Question: Value a 1.5-year swap, with swap rate 5.52%. The floating leg is referenced to the 6-month LIBOR, which is at 6% per annum. Notional

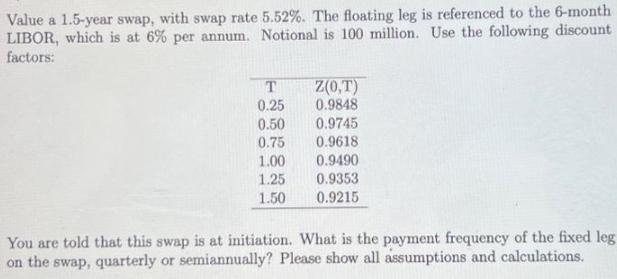

Value a 1.5-year swap, with swap rate 5.52%. The floating leg is referenced to the 6-month LIBOR, which is at 6% per annum. Notional is 100 million. Use the following discount factors: T 0.25 0.50 0.75 1.00 1.25 1.50 Z(0,T) 0.9848 0.9745 0.9618 0.9490 0.9353 0.9215 You are told that this swap is at initiation. What is the payment frequency of the fixed leg on the swap, quarterly or semiannually? Please show all assumptions and calculations.

Step by Step Solution

There are 3 Steps involved in it

To determine the payment frequency of the fixed leg on the swap we need to compare th... View full answer

Get step-by-step solutions from verified subject matter experts