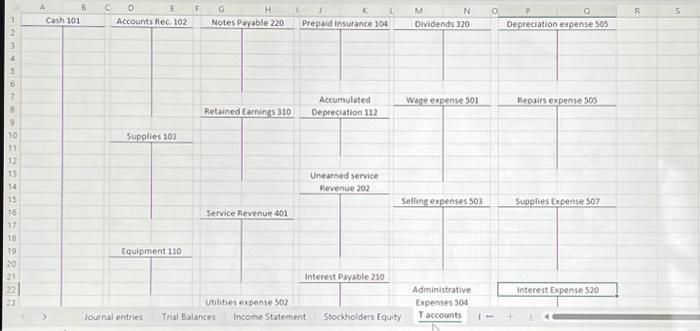

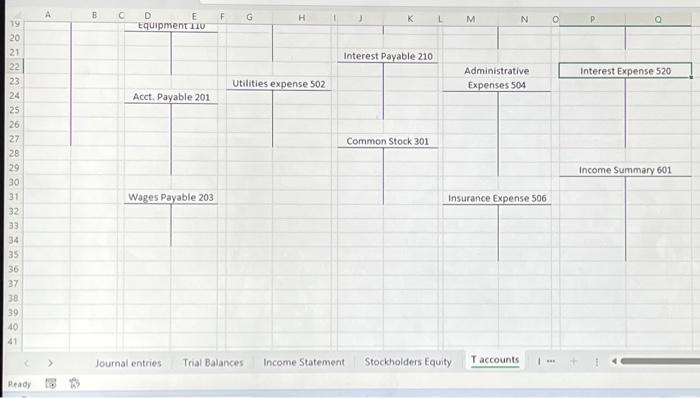

Question: Utilizing the information and templates provided, complete the following steps: 1. Journalize the transactions for the year 2. post the journal entries to a T

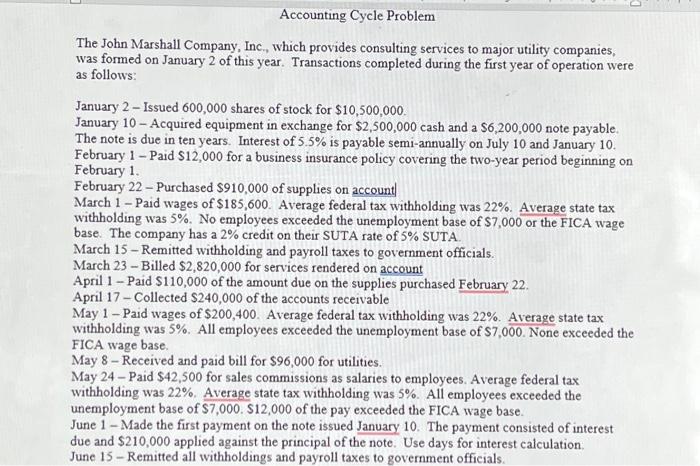

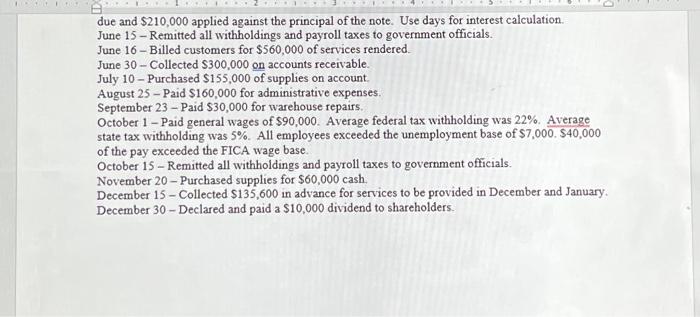

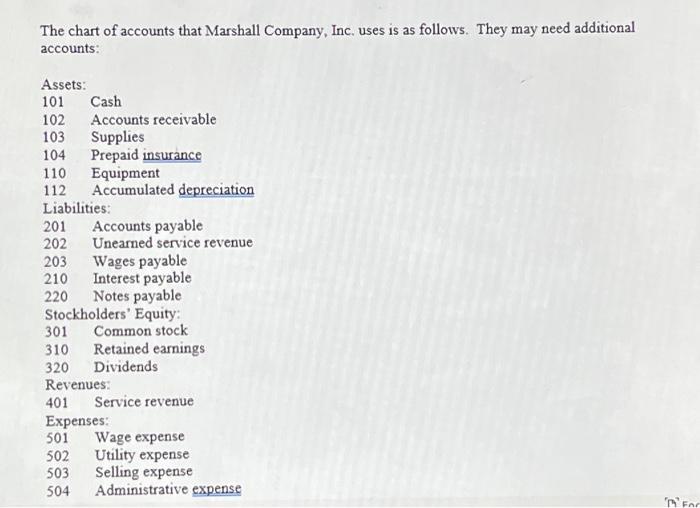

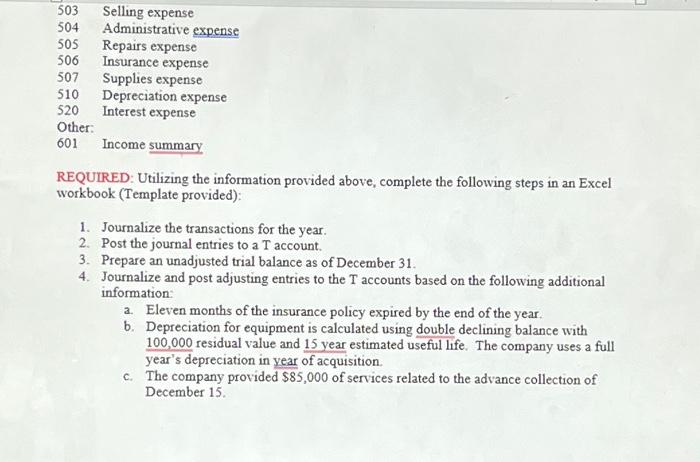

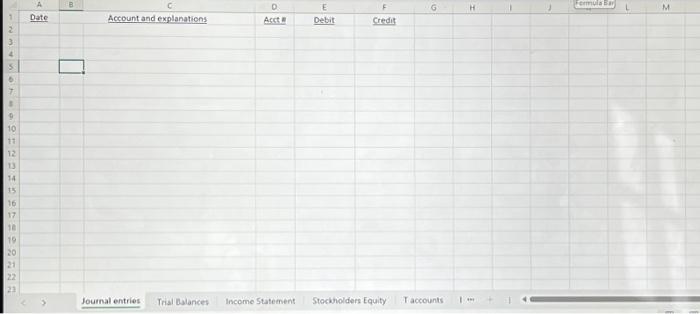

Accounting Cycle Problem The John Marshall Company, Inc., which provides consulting services to major utility companies, was formed on January 2 of this year. Transactions completed during the first year of operation were as follows: January 2 - Issued 600,000 shares of stock for $10,500,000. January 10 - Acquired equipment in exchange for $2,500,000 cash and a $6,200,000 note payable. The note is due in ten years. Interest of 5.5% is payable semi-annually on July 10 and January 10. February 1 - Paid $12,000 for a business insurance policy covering the two-year period beginning on February 1. February 22 - Purchased $910,000 of supplies on account March 1 - Paid wages of $185,600. Average federal tax withholding was 22%. Average state tax withholding was 5%. No employees exceeded the unemployment base of $7,000 or the FICA wage base. The company has a 2% credit on their SUTA rate of 5% SUTA. March 15 -Remitted withholding and payroll taxes to government officials. March 23 - Billed $2,820,000 for services rendered on account April 1 - Paid $110,000 of the amount due on the supplies purchased February 22. April 17 - Collected $240,000 of the accounts receivable May 1 - Paid wages of $200,400. Average federal tax withholding was 22%. Average state tax withholding was 5%. All employees exceeded the unemployment base of $7,000. None exceeded the FICA wage base. May 8 - Received and paid bill for $96,000 for utilities. May 24 - Paid $42,500 for sales commissions as salaries to employees. Average federal tax withholding was 22%. Average state tax withholding was 5%. All employees exceeded the unemployment base of $7,000.$12,000 of the pay exceeded the FICA wage base. June 1 - Made the first payment on the note issued January 10. The payment consisted of interest due and $210,000 applied against the principal of the note. Use days for interest calculation. June 15 - Remitted all withholdings and payroll taxes to government officials. due and $210,000 applied against the principal of the note. Use days for interest calculation. June 15 - Remitted all withholdings and payroll taxes to government officials. June 16 - Billed customers for $560,000 of services rendered. June 30 - Collected $300,000 on accounts receivable. July 10 - Purchased $155,000 of supplies on account. August 25 - Paid $160,000 for administrative expenses. September 23 - Paid $30,000 for warehouse repairs. October 1 - Paid general wages of $90,000. Average federal tax withholding was 22%. Average state tax withholding was 5%. All employees exceeded the unemployment base of $7,000,$40,000 of the pay exceeded the FICA wage base. October 15 - Remitted all withholdings and payroll taxes to government officials. November 20 - Purchased supplies for $60,000 cash. December 15 - Collected $135,600 in advance for services to be provided in December and January. December 30 - Declared and paid a $10,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows. They may need additional accounts: Assets: 101 Cash 102 Accounts receivable 103 Supplies 104 Prepaid insurance 110 Equipment 112 Accumulated depreciation Liabilities: 201 Accounts payable 202 Unearned service revenue 203 Wages payable 210 Interest payable 220 Notes payable Stockholders' Equity: 301 Common stock 310 Retained earnings 320 Dividends Revenues: 401 Service revenue Expenses: 501 Wage expense 502 Utility expense 503 Selling expense 504 Administrative expense REQUIRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31 . 4. Journalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance policy expired by the end of the year. b. Depreciation for equipment is calculated using double declining balance with 100,000 residual value and 15 year estimated useful life. The company uses a full year's depreciation in year of acquisition. c. The company provided $85,000 of services related to the advance collection of December 15 . d. There are $520,000 of supplies on hand at the end of the year. e. Interest has accrued on the note by the end of the year. f. Wilson accrued wages of $210,000 at the end of the year. All wages would be in. excess.of unemployment wage base and FICA wage base. g. John Marshall's attorney informed the company that it was probable they would be liable for an injury claim by a customer of somewhere between $5,000 and $10,000. 5. Prepare an adjusted trial balance as of December 31. 6. Prepare a single-step income statement and statement of retained earnings for the year ended December 31 and a classified balance sheet as of December 31 . 7. Journalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31 . bmit your completed Excel workbook in Black Board under assignments by the due date. Date Account and explanations Acct: F H Eermulosin M 2 3 4 54 6 T. 4 9 10 11 12 13 14 is 16. 17 18 19 20 21 22 23 Joumal entries Trisl Bulances Income statement Stockholders Equity T accounts 1 Trial Balance Worksheets Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation Accounts payable Unearned service revenue Wages payable interest payable Notes payable Common stock Retained earnings Dividends Service revenue Wage expense Utilities expense Selling expenses Administrative expenses Repairs expense Journal entries Trial Balances income Statement Stockholders Equity Taccounts fournal entres Irial Ealances Inceme statement stocknoldees tast. r.account A B c D E F G H K 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 27 Journal entries Trial Balances Income Statement Stockholders Equity Taccounts I Peafy 51 Accounting Cycle Problem The John Marshall Company, Inc., which provides consulting services to major utility companies, was formed on January 2 of this year. Transactions completed during the first year of operation were as follows: January 2 - Issued 600,000 shares of stock for $10,500,000. January 10 - Acquired equipment in exchange for $2,500,000 cash and a $6,200,000 note payable. The note is due in ten years. Interest of 5.5% is payable semi-annually on July 10 and January 10. February 1 - Paid $12,000 for a business insurance policy covering the two-year period beginning on February 1. February 22 - Purchased $910,000 of supplies on account March 1 - Paid wages of $185,600. Average federal tax withholding was 22%. Average state tax withholding was 5%. No employees exceeded the unemployment base of $7,000 or the FICA wage base. The company has a 2% credit on their SUTA rate of 5% SUTA. March 15 -Remitted withholding and payroll taxes to government officials. March 23 - Billed $2,820,000 for services rendered on account April 1 - Paid $110,000 of the amount due on the supplies purchased February 22. April 17 - Collected $240,000 of the accounts receivable May 1 - Paid wages of $200,400. Average federal tax withholding was 22%. Average state tax withholding was 5%. All employees exceeded the unemployment base of $7,000. None exceeded the FICA wage base. May 8 - Received and paid bill for $96,000 for utilities. May 24 - Paid $42,500 for sales commissions as salaries to employees. Average federal tax withholding was 22%. Average state tax withholding was 5%. All employees exceeded the unemployment base of $7,000.$12,000 of the pay exceeded the FICA wage base. June 1 - Made the first payment on the note issued January 10. The payment consisted of interest due and $210,000 applied against the principal of the note. Use days for interest calculation. June 15 - Remitted all withholdings and payroll taxes to government officials. due and $210,000 applied against the principal of the note. Use days for interest calculation. June 15 - Remitted all withholdings and payroll taxes to government officials. June 16 - Billed customers for $560,000 of services rendered. June 30 - Collected $300,000 on accounts receivable. July 10 - Purchased $155,000 of supplies on account. August 25 - Paid $160,000 for administrative expenses. September 23 - Paid $30,000 for warehouse repairs. October 1 - Paid general wages of $90,000. Average federal tax withholding was 22%. Average state tax withholding was 5%. All employees exceeded the unemployment base of $7,000,$40,000 of the pay exceeded the FICA wage base. October 15 - Remitted all withholdings and payroll taxes to government officials. November 20 - Purchased supplies for $60,000 cash. December 15 - Collected $135,600 in advance for services to be provided in December and January. December 30 - Declared and paid a $10,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows. They may need additional accounts: Assets: 101 Cash 102 Accounts receivable 103 Supplies 104 Prepaid insurance 110 Equipment 112 Accumulated depreciation Liabilities: 201 Accounts payable 202 Unearned service revenue 203 Wages payable 210 Interest payable 220 Notes payable Stockholders' Equity: 301 Common stock 310 Retained earnings 320 Dividends Revenues: 401 Service revenue Expenses: 501 Wage expense 502 Utility expense 503 Selling expense 504 Administrative expense REQUIRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31 . 4. Journalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance policy expired by the end of the year. b. Depreciation for equipment is calculated using double declining balance with 100,000 residual value and 15 year estimated useful life. The company uses a full year's depreciation in year of acquisition. c. The company provided $85,000 of services related to the advance collection of December 15 . d. There are $520,000 of supplies on hand at the end of the year. e. Interest has accrued on the note by the end of the year. f. Wilson accrued wages of $210,000 at the end of the year. All wages would be in. excess.of unemployment wage base and FICA wage base. g. John Marshall's attorney informed the company that it was probable they would be liable for an injury claim by a customer of somewhere between $5,000 and $10,000. 5. Prepare an adjusted trial balance as of December 31. 6. Prepare a single-step income statement and statement of retained earnings for the year ended December 31 and a classified balance sheet as of December 31 . 7. Journalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31 . bmit your completed Excel workbook in Black Board under assignments by the due date. Date Account and explanations Acct: F H Eermulosin M 2 3 4 54 6 T. 4 9 10 11 12 13 14 is 16. 17 18 19 20 21 22 23 Joumal entries Trisl Bulances Income statement Stockholders Equity T accounts 1 Trial Balance Worksheets Cash Accounts receivable Supplies Prepaid insurance Equipment Accumulated depreciation Accounts payable Unearned service revenue Wages payable interest payable Notes payable Common stock Retained earnings Dividends Service revenue Wage expense Utilities expense Selling expenses Administrative expenses Repairs expense Journal entries Trial Balances income Statement Stockholders Equity Taccounts fournal entres Irial Ealances Inceme statement stocknoldees tast. r.account A B c D E F G H K 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 27 Journal entries Trial Balances Income Statement Stockholders Equity Taccounts I Peafy 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts