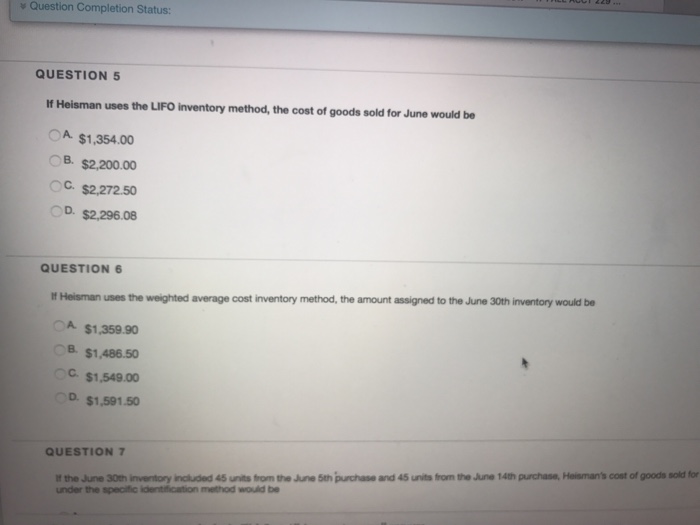

Question: v Question Completion Status: QUESTION 5 If Heisman uses the LIFO inventory method, the cost of goods sold for June would be OA $1,354.00 OB,

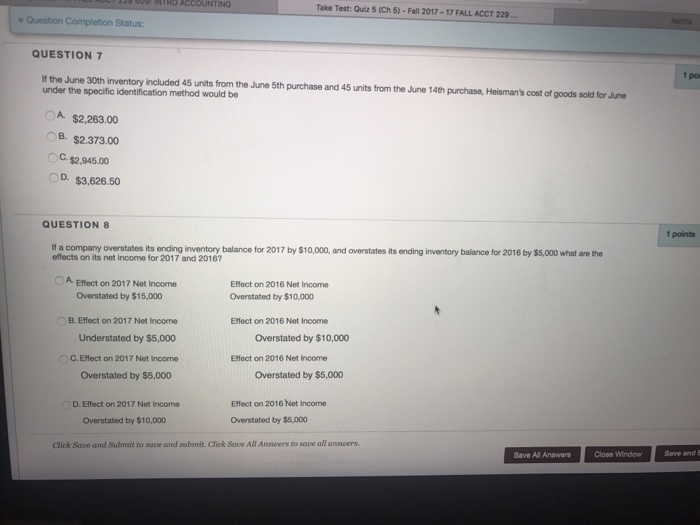

v Question Completion Status: QUESTION 5 If Heisman uses the LIFO inventory method, the cost of goods sold for June would be OA $1,354.00 OB, $2.200.00 C. $2,272.50 OD. $2,296.08 QUESTION If Heisman uses the weighted average cost inventory method, the amount assigned to the June 30th inventory would be A $1.359.90 B $1,486.50 C $1,549.00 D. $1,591.50 It the June 30th inventory included 45 units from the June 5th purchase and 45 units from the June 14th purchase, Heisman's cost of goods sold for under the specific identification method wouid be QUESTION 7 v Question Completion Status: QUESTION 5 If Heisman uses the LIFO inventory method, the cost of goods sold for June would be OA $1,354.00 OB, $2.200.00 C. $2,272.50 OD. $2,296.08 QUESTION If Heisman uses the weighted average cost inventory method, the amount assigned to the June 30th inventory would be A $1.359.90 B $1,486.50 C $1,549.00 D. $1,591.50 It the June 30th inventory included 45 units from the June 5th purchase and 45 units from the June 14th purchase, Heisman's cost of goods sold for under the specific identification method wouid be QUESTION 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts