Question: Value stocks are commonly viewed as steady, or conservative. Because you are saving toward your retirement, if you invest in a Value fund, you hope

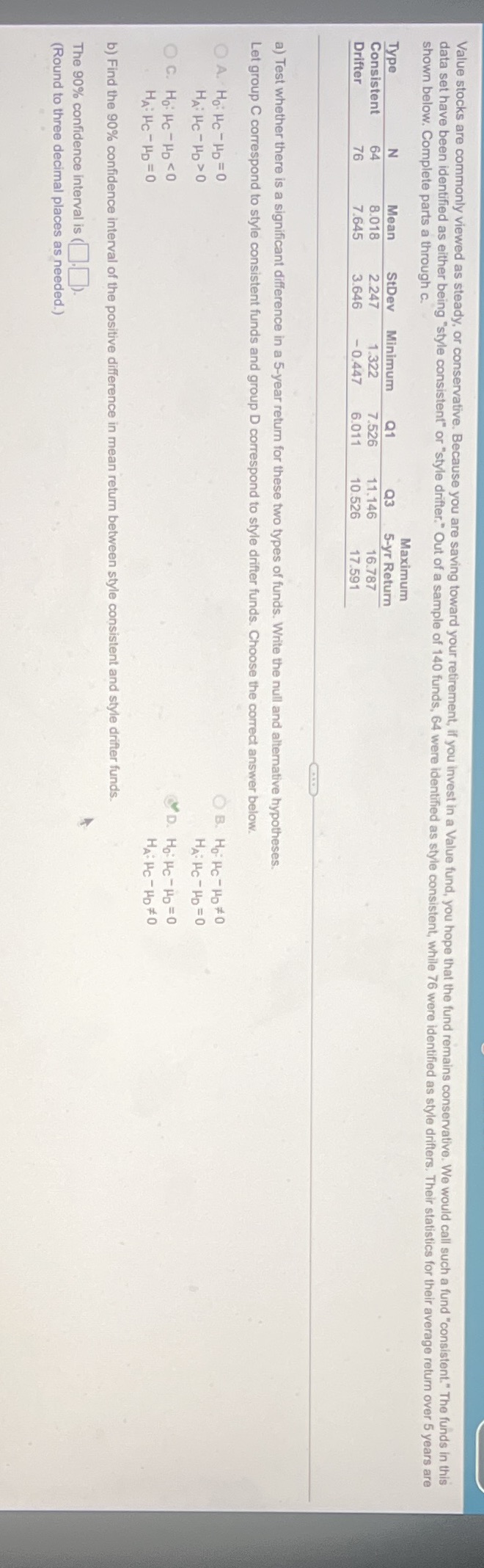

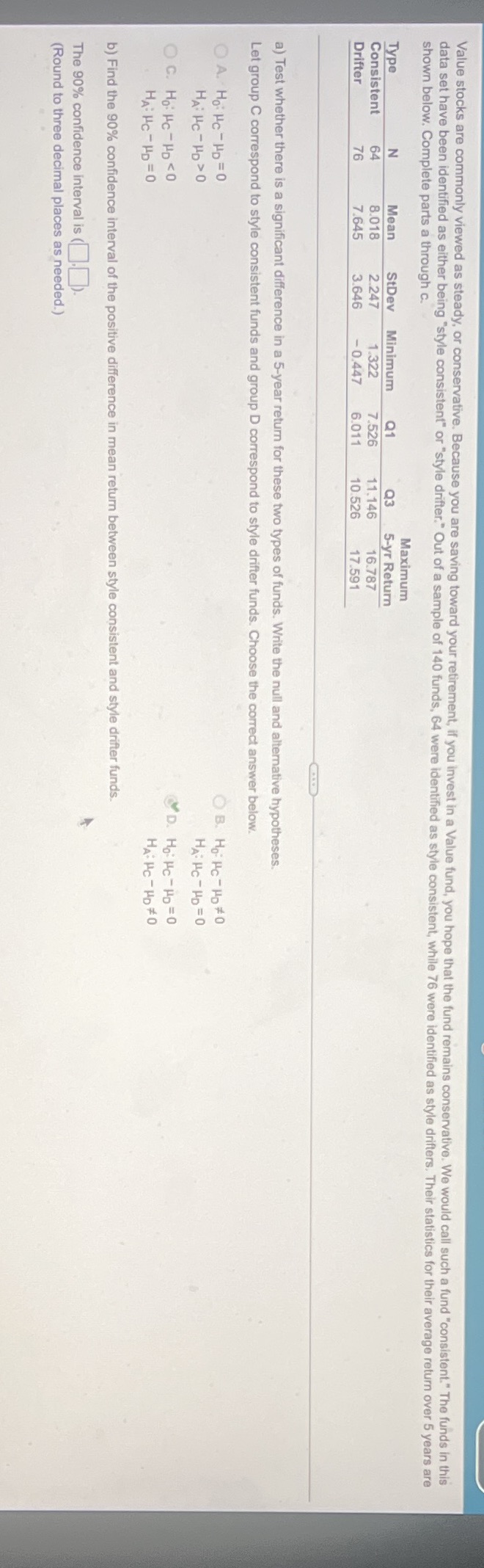

Value stocks are commonly viewed as steady, or conservative. Because you are saving toward your retirement, if you invest in a Value fund, you hope that the fund remains conservative. We would call such a fund "consistent." The funds in this data set have been identified as either being "style consistent" or "style drifter." Out of a sample of 140 funds, 64 were identified as style consistent, while 76 were identified as style drifters. Their statistics for their average return over 5 years are shown below. Complete parts a through c. Maximum Type Mean StDev Minimum Q1 Q3 5-yr Return Consistent 8.018 2.247 1.322 7.526 11.146 16.787 Drifter 7.645 3.646 -0.447 6.011 10.526 17.591 a) Test whether there is a significant difference in a 5-year return for these two types of funds. Write the null and alternative hypotheses. Let group C correspond to style consistent funds and group D correspond to style drifter funds. Choose the correct answer below. O A. Ho: HC- HD= 0 OB. Ho: PC -HD#0 HA: HC - HD > 0 HA: PC - HD = 0 O C. Ho: HC- HD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts