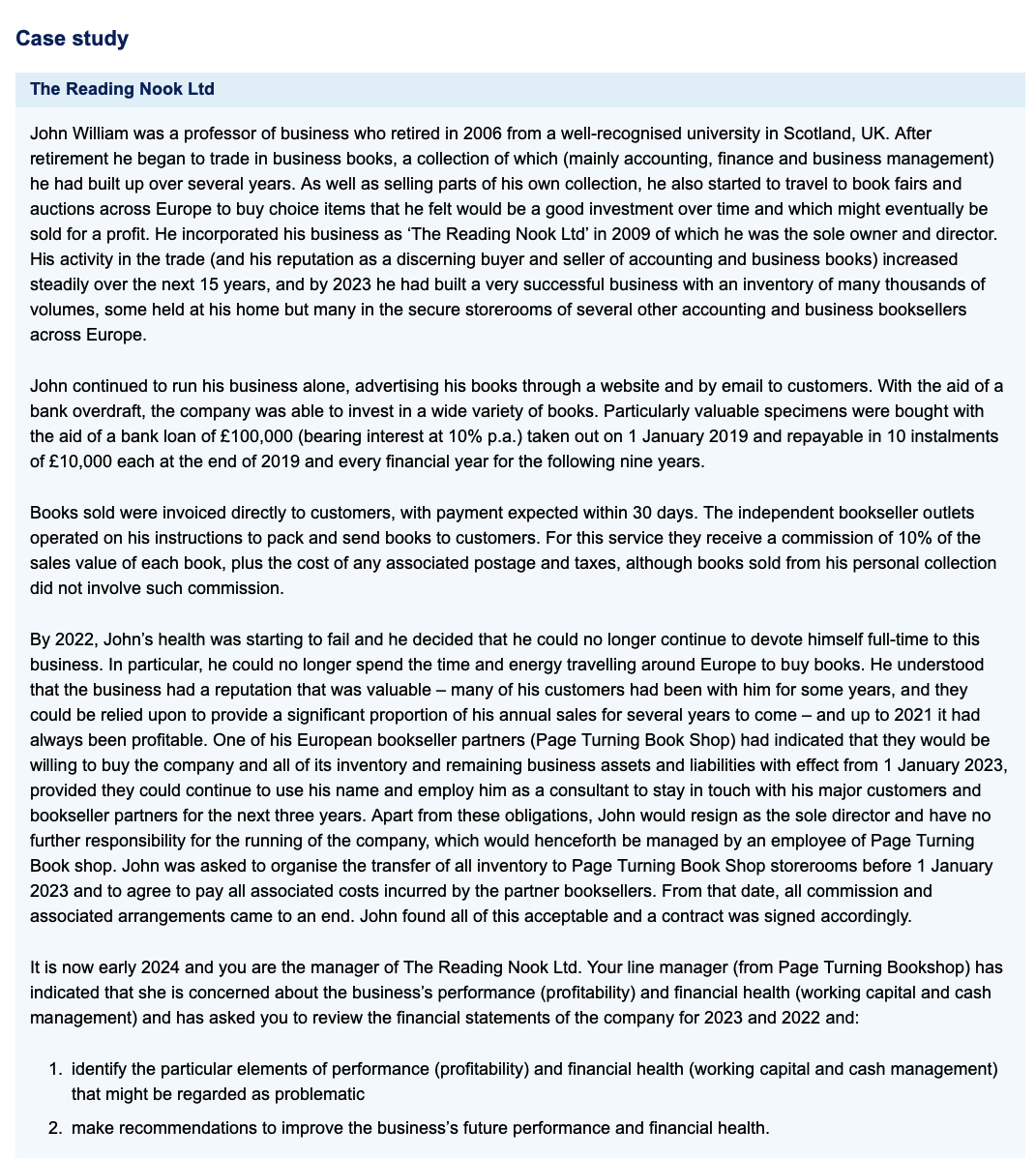

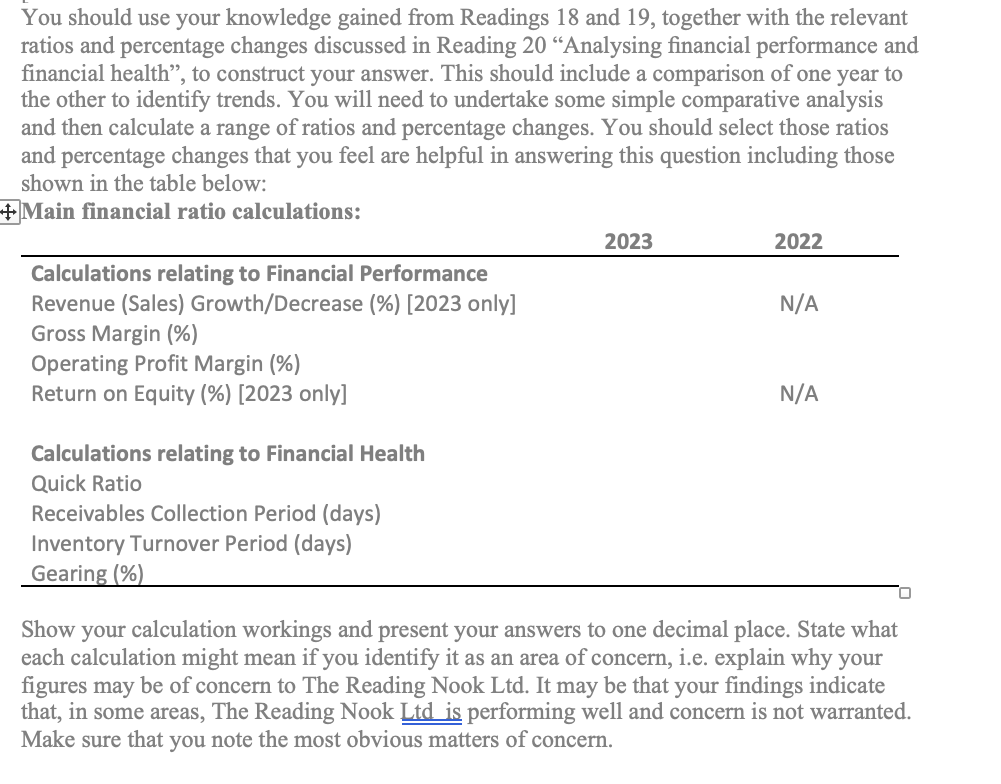

Question: Using trend analysis and appropriate ratios, analyse the financial statements that have been prepared by the business in the case study. In particular, comment on

- Using trend analysis and appropriate ratios, analyse the financial statements that have been prepared by the business in the case study. In particular, comment on the following aspects of the company:

- areas of concern in financial performance, focussing mainly on the performance statement

- areas of concern in financial health, focussing mainly on both the performance and position statements

- Using the analysis in your answer t, comment on the validity of the concerns expressed about the business by Page Turning Book Shop's finance director. What practical steps should now be undertaken to improve the financial performance and financial health of the business?

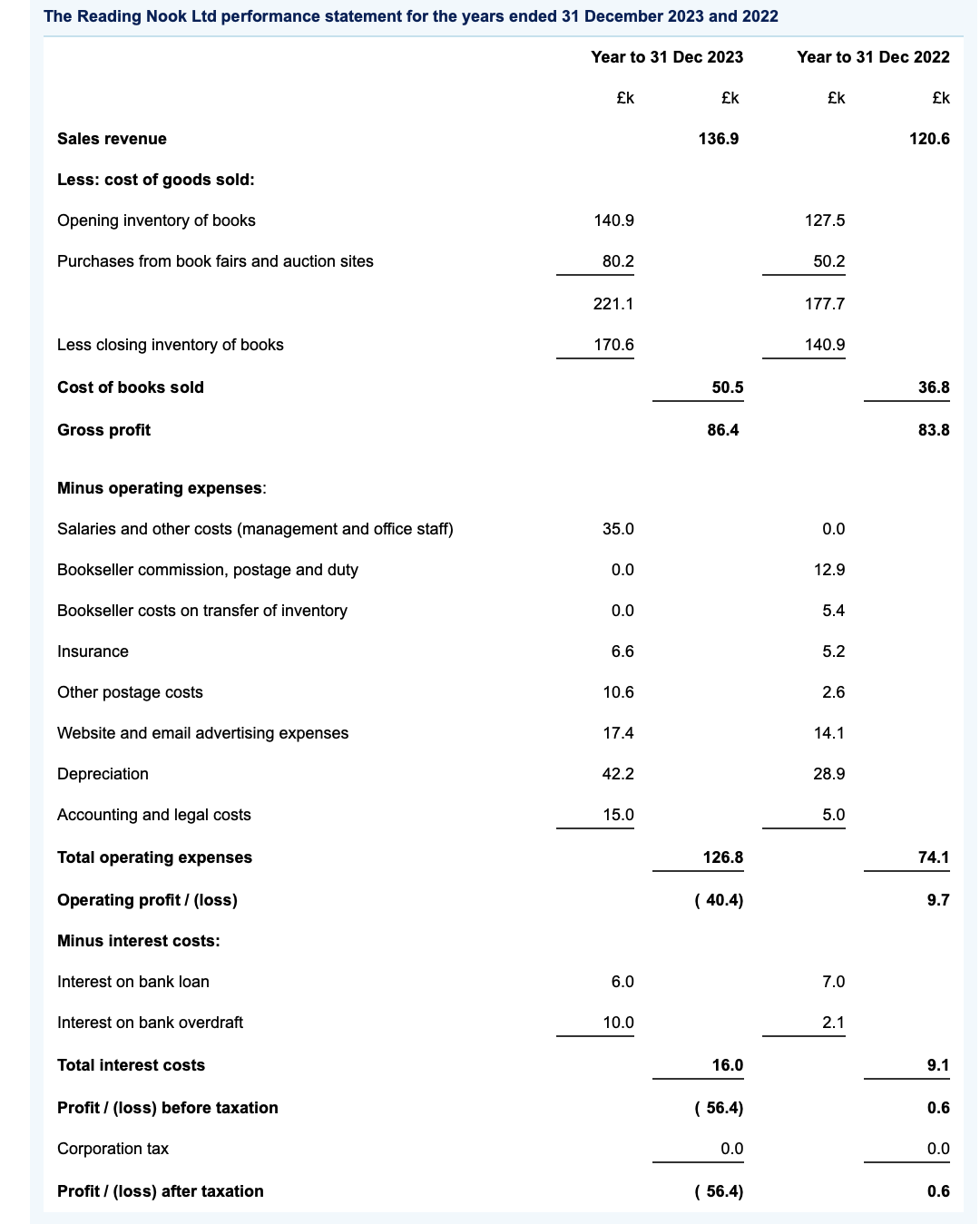

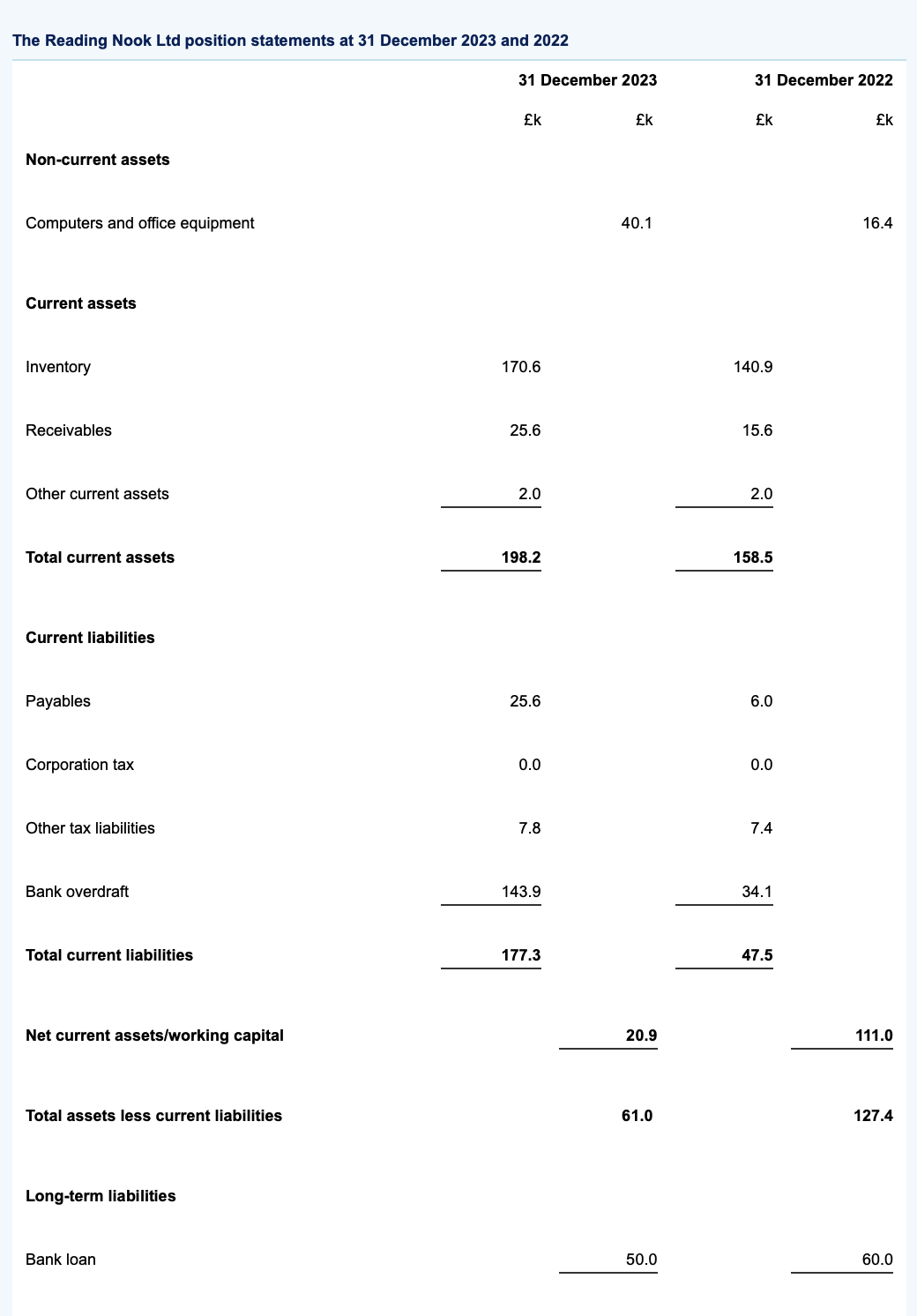

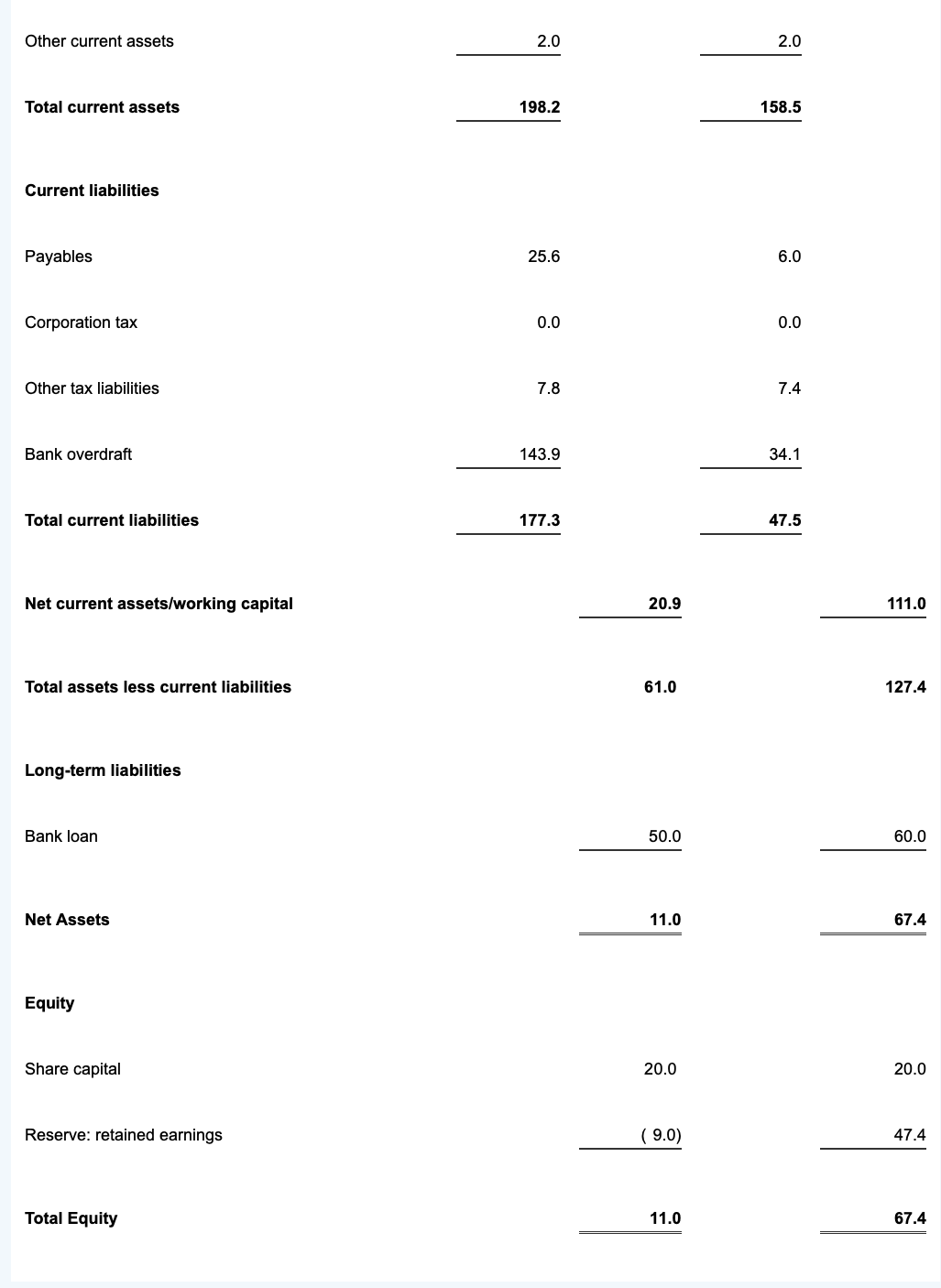

The Reading Nook Ltd performance statement for the years ended 31 December 2023 and 2022 Year to 31 Dec 2023 Year to 31 Dec 2022 k k k k 136.9 120.6 Sales revenue Less: cost of goods sold: Opening inventory of books 140.9 127.5 Purchases from book fairs and auction sites 80.2 50.2 221.1 177.7 170.6 140.9 Less closing inventory of books Cost of books sold 50.5 Gross profit 86.4 Minus operating expenses: Salaries and other costs (management and office staff) 35.0 0.0 Bookseller commission, postage and duty 0.0 12.9 Bookseller costs on transfer of inventory 0.0 5.4 Insurance 6.6 5.2 Other postage costs 10.6 2.6 Website and email advertising expenses 17.4 14.1 Depreciation 42.2 28.9 Accounting and legal costs 15.0 5.0 Total operating expenses Operating profit/(loss) Minus interest costs: Interest on bank loan Interest on bank overdraft Total interest costs Profit/(loss) before taxation Corporation tax Profit/(loss) after taxation 6.0 10.0 126.8 ( 40.4) 7.0 36.8 83.8 74.1 9.7 2.1 16.0 9.1 ( 56.4) 0.6 0.0 0.0 ( 56.4) 0.6

Step by Step Solution

There are 3 Steps involved in it

Based on the analysis of the financial statements provided for The Reading Nook Ltd for the years ended 31 December 2023 and 2022 my comments are as follows Areas of concern in financial performance R... View full answer

Get step-by-step solutions from verified subject matter experts