Question: Valuation - Terminal Multiple Method In practice, there are two different ways to calculate the terminal value in a DCF. - Open the attached Excel

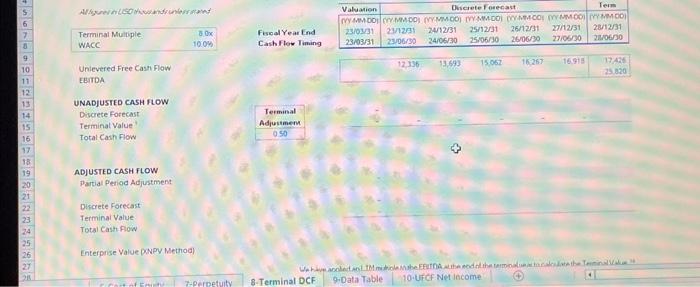

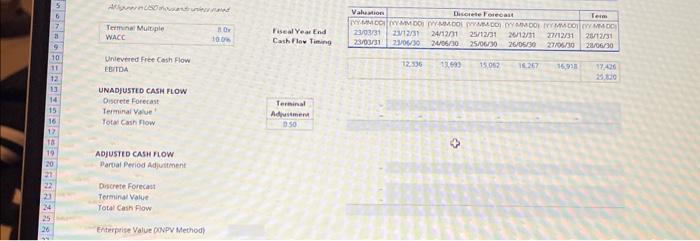

Valuation - Terminal Multiple Method In practice, there are two different ways to calculate the terminal value in a DCF. - Open the attached Excel file and go to the worksheet labeled: 8-Terminal DCF Calculate the enterprise value using the XNPV method. $192,364$186,468$192,293$186,536 Unievered Free Cash Flow EBTDA UNADJUSTED CASH FLOW Discrete Forecast Terminat Value total Cash Flow ADJUSTED CASH FLOW partial Period Adjustment Discrete Forecast Terminal Value Total Cash Plow Enterprise Value DNPV Method) Unievered free Cosh flow Eerros UNADJUSTLO CASH FLOW Qiscrete Forecast Terminal Volve ' totar Cash nlow \begin{tabular}{c} Terminal \\ Adrusmen \\ \hline 050 \\ \hline \end{tabular} ADJUSTE CASH How Perval Period Adjuitment Oncrete Forecast Terminal Value Jour Cash Fow Ehterprise Value CovPV Method? Valuation - Terminal Multiple Method In practice, there are two different ways to calculate the terminal value in a DCF. - Open the attached Excel file and go to the worksheet labeled: 8-Terminal DCF Calculate the enterprise value using the XNPV method. $192,364$186,468$192,293$186,536 Unievered Free Cash Flow EBTDA UNADJUSTED CASH FLOW Discrete Forecast Terminat Value total Cash Flow ADJUSTED CASH FLOW partial Period Adjustment Discrete Forecast Terminal Value Total Cash Plow Enterprise Value DNPV Method) Unievered free Cosh flow Eerros UNADJUSTLO CASH FLOW Qiscrete Forecast Terminal Volve ' totar Cash nlow \begin{tabular}{c} Terminal \\ Adrusmen \\ \hline 050 \\ \hline \end{tabular} ADJUSTE CASH How Perval Period Adjuitment Oncrete Forecast Terminal Value Jour Cash Fow Ehterprise Value CovPV Method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts