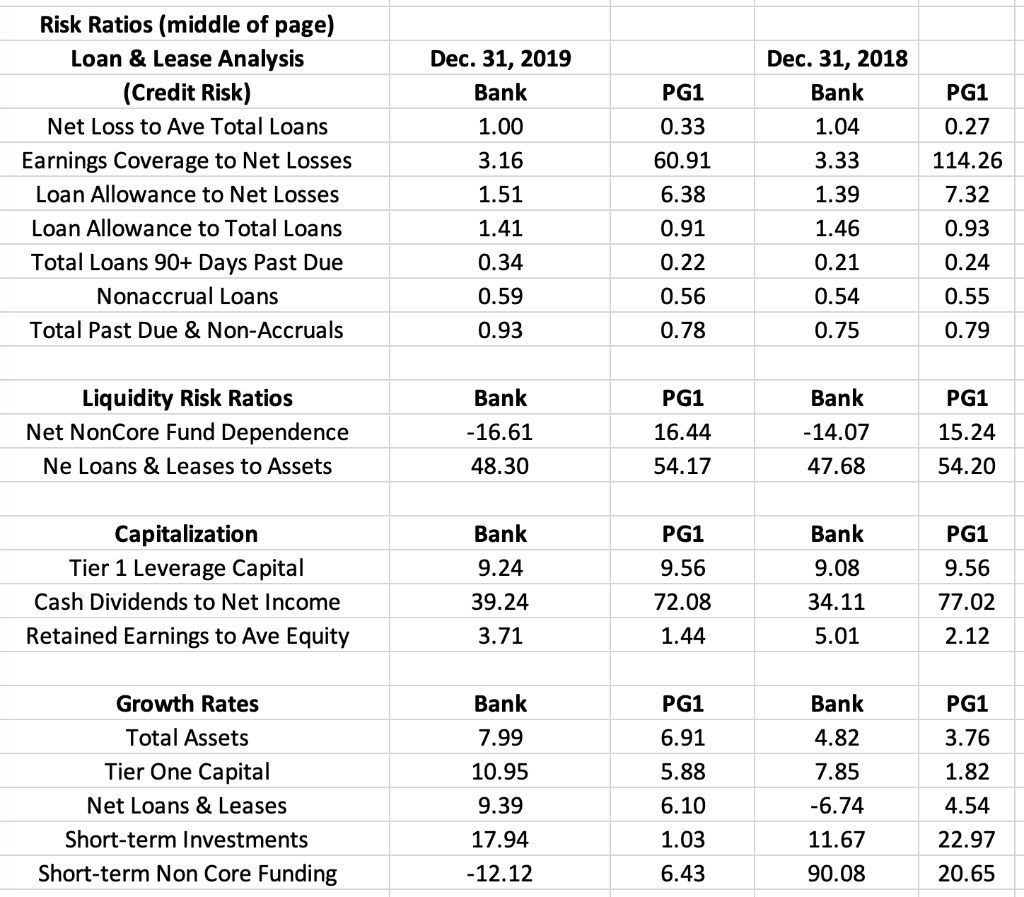

Question: V. Risk Analysis Peer Comparison for 2021) (See Spreadsheet, Tab 1, bottom of the page for risk ratios for Credit Risk, Liquidity Risk, Capitalization, and

V. Risk Analysis Peer Comparison for 2021)

(See Spreadsheet, Tab 1, bottom of the page for risk ratios for Credit Risk, Liquidity Risk, Capitalization, and Growth Rates for Capital and Assets, with Additional Risk Ratios on the 4th Tab Risk Ratios including Int. Rate Analysis).

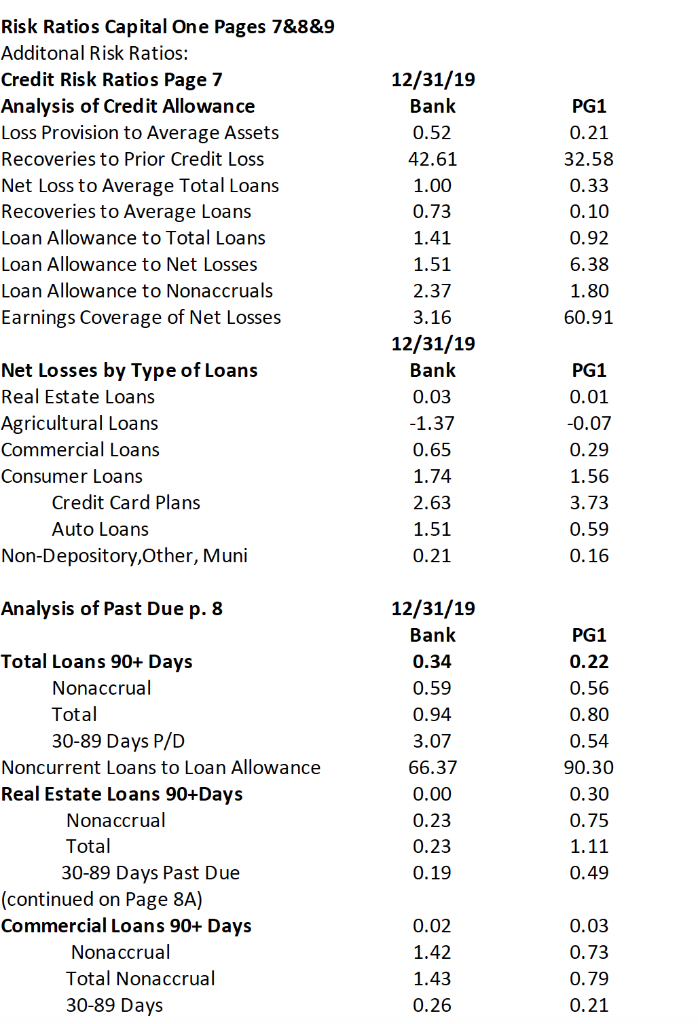

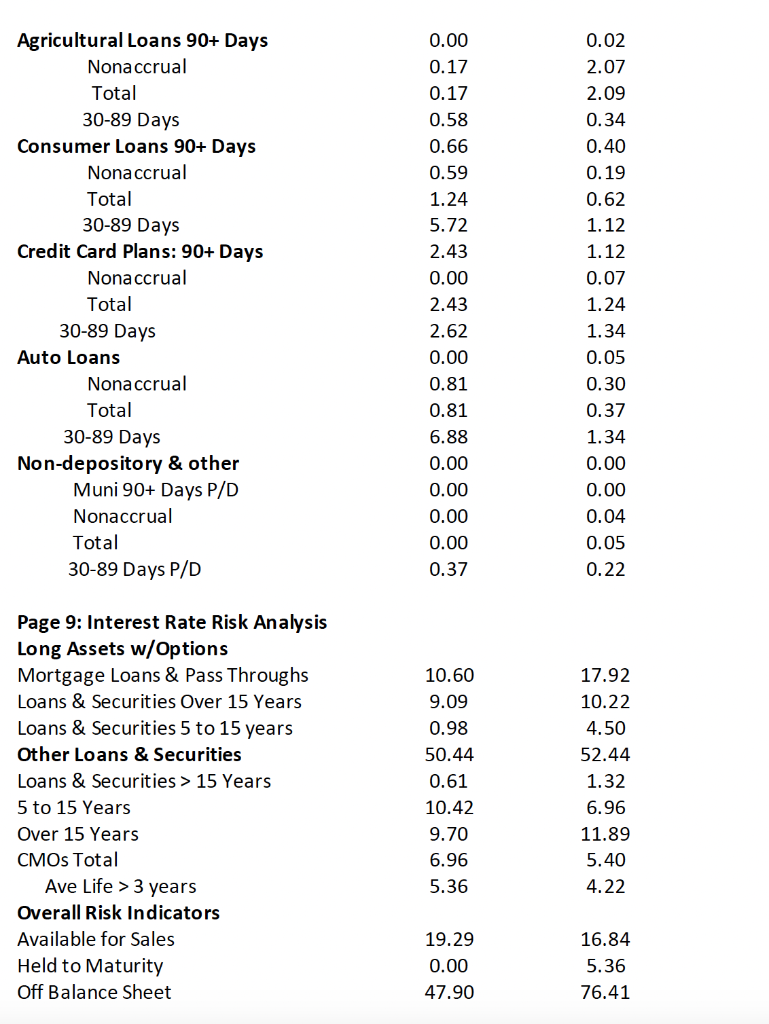

A. Analysis of Credit Risk Comparing the Bank to its Peers in 2019 (Look at the bank's mix changes & credit risk ratios including loss ratios and earnings coverage ratios)

B. Analysis of Liquidity Risk Comparing the Bank to its Peers in 2019 (Look at ratios for the Bank's Liquidity risk on the asset, liability, and off-balance sheet sides)

C. Analysis of Capital Risk Comparing the Bank to its Peers in 2019 (Look at Tier 1 Capital Ratios, Dividend Payout Ratios, Growth in Equity compared to Growth in Assets)

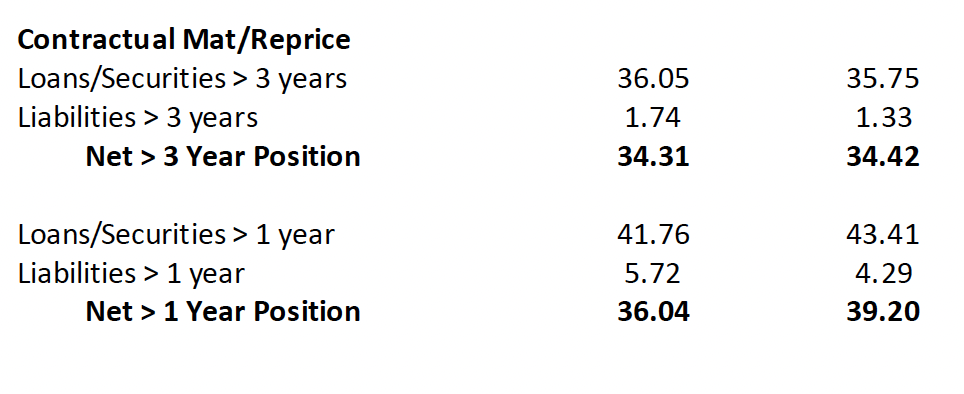

D. Analysis of Interest Rate Risk Comparing the Bank to its Peers in 1-year and 3-year positions, that take Long-term Assets - Long-term Liabilities). Larger net positions indicate greater interest rate risk.

VI. Conclusion: Based on your Analysis: Summarize why the Bank's Performance Changed in 2019and why it differs from the Peers in 2019 and your risk analysis compared to the Peers, and the Banks strengths and weaknesses, and suggestions for improvement.

Risk Ratios (middle of page) Risk Ratios Capital One Pages 788\&9 Additonal Risk Ratios: CreditRiskRatiosPage7AnalysisofCreditAllowanceLossProvisiontoAverageAssetsRecoveriestoPriorCreditLossNetLosstoAverageTotalLoansRecoveriestoAverageLoansLoanAllowancetoTotalLoansLoanAllowancetoNetLossesLoanAllowancetoNonaccrualsEarningsCoverageofNetLossesNetLossesbyTypeofLoansRealEstateLoansAgriculturalLoansCommercialLoansConsumerLoansCreditCardPlansAutoLoansNon-Depository,Other,Muni12/31/19Bank0.5242.611.000.731.411.512.373.1612/31/19Bank0.031.370.651.742.631.51PG10.2132.580.330.100.926.381.8060.910.010.070.291.563.730.590.16 AnalysisofPastDuep.8TotalLoans90+DaysNonaccrualTotal30-89DaysP/DNoncurrentLoanstoLoanAllowanceRealEstateLoans90+DaysNonaccrualTotal30-89DaysPastDue12/31/19Bank0.340.590.943.0766.370.000.230.23PG10.220.560.800.5490.300.300.751.11 (continued on Page 8A) CommercialLoans90+DaysNonaccrualTotalNonaccrual30-89Days0.021.421.430.260.030.730.790.21 Page 9: Interest Rate Risk Analysis Long Assets w/Options Mortgage Loans \& Pass Throughs 10.6017.92 OtherLoans&Securities50.4452.44 Loans&Securities>15Years0.611.32 Over15Years9.7011.89 CMOsTotal6.965.40 AveLife>3years5.364.22 Overall Risk Indicators Available for Sales Held to Maturity Off Balance Sheet 19.290.0047.9016.845.3676.41 Contractual Mat/Reprice Loans/Securities >3 years Liabilities >3 years Net >3 Year Position 36.051.7434.3135.751.3334.42 Loans/Securities >1 year Liabilities >1 year 41.765.7236.0443.414.2939.20 Risk Ratios (middle of page) Risk Ratios Capital One Pages 788\&9 Additonal Risk Ratios: CreditRiskRatiosPage7AnalysisofCreditAllowanceLossProvisiontoAverageAssetsRecoveriestoPriorCreditLossNetLosstoAverageTotalLoansRecoveriestoAverageLoansLoanAllowancetoTotalLoansLoanAllowancetoNetLossesLoanAllowancetoNonaccrualsEarningsCoverageofNetLossesNetLossesbyTypeofLoansRealEstateLoansAgriculturalLoansCommercialLoansConsumerLoansCreditCardPlansAutoLoansNon-Depository,Other,Muni12/31/19Bank0.5242.611.000.731.411.512.373.1612/31/19Bank0.031.370.651.742.631.51PG10.2132.580.330.100.926.381.8060.910.010.070.291.563.730.590.16 AnalysisofPastDuep.8TotalLoans90+DaysNonaccrualTotal30-89DaysP/DNoncurrentLoanstoLoanAllowanceRealEstateLoans90+DaysNonaccrualTotal30-89DaysPastDue12/31/19Bank0.340.590.943.0766.370.000.230.23PG10.220.560.800.5490.300.300.751.11 (continued on Page 8A) CommercialLoans90+DaysNonaccrualTotalNonaccrual30-89Days0.021.421.430.260.030.730.790.21 Page 9: Interest Rate Risk Analysis Long Assets w/Options Mortgage Loans \& Pass Throughs 10.6017.92 OtherLoans&Securities50.4452.44 Loans&Securities>15Years0.611.32 Over15Years9.7011.89 CMOsTotal6.965.40 AveLife>3years5.364.22 Overall Risk Indicators Available for Sales Held to Maturity Off Balance Sheet 19.290.0047.9016.845.3676.41 Contractual Mat/Reprice Loans/Securities >3 years Liabilities >3 years Net >3 Year Position 36.051.7434.3135.751.3334.42 Loans/Securities >1 year Liabilities >1 year 41.765.7236.0443.414.2939.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts