Question: UW Estimation and Risk Analysis Back to Assignment Attempts Keep the Highest/5 6. Problem 12.08 (New Project Analysis) ebook You must evaluate the purchase of

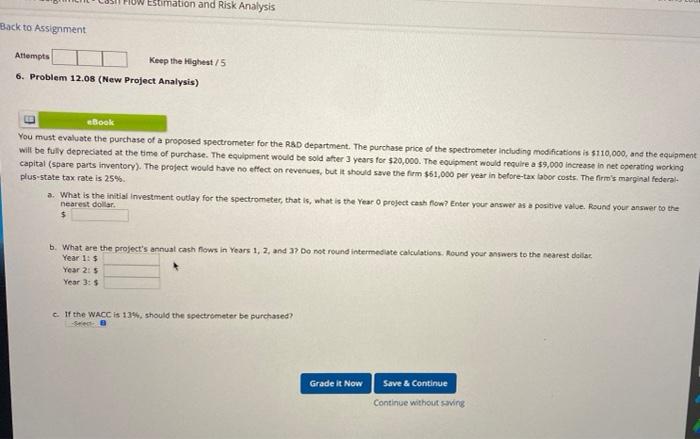

UW Estimation and Risk Analysis Back to Assignment Attempts Keep the Highest/5 6. Problem 12.08 (New Project Analysis) ebook You must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $110,000, and the equipment will be fully deprecated at the time of purchase. The equipment would be sold after 3 years for $20,000. The equipment would require a $9,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $61,000 per year in before-tex labor costs. The firm's marginal federal plus-state tax rate is 25% a. What is the initial investment outlay for the spectrometer, that is what is the Year O project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar $ b. What are the project's annual cash flows in Years 1, 2, anda? Do not round intermediate calculations. Round your answers to the nearest dollar Year 1:$ Year 2:5 Year 3: 5 c. If the WACC is 13%, should the spectrometer be purchased? Grade it Now Save & Continue Continue without swing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts