Question: Valuing a European Put Option Using a Binomial Tree Consider a stock that is currently priced at $ 1 0 0 . Over the next

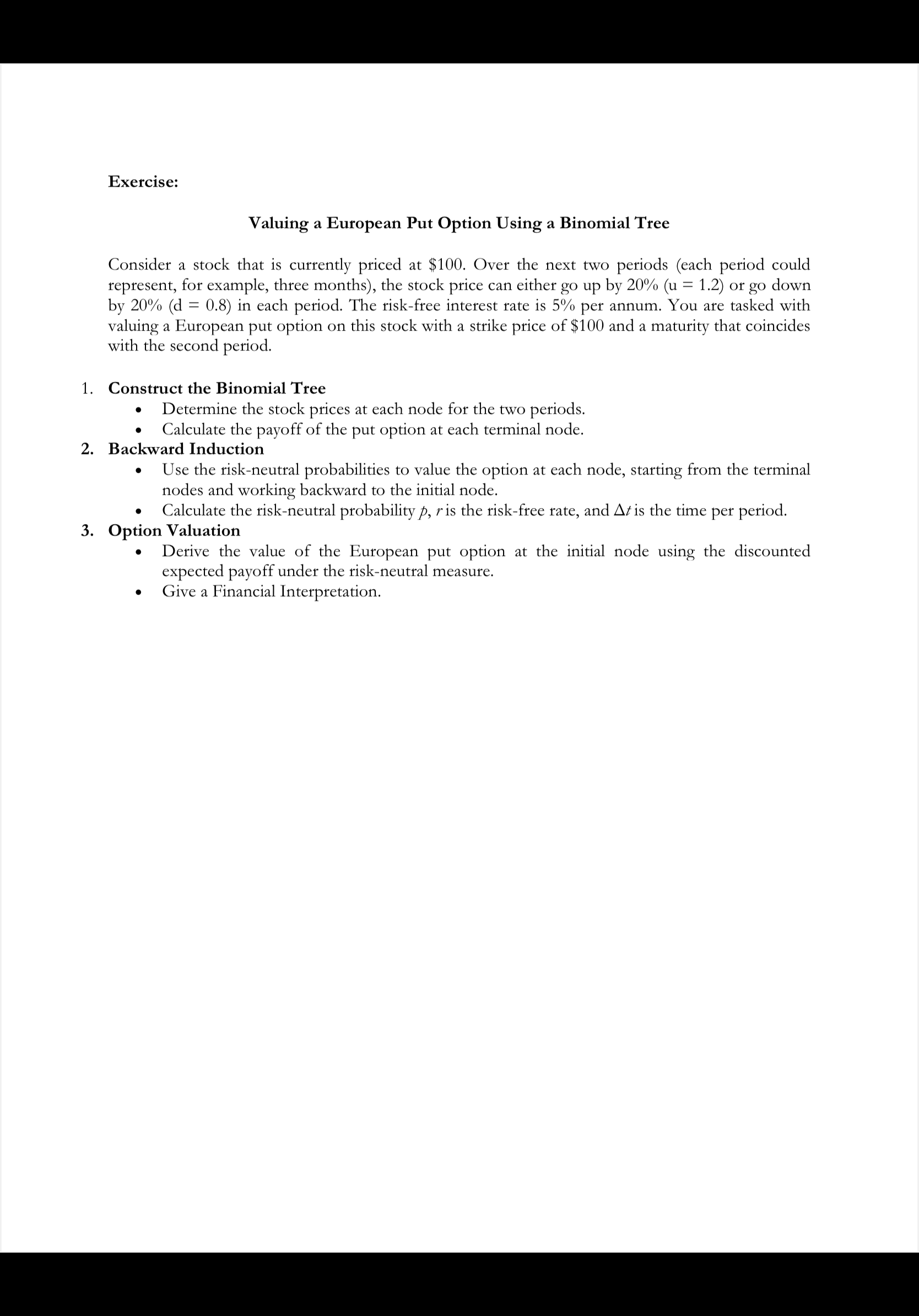

Valuing a European Put Option Using a Binomial Tree

Consider a stock that is currently priced at $ Over the next two periods each period could

represent, for example, three months the stock price can either go up by or go down

by in each period. The riskfree interest rate is per annum. You are tasked with

valuing a European put option on this stock with a strike price of $ and a maturity that coincides

with the second period.

Construct the Binomial Tree

Determine the stock prices at each node for the two periods.

Calculate the payoff of the put option at each terminal node.

Backward Induction

Use the riskneutral probabilities to value the option at each node, starting from the terminal

nodes and working backward to the initial node.

Calculate the riskneutral probability is the riskfree rate, and is the time per period.

Option Valuation

Derive the value of the European put option at the initial node using the discounted

expected payoff under the riskneutral measure.

Give a Financial Interpretation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock