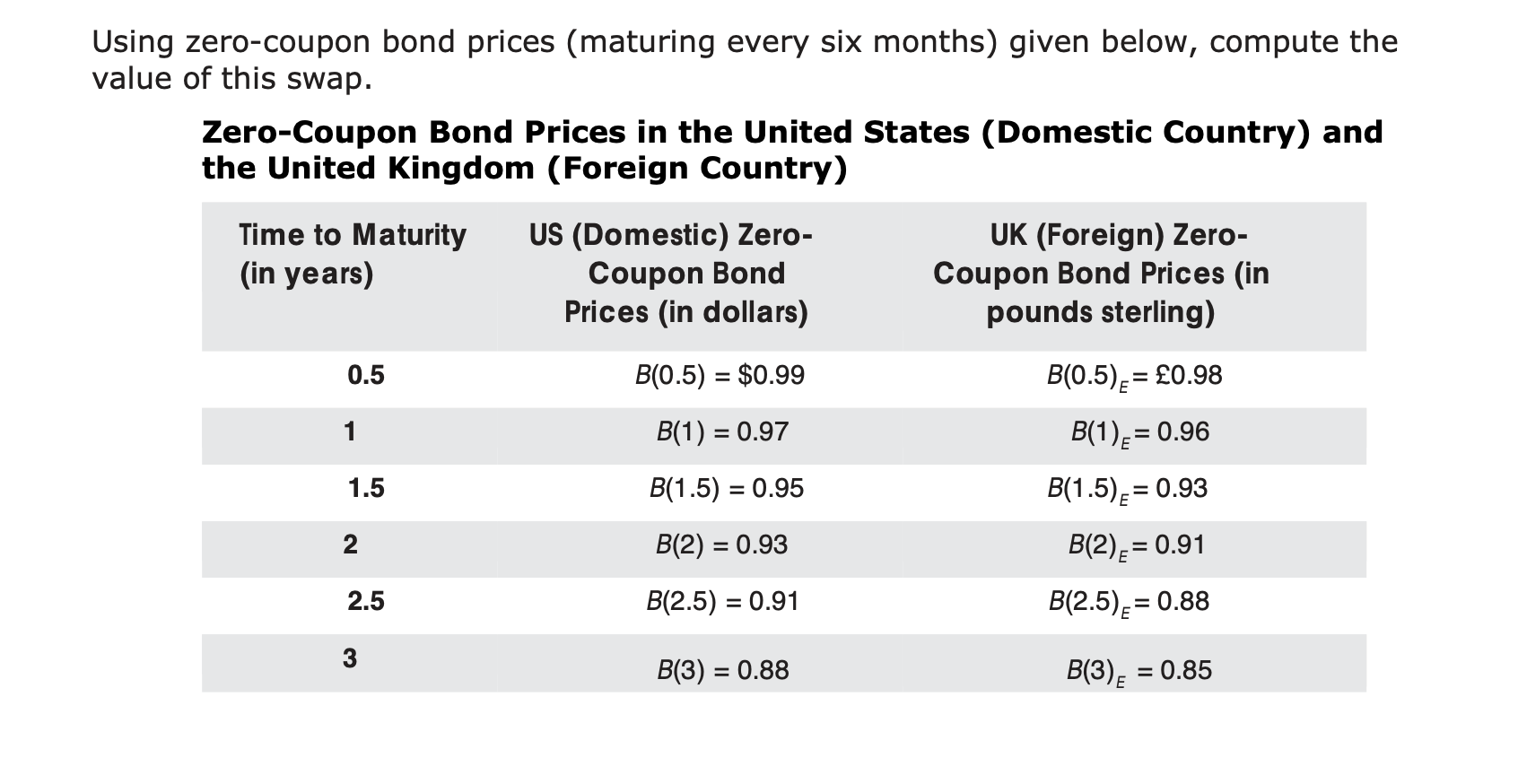

Question: Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap. Zero-Coupon Bond Prices in the United States (Domestic Country)

Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap. Zero-Coupon Bond Prices in the United States (Domestic Country) and the United Kingdom (Foreign Country) Time to Maturity (in years) US (Domestic) Zero- Coupon Bond Prices (in dollars) B(0.5) = $0.99 0.5 1 1.5 2 2.5 B(1) = 0.97 B(1.5) = 0.95 B(2) = 0.93 B(2.5) = 0.91 UK (Foreign) Zero- Coupon Bond Prices (in pounds sterling) B(0.5)= 0.98 B(1) = 0.96 B(1.5) = 0.93 B(2).= 0.91 B(2.5) = 0.88 B(3) = 0.88 B(3), = 0.85 Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap. Zero-Coupon Bond Prices in the United States (Domestic Country) and the United Kingdom (Foreign Country) Time to Maturity (in years) US (Domestic) Zero- Coupon Bond Prices (in dollars) B(0.5) = $0.99 0.5 1 1.5 2 2.5 B(1) = 0.97 B(1.5) = 0.95 B(2) = 0.93 B(2.5) = 0.91 UK (Foreign) Zero- Coupon Bond Prices (in pounds sterling) B(0.5)= 0.98 B(1) = 0.96 B(1.5) = 0.93 B(2).= 0.91 B(2.5) = 0.88 B(3) = 0.88 B(3), = 0.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts