Question: Value analysis determination and distribution schedule? E1 and E2? Trial balance and elemination and adjustments? Exercise 7 (LO 3) Cost method, first year, eliminations, statements.

Value analysis determination and distribution schedule?

E1 and E2?

Trial balance and elemination and adjustments?

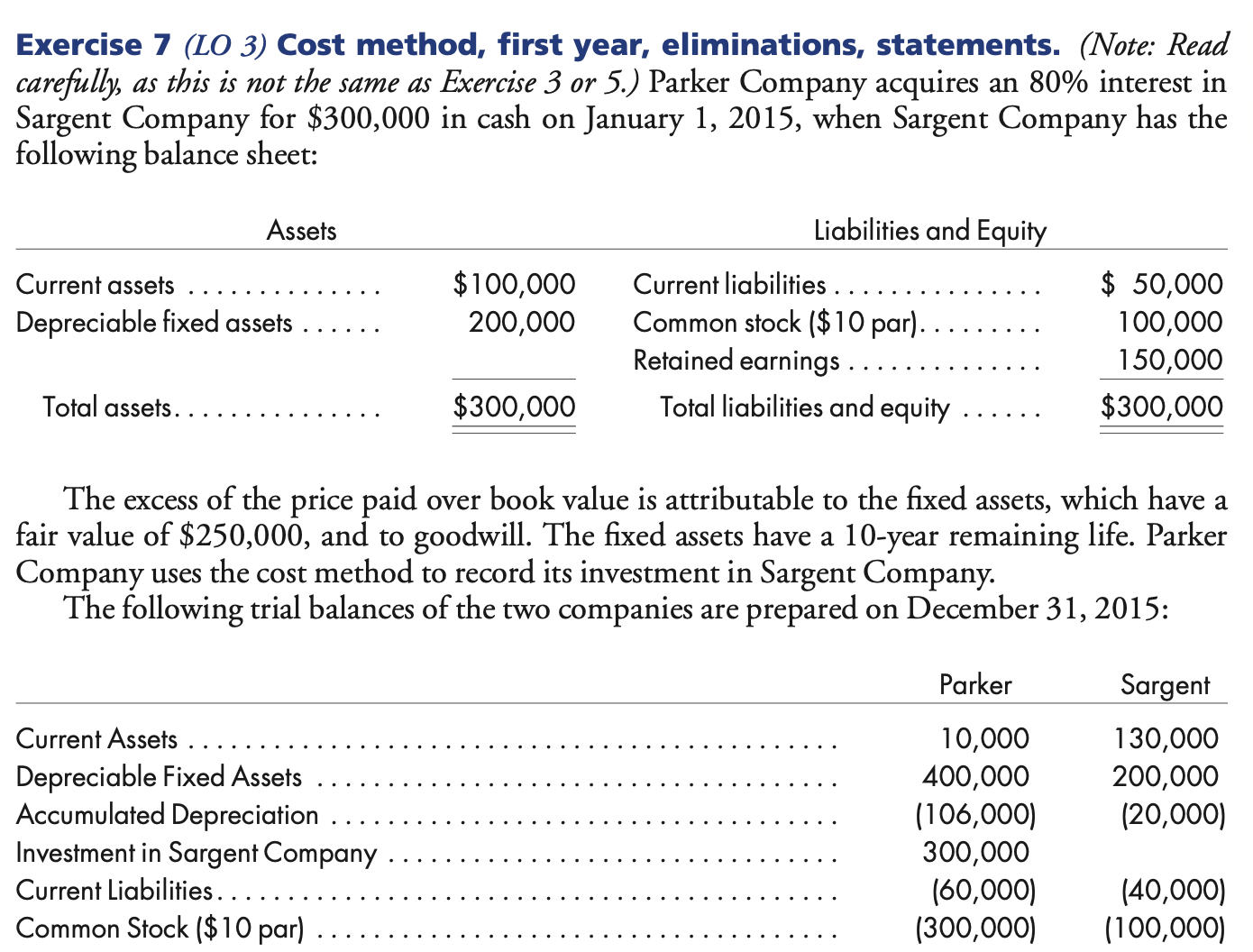

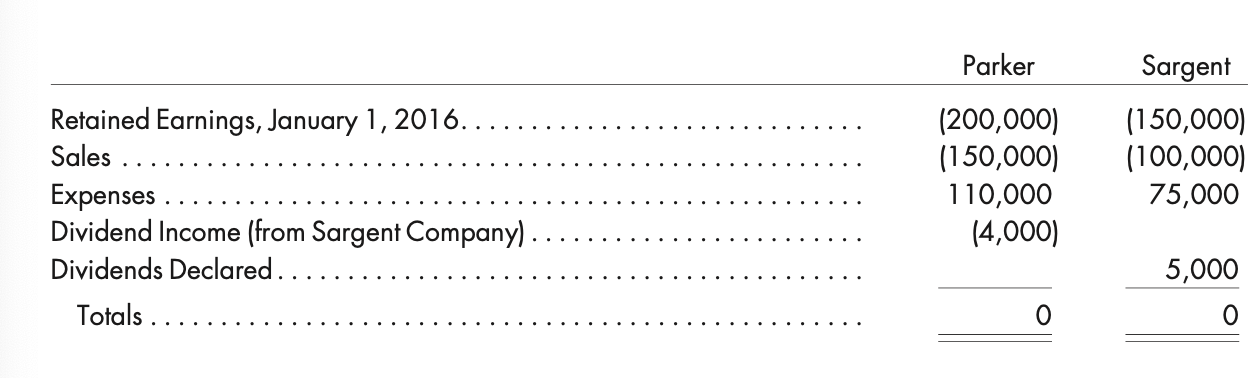

Exercise 7 (LO 3) Cost method, first year, eliminations, statements. (Note: Read carefully, as this is not the same as Exercise 3 or 5.) Parker Company acquires an 80% interest in Sargent Company for $300,000 in cash on January 1, 2015, when Sargent Company has the following balance sheet: The excess of the price paid over book value is attributable to the fixed assets, which have a fair value of $250,000, and to goodwill. The fixed assets have a 10 -year remaining life. Parker Company uses the cost method to record its investment in Sargent Company. The following trial balances of the two companies are prepared on December 31, 2015: \begin{tabular}{|c|c|c|} \hline & Parker & Sargent \\ \hline Retained Earnings, January 1, 2016.. & (200,000) & (150,000) \\ \hline Sales. & (150,000) & (100,000) \\ \hline Expenses . & 110,000 & 75,000 \\ \hline Dividend Income (from Sargent Company) & (4,000) & \\ \hline Dividends Declared. & & 5,000 \\ \hline Totals & 0 & 0 \\ \hline \end{tabular} Exercise 7 (LO 3) Cost method, first year, eliminations, statements. (Note: Read carefully, as this is not the same as Exercise 3 or 5.) Parker Company acquires an 80% interest in Sargent Company for $300,000 in cash on January 1, 2015, when Sargent Company has the following balance sheet: The excess of the price paid over book value is attributable to the fixed assets, which have a fair value of $250,000, and to goodwill. The fixed assets have a 10 -year remaining life. Parker Company uses the cost method to record its investment in Sargent Company. The following trial balances of the two companies are prepared on December 31, 2015: \begin{tabular}{|c|c|c|} \hline & Parker & Sargent \\ \hline Retained Earnings, January 1, 2016.. & (200,000) & (150,000) \\ \hline Sales. & (150,000) & (100,000) \\ \hline Expenses . & 110,000 & 75,000 \\ \hline Dividend Income (from Sargent Company) & (4,000) & \\ \hline Dividends Declared. & & 5,000 \\ \hline Totals & 0 & 0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts