Question: V B N M T Shift 1 End A> 0 I Alt Gr II Ctrl ins WYR TOT Toow up Question 37 of 75. A

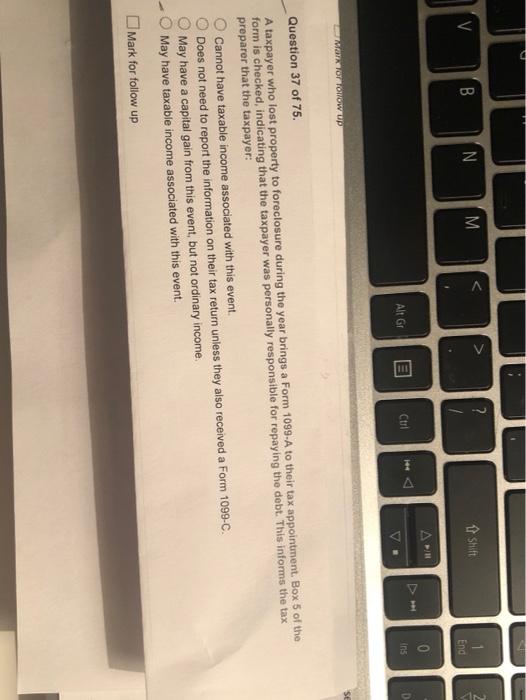

V B N M T Shift 1 End A> 0 I Alt Gr II Ctrl ins WYR TOT Toow up Question 37 of 75. A taxpayer who lost property to foreclosure during the year brings a Form 1099-A to their tax appointment. Box 5 of the form is checked, indicating that the taxpayer was personally responsible for repaying the debt. This informs the tax preparer that the taxpayer: Cannot have taxable income associated with this event. Does not need to report the information on their tax return unless they also received a Form 1099-C. May have a capital gain from this event, but not ordinary income May have taxable income associated with this event. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts