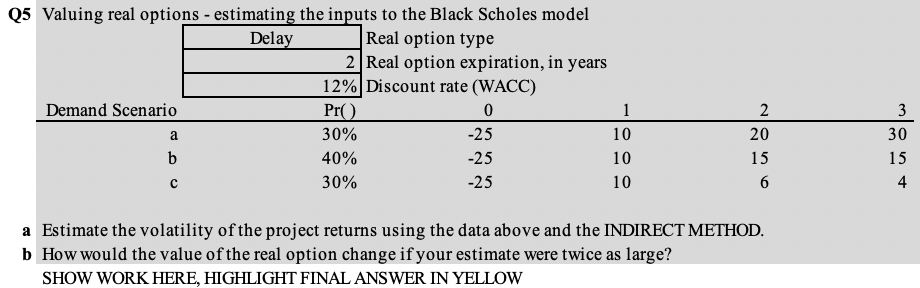

Question: Q5 Valuing real options - estimating the inputs to the Black Scholes model Delay Real option type 2 Real option expiration, in years 12% Discount

Q5 Valuing real options - estimating the inputs to the Black Scholes model Delay Real option type 2 Real option expiration, in years 12% Discount rate (WACC) Demand Scenario Pro 0 1 30% -25 10 b 40% -25 10 30% -25 10 a 2 20 15 6 3 30 15 4 a Estimate the volatility of the project returns using the data above and the INDIRECT METHOD. b How would the value of the real option change if your estimate were twice as large? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW Q5 Valuing real options - estimating the inputs to the Black Scholes model Delay Real option type 2 Real option expiration, in years 12% Discount rate (WACC) Demand Scenario Pro 0 1 30% -25 10 b 40% -25 10 30% -25 10 a 2 20 15 6 3 30 15 4 a Estimate the volatility of the project returns using the data above and the INDIRECT METHOD. b How would the value of the real option change if your estimate were twice as large? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts