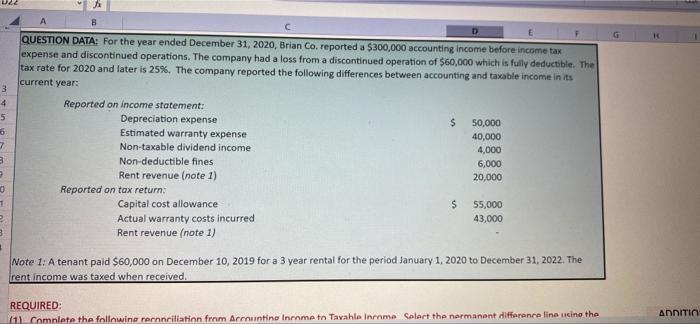

Question: UZ B 3 4 5 6 7 8 - QUESTION DATA: For the year ended December 31, 2020, Brian Co. reported a $300,000 accounting income

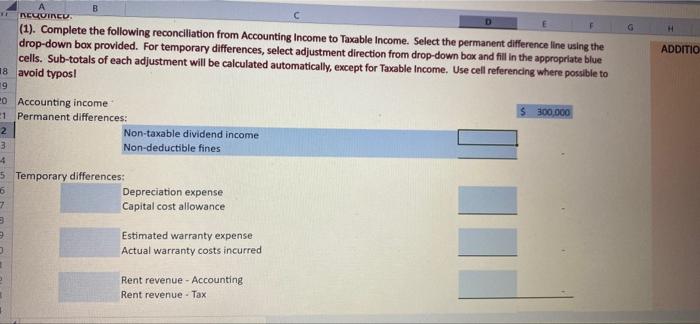

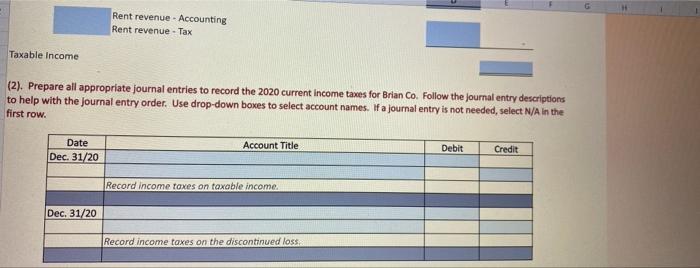

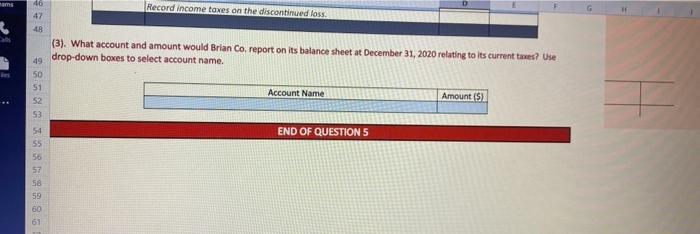

UZ B 3 4 5 6 7 8 - QUESTION DATA: For the year ended December 31, 2020, Brian Co. reported a $300,000 accounting income before income tax expense and discontinued operations. The company had a loss from a discontinued operation of $60,000 which is fully deductible. The tax rate for 2020 and later is 25%. The company reported the following differences between accounting and table income in its current year: Reported on income statement: Depreciation expense $ 50,000 Estimated warranty expense 40,000 Non-taxable dividend income 4,000 Non-deductible fines 6,000 Rent revenue (note 1) 20,000 Reported on tax return; Capital cost allowance $ 55,000 Actual warranty costs incurred 43,000 Rent revenue (note 1) 0 1 Note 1: A tenant paid $60,000 on December 10, 2019 for a 3 year rental for the period January 1, 2020 to December 31, 2022. The rent income was taxed when received REQUIRED: 11. Complete the following rernnrillation from Armounting Inrome to Tavahle Inrome Solart the narmanent difference line icing the ADDITIO B G H ADDITIO NEQUINCU (1). Complete the following reconciliation from Accounting Income to Taxable income. Select the permanent difference line using the drop-down box provided. For temporary differences, select adjustment direction from drop-down box and fill in the appropriate blue cells. Sub-totals of each adjustment will be calculated automatically, except for Taxable income. Use cell referencing where possible to 18 avoid typos! 19 0 Accounting income $ 300,000 1 Permanent differences: 2 Non-taxable dividend income Non-deductible fines 4 5. Temporary differences: Depreciation expense 7 Capital cost allowance 3 6 Estimated warranty expense Actual warranty costs incurred 3 Rent revenue - Accounting Rent revenue - Tax Rent revenue - Accounting Rent revenue - Tax Taxable income (2). Prepare all appropriate journal entries to record the 2020 current income taxes for Brian Co. Follow the journal entry descriptions to help with the journal entry order. Use drop-down boxes to select account names. If a journal entry is not needed, select N/A In the first row. Date Dec. 31/20 Account Title Debit Credit Record income taxes on taxable income Dec. 31/20 Record income taxes on the discontinued loss. moms 46 Record income taxes on the discontinued loss. G 47 48 (3). What account and amount would Brian Co, report on its balance sheet at December 31, 2020 relating to its current taxes? Use drop-down boxes to select account name. 50 51 52 53 Account Name Amount (5) 54 END OF QUESTION 5 55 50 57 58 59 60 61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts