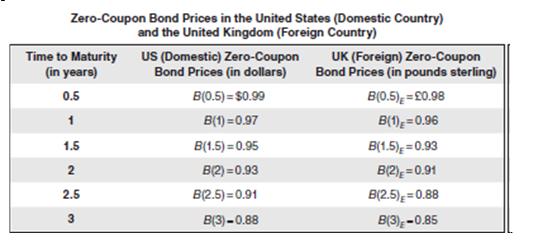

Question: Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap Zero-Coupon Bond Prices in the United States (Domestic Country)

Using zero-coupon bond prices (maturing every six months) given below, compute the value of this swap

Zero-Coupon Bond Prices in the United States (Domestic Country) and the United Kingdom (Foreign Country) Time to Maturity (in years) 0.5 US (Domestic) Zero-Coupon UK (Foreign) Zero-Coupon Bond Prices (in dollars) B(0.5)-$0.99 B(1)-0.97 B(1.5)-0.95 B(2)-0.93 B(2.5)-0.91 B(3)-0.88 Bond Prices (in pounds sterling) B(O.5)E-20.98 B(E 0.96 B(1.5) 0.93 B(2E-0.91 B(2.5)-0.88 BI3E-0.85 1.5 2.5

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Using the information from above todays cash flows cancel and do not affect the swap valuation As Americana will be receiving dollars and paying sterl... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

646-B-B-F-M (2695).docx

120 KBs Word File