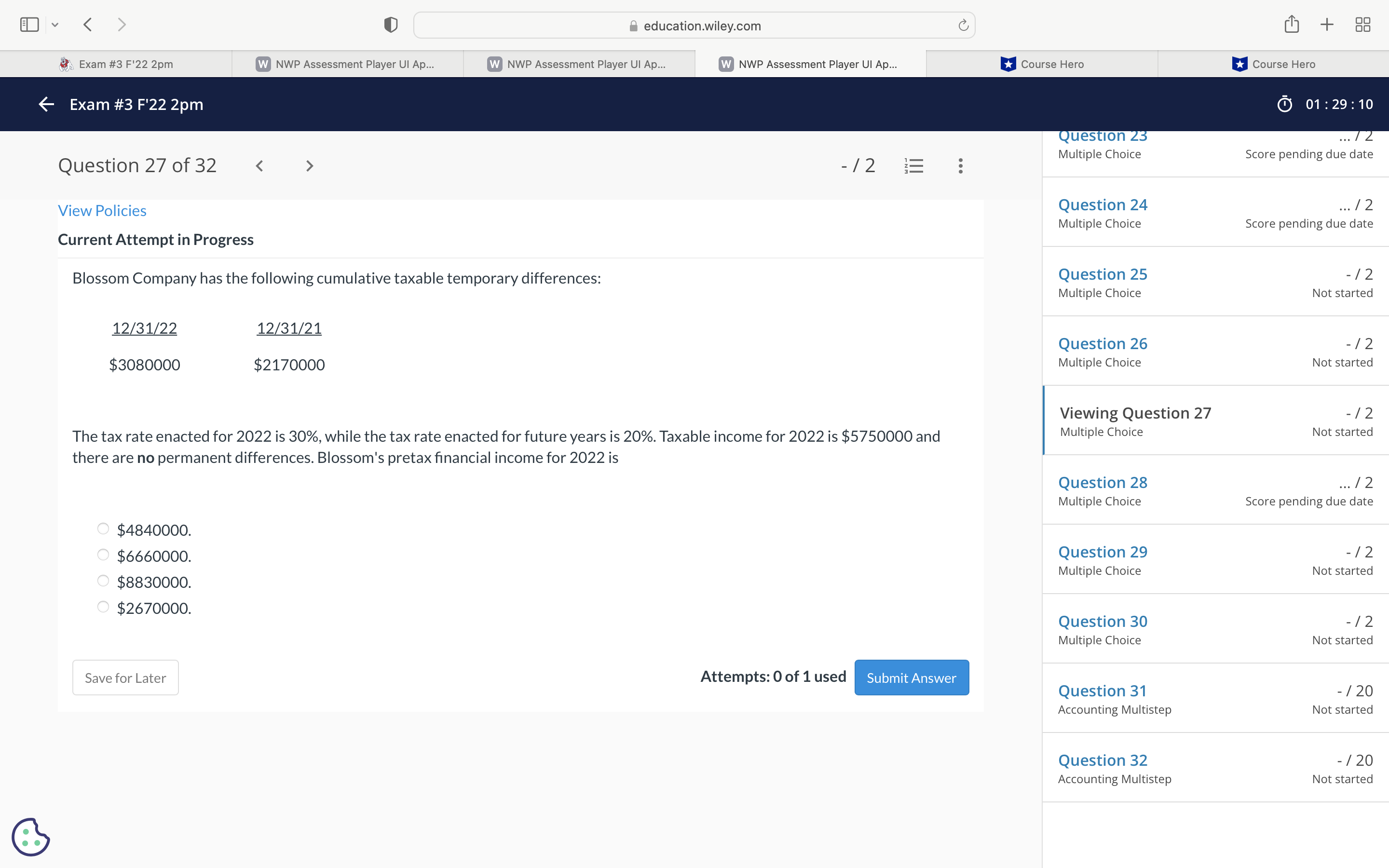

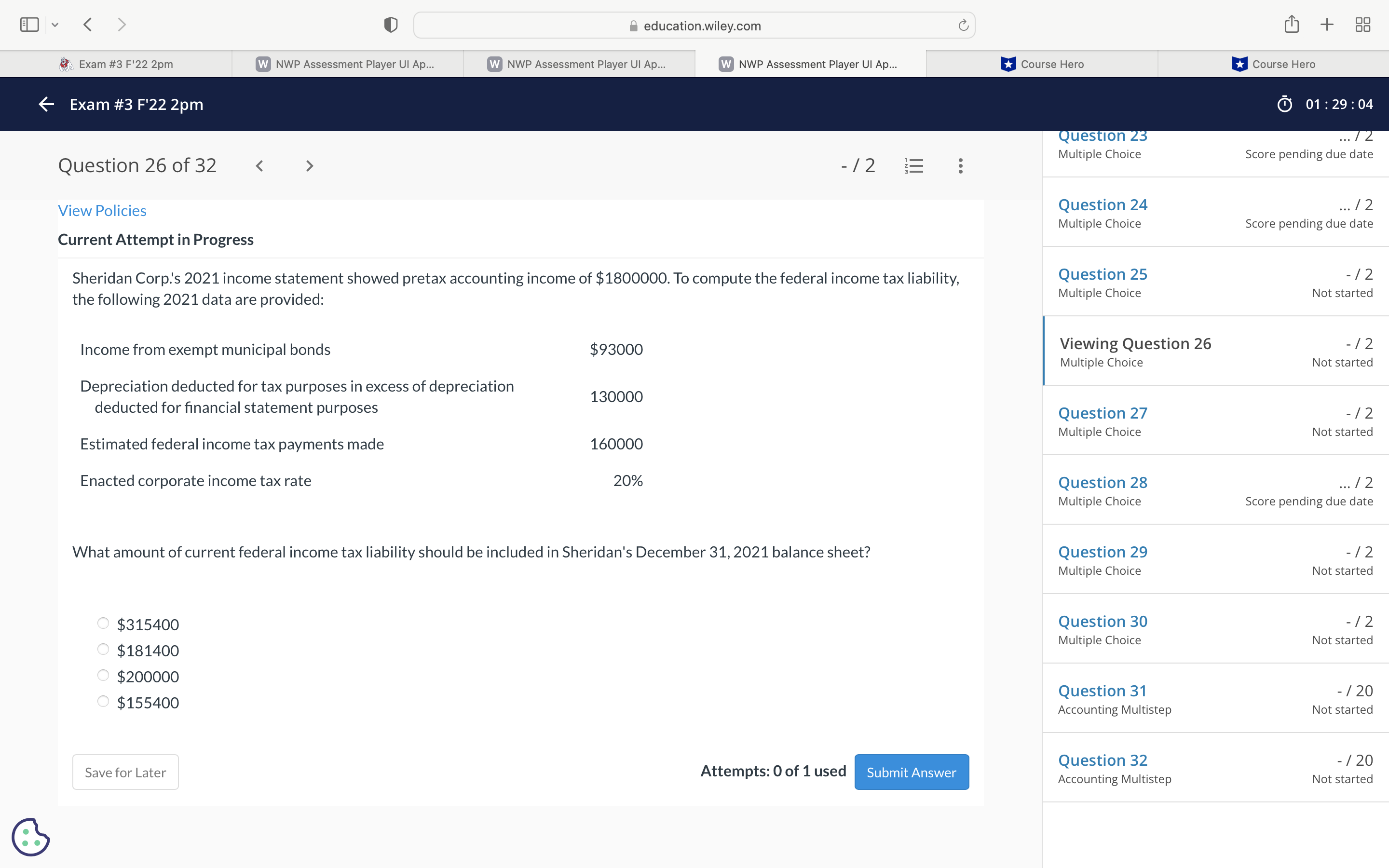

Question: v / 2 E View Policies Current Attempt in Progress Sheridan Corp.'s 2021 income statement showed pretax accounting income of $1800000t To compute the federal

Step by Step Solution

There are 3 Steps involved in it

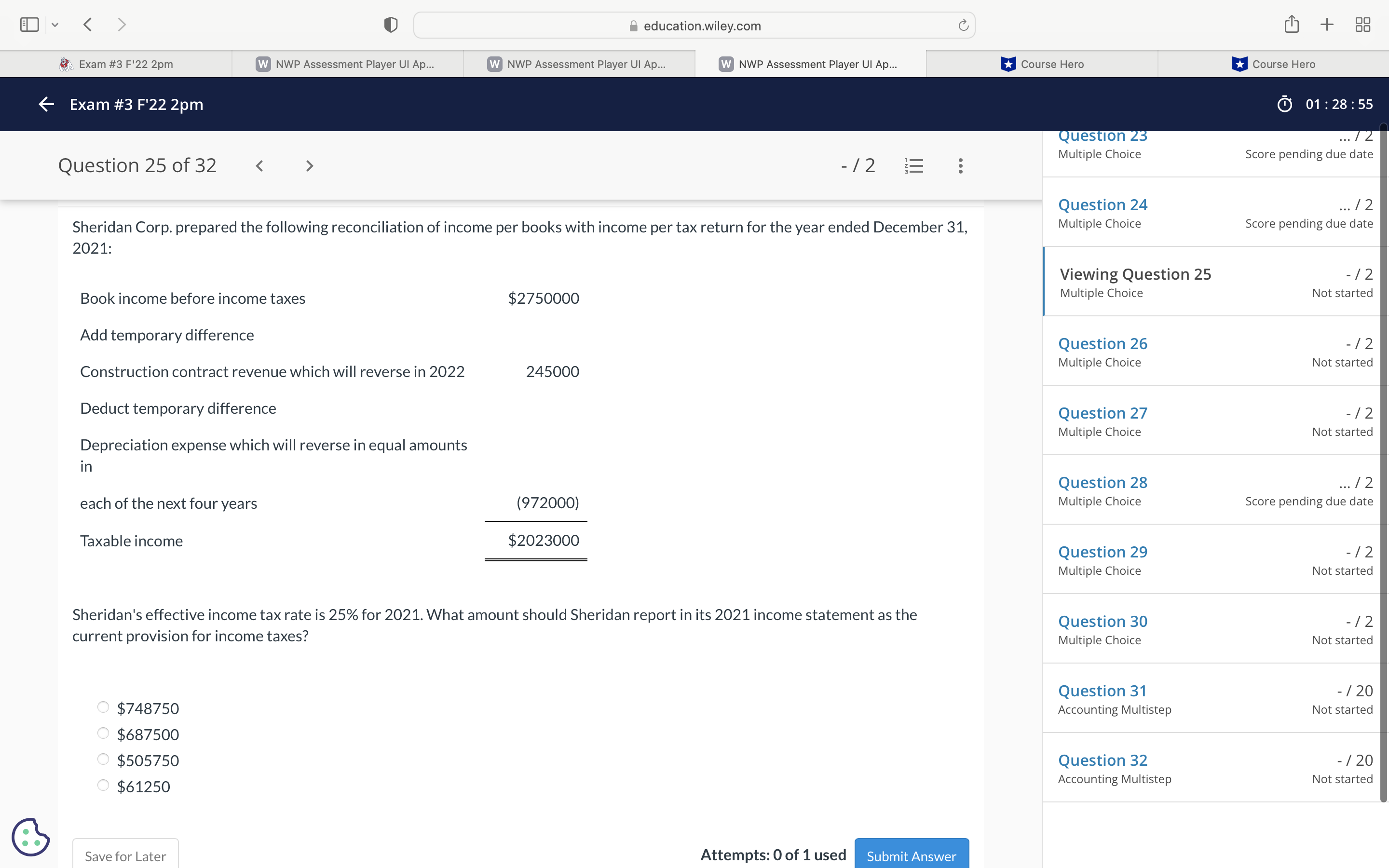

Lets solve each question step by step Question 25 Data Book income before income taxes 2750000 Add Temporary difference construction revenue 245000 De... View full answer

Get step-by-step solutions from verified subject matter experts