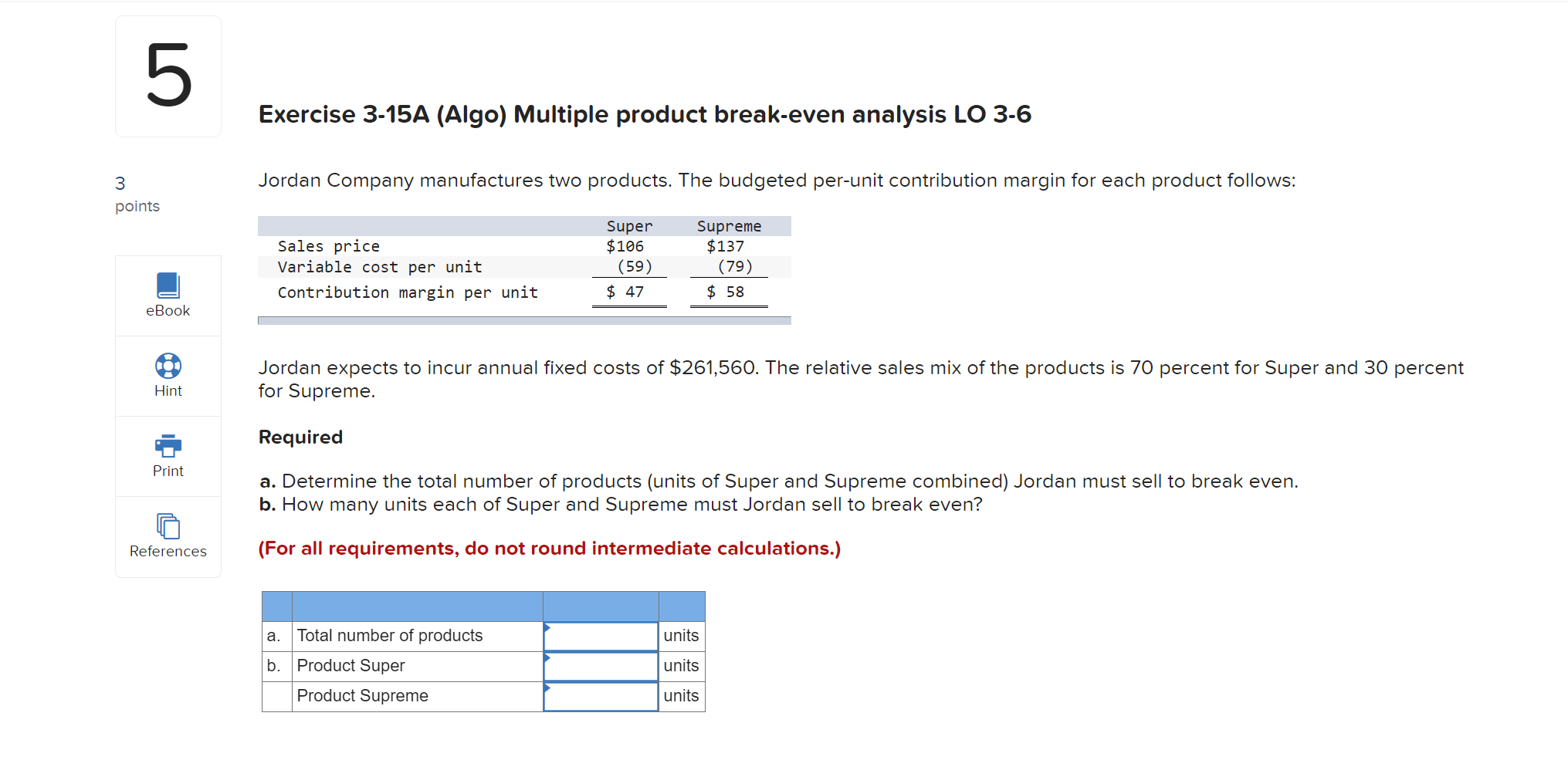

Question: UT Exercise 3-15A (Algo) Multiple product break-even analysis LO 3-6 3 Jordan Company manufactures two products. The budgeted per-unit contribution margin for each product follows:

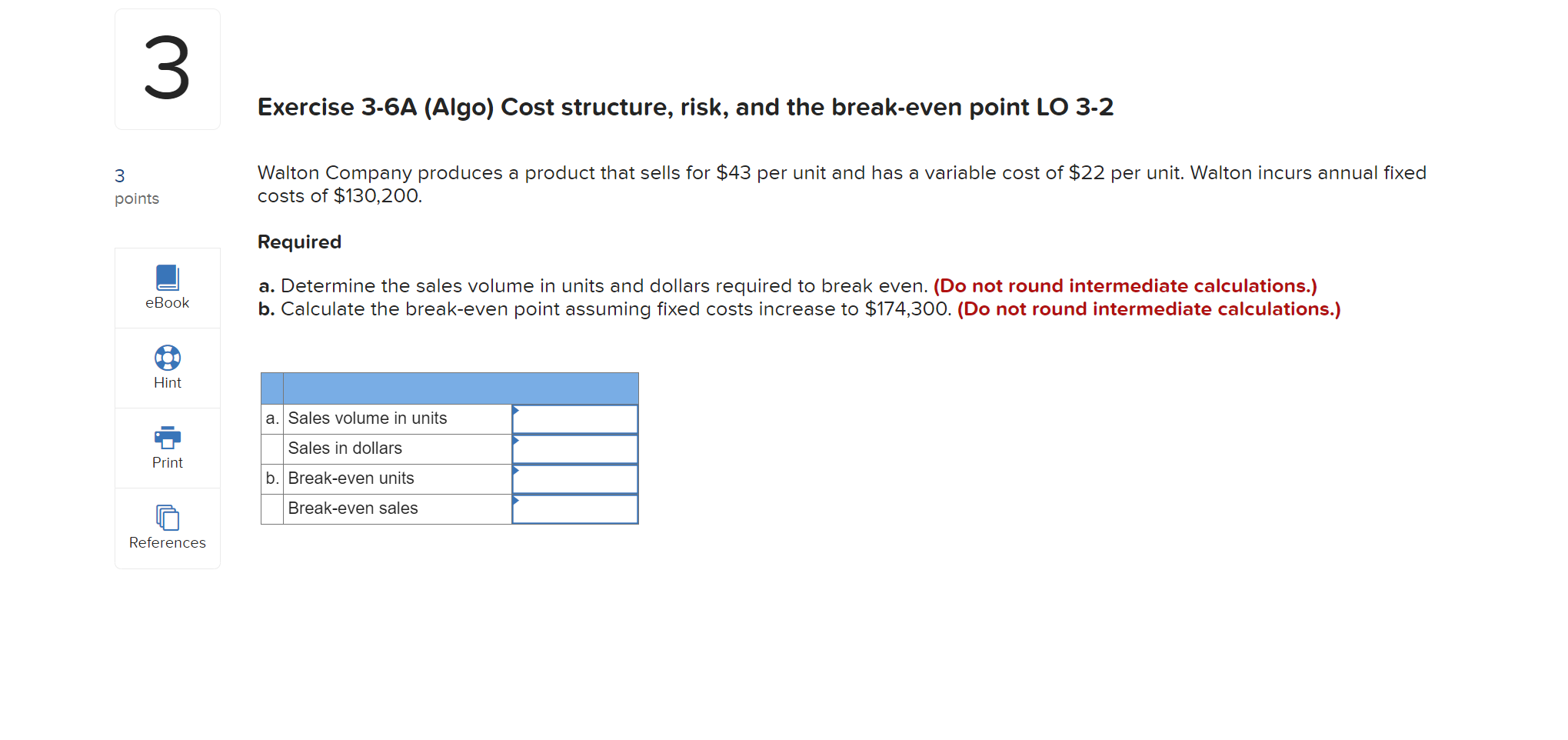

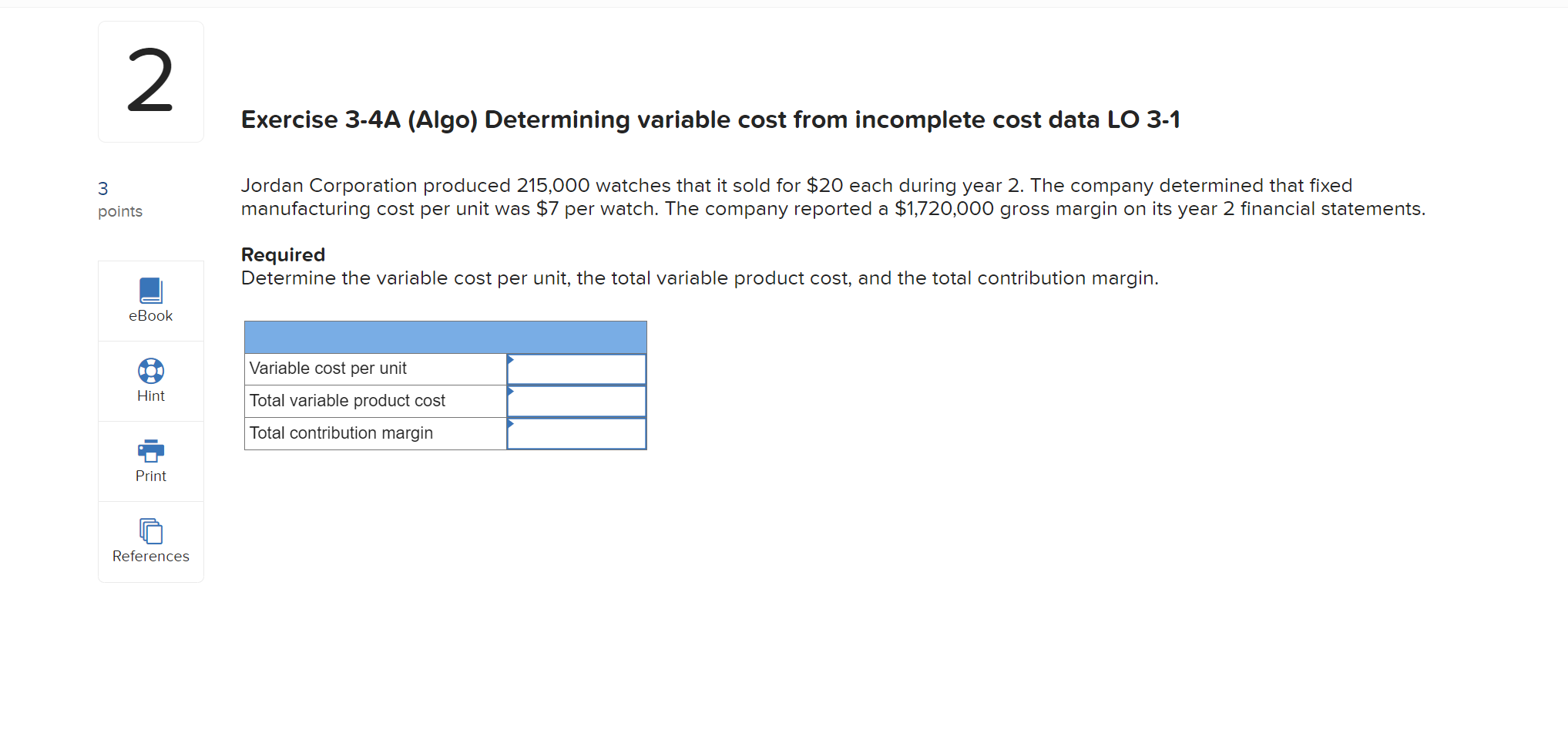

UT Exercise 3-15A (Algo) Multiple product break-even analysis LO 3-6 3 Jordan Company manufactures two products. The budgeted per-unit contribution margin for each product follows: points Sales price Variable cost per unit Contribution margin per unit Super $106 (59) $ 47 Supreme $137 (79) $ 58 eBook Jordan expects to incur annual fixed costs of $261,560. The relative sales mix of the products is 70 percent for Super and 30 percent for Supreme. Hint Required Print a. Determine the total number of products (units of Super and Supreme combined) Jordan must sell to break even. b. How many units each of Super and Supreme must Jordan sell to break even? References (For all requirements, do not round intermediate calculations.) a. Total number of products units units b. Product Super Product Supreme units 3 Exercise 3-6A (Algo) Cost structure, risk, and the break-even point LO 3-2 3 points Walton Company produces a product that sells for $43 per unit and has a variable cost of $22 per unit. Walton incurs annual fixed costs of $130,200. Required eBook a. Determine the sales volume in units and dollars required to break even. (Do not round intermediate calculations.) b. Calculate the break-even point assuming fixed costs increase to $174,300. (Do not round intermediate calculations.) Hint a. Sales volume in units Sales in dollars Print b. Break-even units Break-even sales References 2 Exercise 3-4A (Algo) Determining variable cost from incomplete cost data LO 3-1 3 points Jordan Corporation produced 215,000 watches that it sold for $20 each during year 2. The company determined that fixed manufacturing cost per unit was $7 per watch. The company reported a $1,720,000 gross margin on its year 2 financial statements. Required Determine the variable cost per unit, the total variable product cost, and the total contribution margin. eBook Variable cost per unit Hint Total variable product cost Total contribution margin Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts