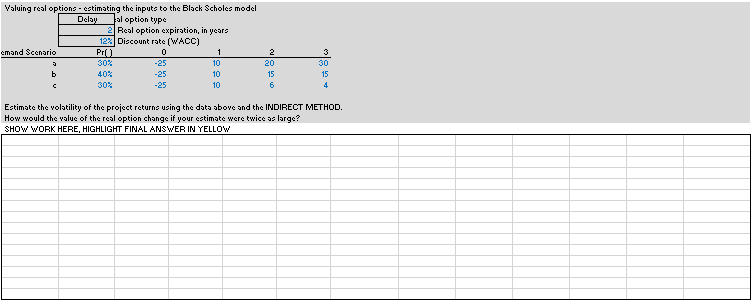

Question: Valuing real options - estimating the inputs to the Black Scholes model Delay al option type 2 Real option expiration, in years 12% Discount rate

Valuing real options - estimating the inputs to the Black Scholes model Delay al option type 2 Real option expiration, in years 12% Discount rate (WACC) emand Scenario Pro 0 1 3 30% -25 10 b 40% -25 10 30% -25 10 2 20 15 6 3 30 15 4 C Estimate the volatility of the project returns using the data above and the INDIRECT METHOD. How would the value of the real option change if your estimate were twice as large? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW Valuing real options - estimating the inputs to the Black Scholes model Delay al option type 2 Real option expiration, in years 12% Discount rate (WACC) emand Scenario Pro 0 1 3 30% -25 10 b 40% -25 10 30% -25 10 2 20 15 6 3 30 15 4 C Estimate the volatility of the project returns using the data above and the INDIRECT METHOD. How would the value of the real option change if your estimate were twice as large? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts