Question: Valuing Stocks - Your Turn - Please complete the problem below. A firm has common stock with a market price of $100 per share and

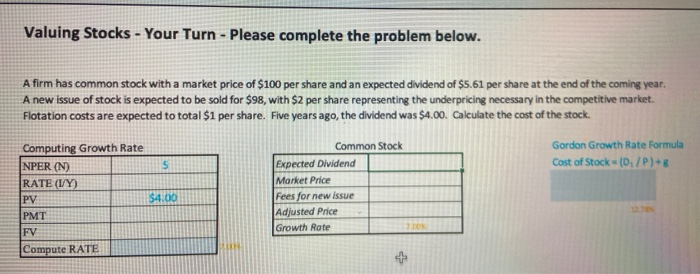

Valuing Stocks - Your Turn - Please complete the problem below. A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive market. Flotation costs are expected to total $1 per share. Five years ago, the dividend was $4.00. Calculate the cost of the stock. Computing Growth Rate NPER (N) RATE (I/Y) Gordon Growth Rate Formula Cost of Stock - 10./P)+8 Common Stock Expected Dividend Market Price Fees for new issue Adjusted Price Growth Rote $4.00 Compute RATE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts