Question: v Question 7 (2 points) Listen A firm expects to generate $ 100 million in free cash flow in a year. This free cash flow

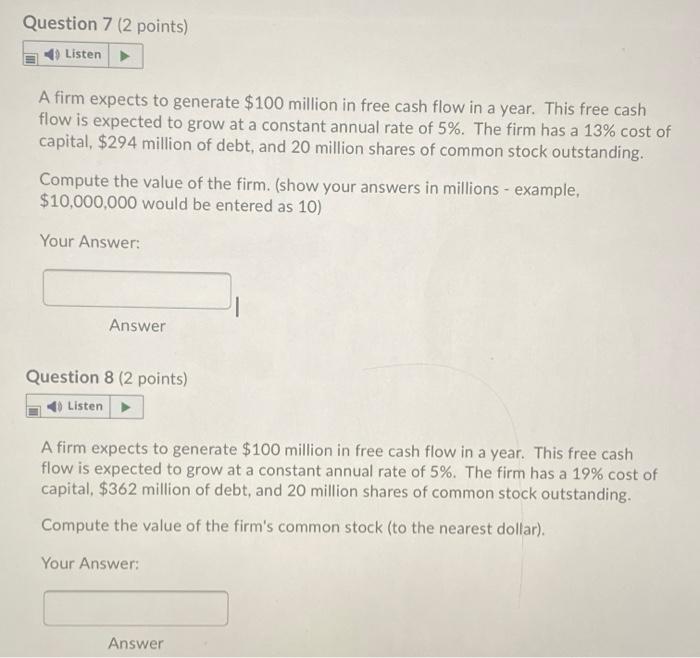

Question 7 (2 points) Listen A firm expects to generate $ 100 million in free cash flow in a year. This free cash flow is expected to grow at a constant annual rate of 5%. The firm has a 13% cost of capital, $294 million of debt, and 20 million shares of common stock outstanding. Compute the value of the firm. (show your answers in millions - example, $10,000,000 would be entered as 10) Your Answer: Answer Question 8 (2 points) Listen A firm expects to generate $ 100 million in free cash flow in a year. This free cash flow is expected to grow at a constant annual rate of 5%. The firm has a 19% cost of capital, $362 million of debt, and 20 million shares of common stock outstanding. Compute the value of the firm's common stock (to the nearest dollar). Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts