Question: Valuing a company using a multiple step valuation process requires the valuer to: Select one: O a. First, estimate free cash flows for each year

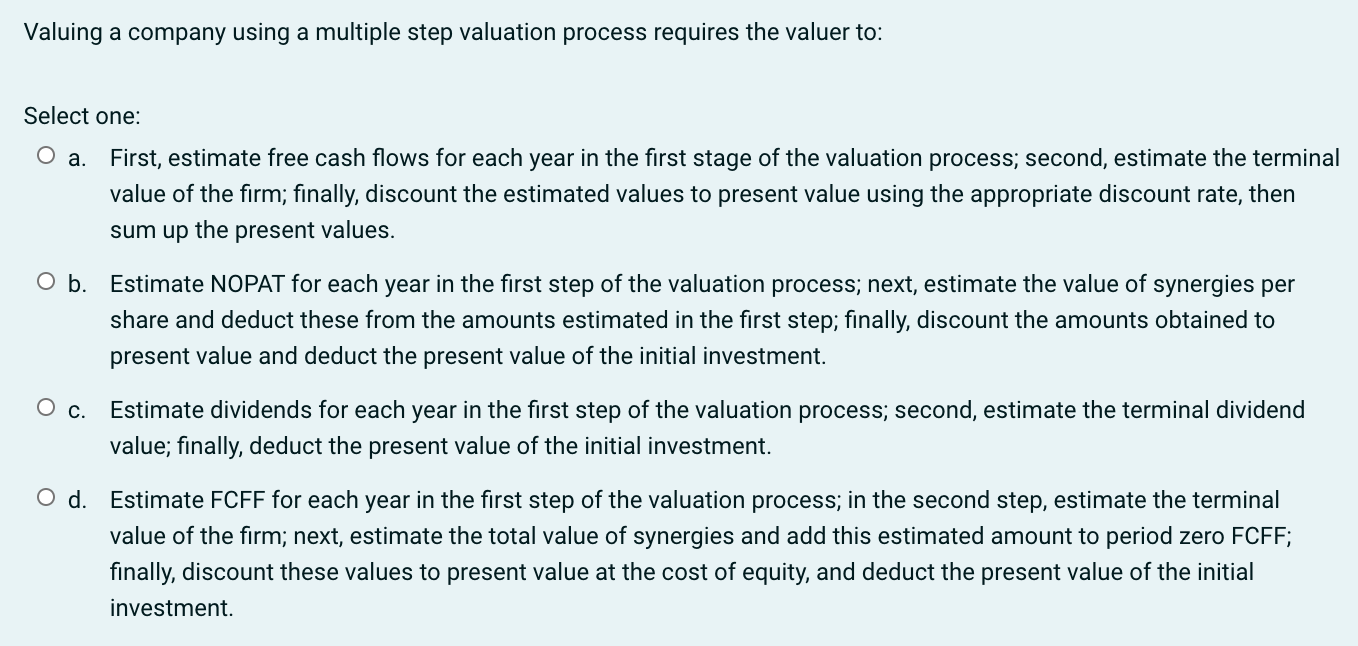

Valuing a company using a multiple step valuation process requires the valuer to: Select one: O a. First, estimate free cash flows for each year in the first stage of the valuation process; second, estimate the terminal value of the firm; finally, discount the estimated values to present value using the appropriate discount rate, then sum up the present values. O b. Estimate NOPAT for each year in the first step of the valuation process; next, estimate the value of synergies per share and deduct these from the amounts estimated in the first step; finally, discount the amounts obtained to present value and deduct the present value of the initial investment. O c. Estimate dividends for each year in the first step of the valuation process; second, estimate the terminal dividend value; finally, deduct the present value of the initial investment. O d. Estimate FCFF for each year in the first step of the valuation process; in the second step, estimate the terminal value of the firm; next, estimate the total value of synergies and add this estimated amount to period zero FCFF; finally, discount these values to present value at the cost of equity, and deduct the present value of the initial investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts