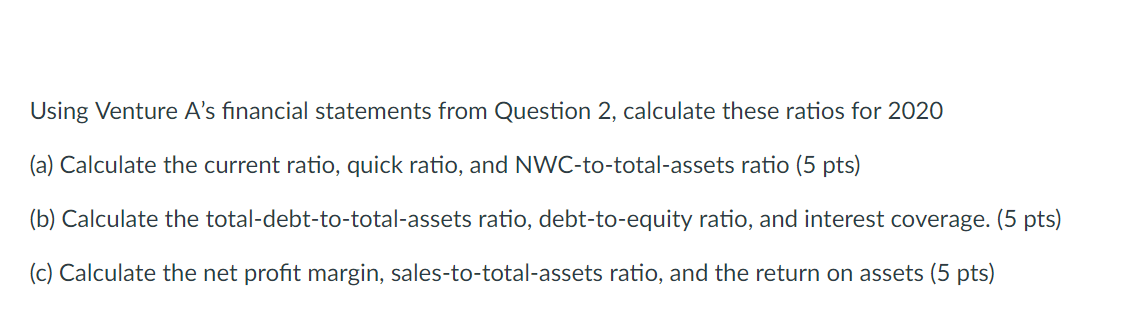

Question: Using Venture A's financial statements from Question 2, calculate these ratios for 2020 (a) Calculate the current ratio, quick ratio, and NWC-to-total-assets ratio (5 pts)

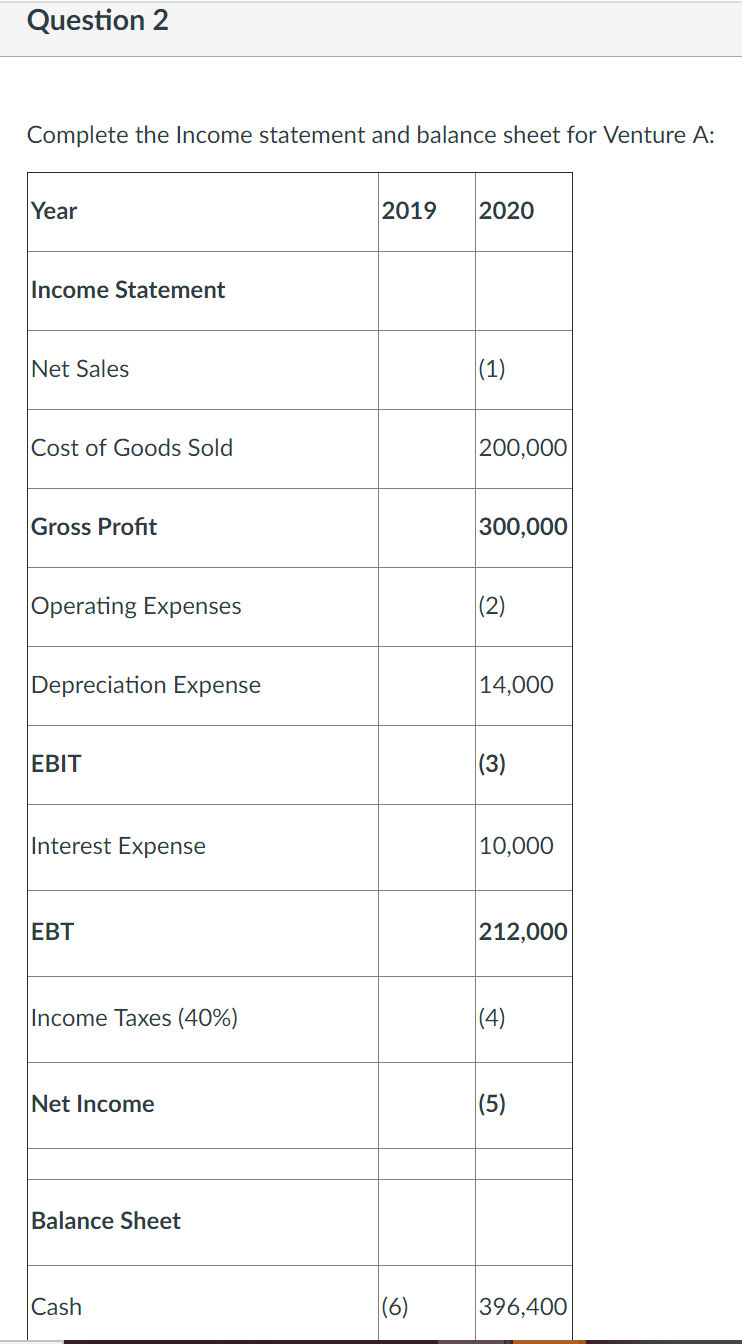

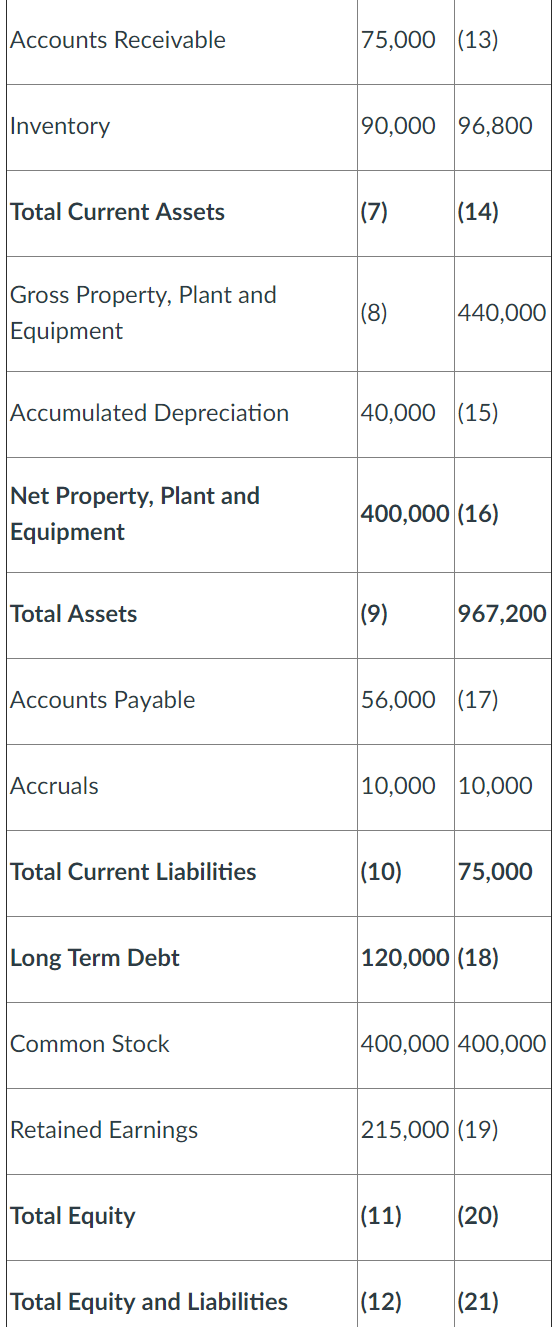

Using Venture A's financial statements from Question 2, calculate these ratios for 2020 (a) Calculate the current ratio, quick ratio, and NWC-to-total-assets ratio (5 pts) (b) Calculate the total-debt-to-total-assets ratio, debt-to-equity ratio, and interest coverage. (5 pts) (c) Calculate the net profit margin, sales-to-total-assets ratio, and the return on assets (5 pts) Question 2 Complete the Income statement and balance sheet for Venture A: Year 2019 2020 Income Statement E Net Sales (1) Cost of Goods Sold 200,000 Gross Profit 300,000 Operating Expenses (2) ) Depreciation Expense 14,000 EBIT (3) Interest Expense 10,000 EBT 212,000 Income Taxes (40%) (4) Net Income (5) ( Balance Sheet Cash (6) 396,400 Accounts Receivable 75,000 (13) Inventory 90,000 96,800 Total Current Assets (7) (14) Gross Property, Plant and Equipment 440,000 Accumulated Depreciation 40,000 (15) Net Property, Plant and Equipment 400,000 (16) Total Assets (9) 967,200 Accounts Payable 56,000 (17) Accruals 10,000 10,000 Total Current Liabilities (10) 75,000 Long Term Debt 120,000 (18) Common Stock 400,000 400,000 Retained Earnings 215,000 (19) Total Equity (11) (20) Total Equity and Liabilities (12) (21) Using Venture A's financial statements from Question 2, calculate these ratios for 2020 (a) Calculate the current ratio, quick ratio, and NWC-to-total-assets ratio (5 pts) (b) Calculate the total-debt-to-total-assets ratio, debt-to-equity ratio, and interest coverage. (5 pts) (c) Calculate the net profit margin, sales-to-total-assets ratio, and the return on assets (5 pts) Question 2 Complete the Income statement and balance sheet for Venture A: Year 2019 2020 Income Statement E Net Sales (1) Cost of Goods Sold 200,000 Gross Profit 300,000 Operating Expenses (2) ) Depreciation Expense 14,000 EBIT (3) Interest Expense 10,000 EBT 212,000 Income Taxes (40%) (4) Net Income (5) ( Balance Sheet Cash (6) 396,400 Accounts Receivable 75,000 (13) Inventory 90,000 96,800 Total Current Assets (7) (14) Gross Property, Plant and Equipment 440,000 Accumulated Depreciation 40,000 (15) Net Property, Plant and Equipment 400,000 (16) Total Assets (9) 967,200 Accounts Payable 56,000 (17) Accruals 10,000 10,000 Total Current Liabilities (10) 75,000 Long Term Debt 120,000 (18) Common Stock 400,000 400,000 Retained Earnings 215,000 (19) Total Equity (11) (20) Total Equity and Liabilities (12) (21)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts