Question: Value: 1.60 points EC-6 Computing Bond Tssue Proceeds and 1ssue Price Your company plans to issue bonds later in the upcoming year. But with the

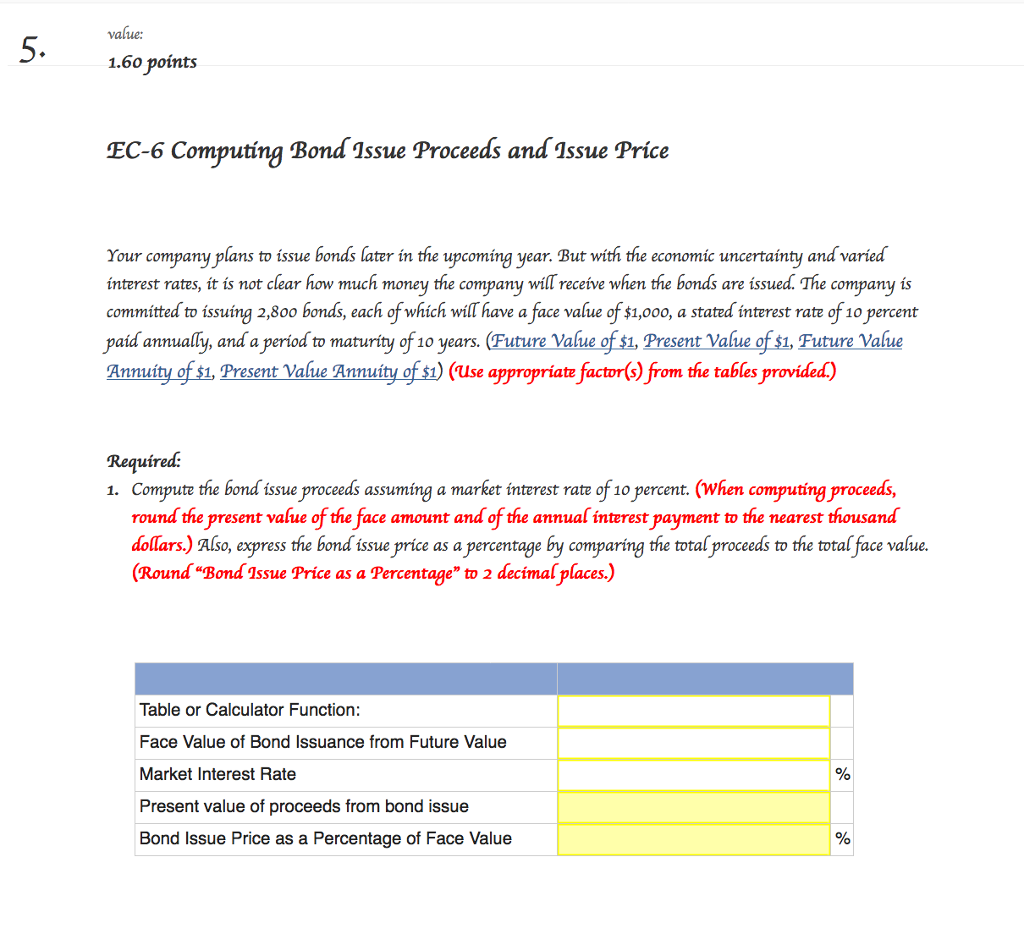

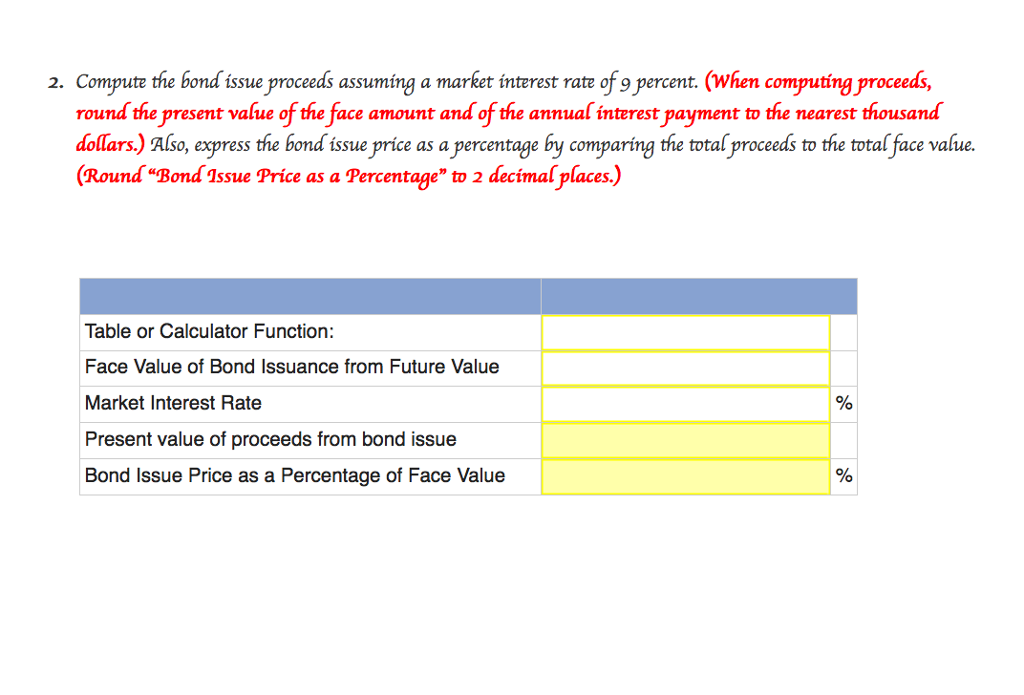

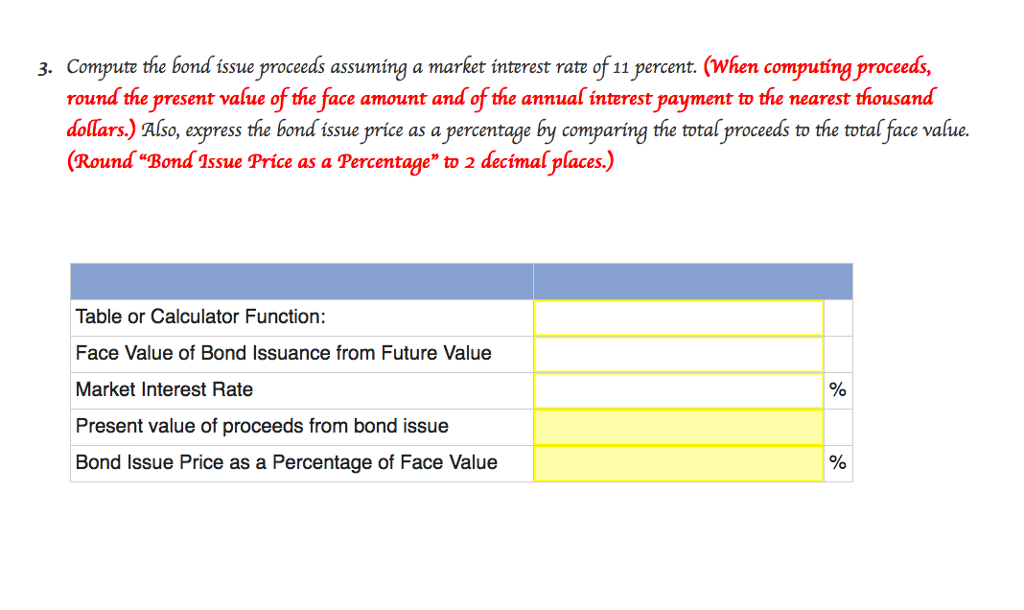

Value: 1.60 points EC-6 Computing Bond Tssue Proceeds and 1ssue Price Your company plans to issue bonds later in the upcoming year. But with the economic uncertainty and varied interest rates, it is not clear how much money the company will receive when the bonds are issued. The company is committed to issuing 2,8oo bonds, each of which wilThave a face value of $1,0oo, a stated interest rate of 10 percent paid annually, and a period to maturity of 10 years. (Future Walue o $1, Present Value o 1 Future Value Annuity of 1, Present value Annuity of $1) (use appropriate factor(s) from the tables provided.) Require 1. Compute the bond issue proceeds assuming a market interest rate of10 percent. When computing proceeds, round the present value of the face a and of the annual interest payment to the nearest thousand dollars) Also, express the bond issue price as a percentage by comparing the total proceeds to the total face value. (Round "Bond Tissue Price as a Percentage" to 2 decimal places.) Table or Calculator Function: Face Value of Bond Issuance from Future Value Market Interest Rate Present value of proceeds from bond issue Bond issue Price as a Percentage of Face Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts