Question: Value Project NPV ( S 6 . 3 ) A widget manufacturer currently produces 2 0 0 , 0 0 0 units a year. It

Value

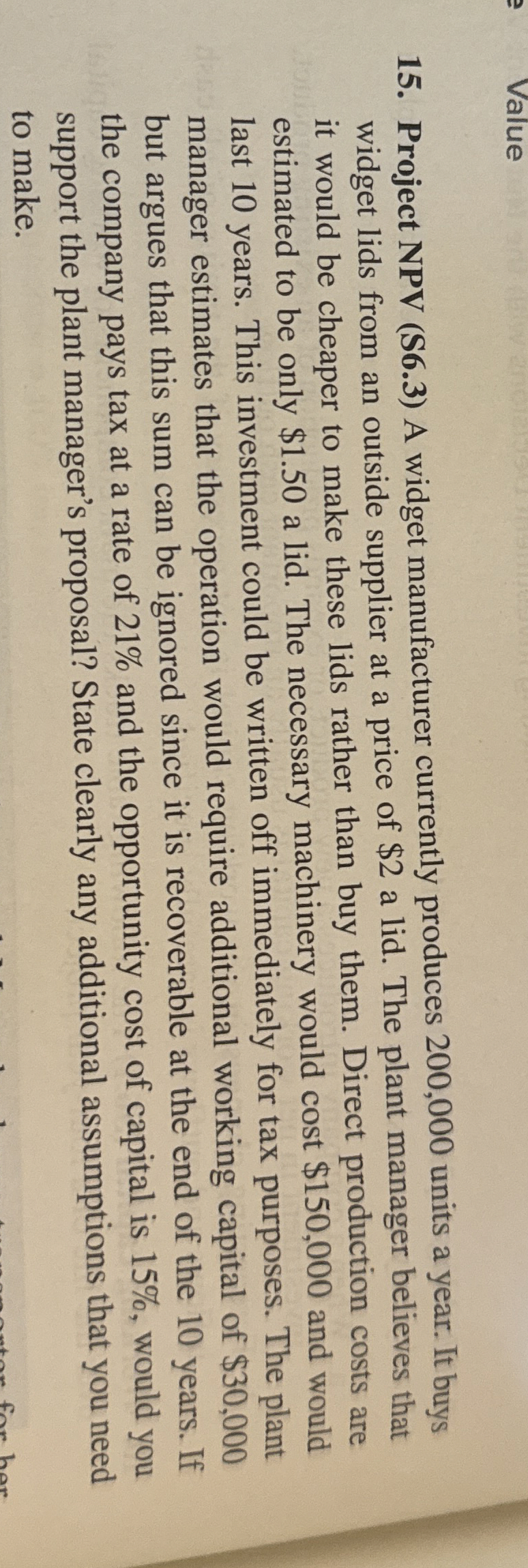

Project NPV S A widget manufacturer currently produces units a year. It buys

widget lids from an outside supplier at a price of $ a lid. The plant manager believes that

it would be cheaper to make these lids rather than buy them. Direct production costs are

estimated to be only $ a lid. The necessary machinery would cost $ and would

last years. This investment could be written off immediately for tax purposes. The plant

manager estimates that the operation would require additional working capital of $

but argues that this sum can be ignored since it is recoverable at the end of the years. If

the company pays tax at a rate of and the opportunity cost of capital is would you

support the plant manager's proposal? State clearly any additional assumptions that you need

to make.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock