Question: v1 TABLE 9.25 Expected profit table with perfect information Conditional profit Probability of Expected profit with under certainty ) market size perfect information Market size

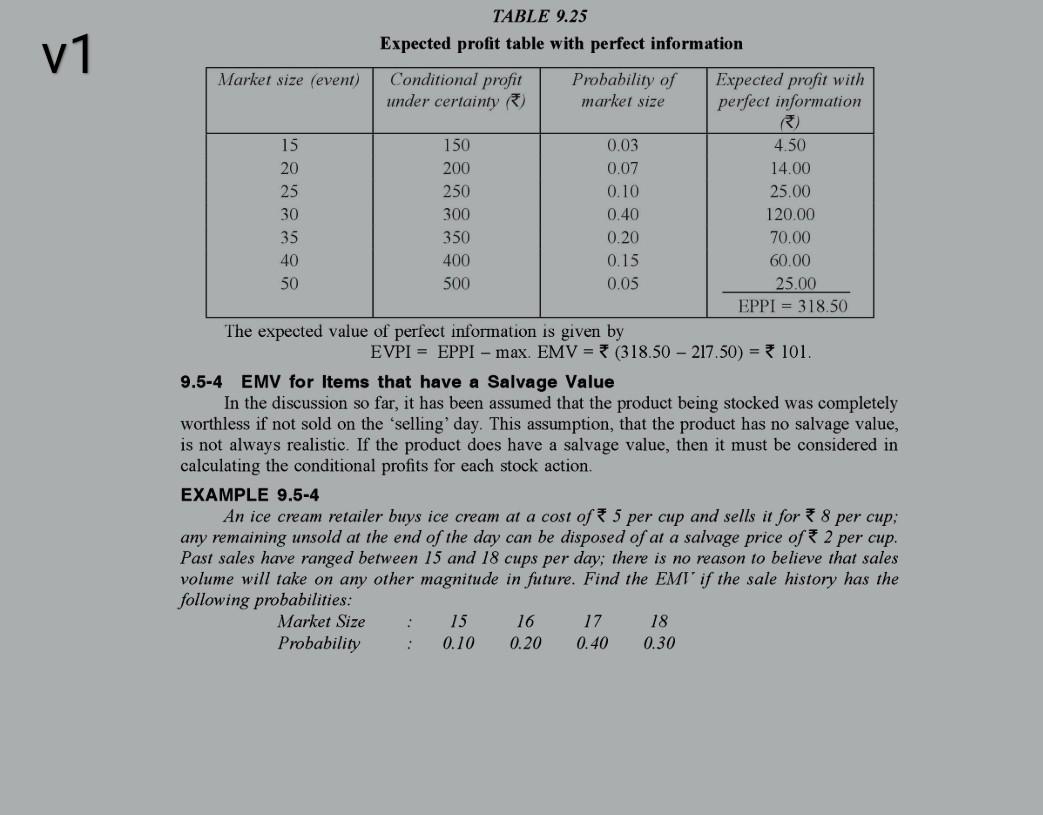

v1 TABLE 9.25 Expected profit table with perfect information Conditional profit Probability of Expected profit with under certainty ) market size perfect information Market size (event) 15 150 0.03 4.50 20 200 0.07 14.00 25 250 0.10 25.00 30 300 0.40 120.00 35 350 0.20 70.00 40 400 0.15 60.00 50 500 0.05 25.00 EPPI = 318.50 The expected value of perfect information is given by EVPI = EPPI - max. EMV = (318.50 - 217.50) = 101. 9.5-4 EMV for Items that have a Salvage Value In the discussion so far, it has been assumed that the product being stocked was completely worthless if not sold on the 'selling' day. This assumption, that the product has no salvage value, is not always realistic. If the product does have a salvage value, then it must be considered in calculating the conditional profits for each stock action. EXAMPLE 9.5-4 An ice cream retailer buys ice cream at a cost of 5 per cup and sells it for 8 per cup; any remaining unsold at the end of the day can be disposed of at a salvage price of 2 per cup. Past sales have ranged between 15 and 18 cups per day, there is no reason to believe that sales volume will take on any other magnitude in future. Find the EMI' if the sale history has the following probabilities: Market Size 15 16 17 18 Probability 0.10 0.20 0.40 0.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts