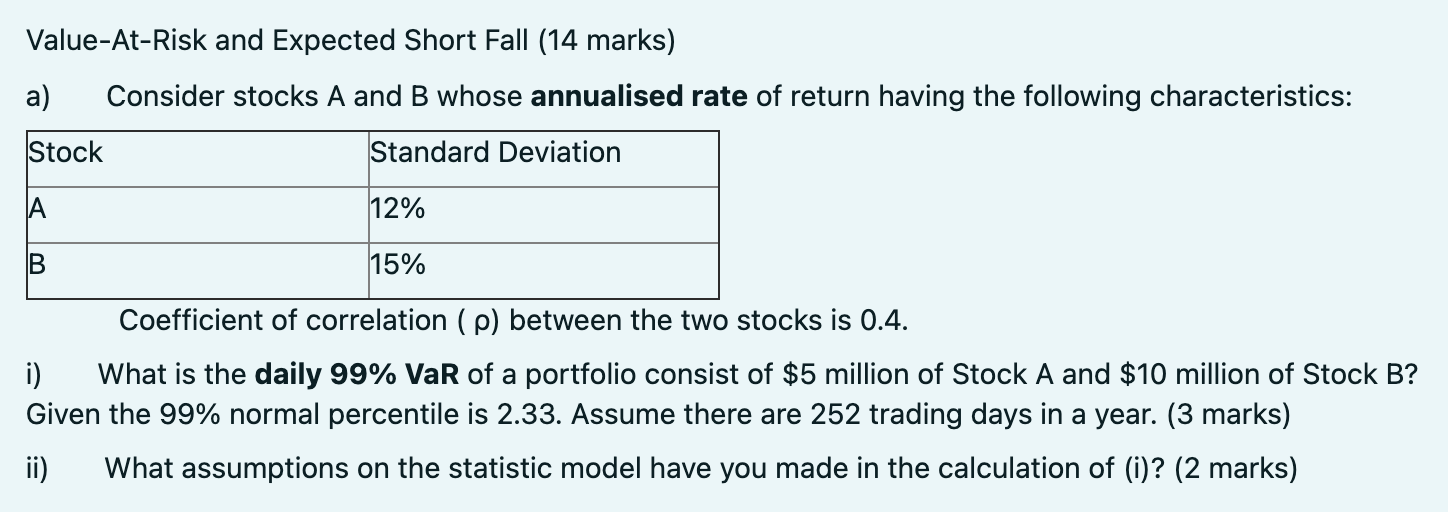

Question: Value-At-Risk and Expected Short Fall (14 marks) a) Consider stocks and B whose annualised rate of return having the following characteristics: Stock Standard Deviation A

Value-At-Risk and Expected Short Fall (14 marks) a) Consider stocks and B whose annualised rate of return having the following characteristics: Stock Standard Deviation A 12% 15% Coefficient of correlation (p) between the two stocks is 0.4. i) What is the daily 99% VaR of a portfolio consist of $5 million of Stock A and $10 million of Stock B? Given the 99% normal percentile is 2.33. Assume there are 252 trading days in a year. (3 marks) ii) What assumptions on the statistic model have you made in the calculation of (i)? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts