Question: Value Line provides explicit dividend forecasts over the relative short term, with dividends rising from $.72 in 2012 to $1 in 2015 . We can

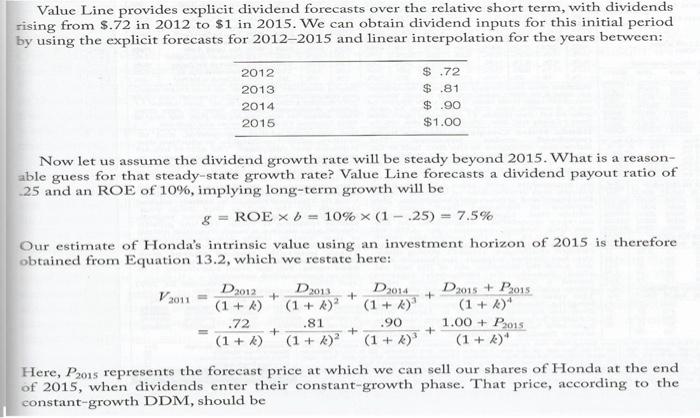

Value Line provides explicit dividend forecasts over the relative short term, with dividends rising from $.72 in 2012 to $1 in 2015 . We can obtain dividend inputs for this initial period by using the explicit forecasts for 2012-2015 and linear interpolation for the years between: Now let us assume the dividend growth rate will be steady beyond 2015. What is a reasonable guess for that steady-state growth rate? Value Line forecasts a dividend payout ratio of 25 and an ROE of 10%, implying long-term growth will be g=ROEb=10%(1.25)=7.5% Our estimate of Honda's intrinsic value using an investment horizon of 2015 is therefore obtained from Equation 13.2, which we restate here: V2011=(1+k)D2012+(1+k)2D2013+(1+k)3D2014+(1+k)4D2015+P2015=(1+k).72+(1+k)2.81+(1+k)3.90+(1+k)41.00+P2015 Here, P2015 represents the forecast price at which we can sell our shares of Honda at the end of 2015 , when dividends enter their constant-growth phase. That price, according to the constant-growth DDM, should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts