Question: AD Valuing Stocks - Your Turn - Please complete the problem below. A firm has common stock with a market price of $100 per share

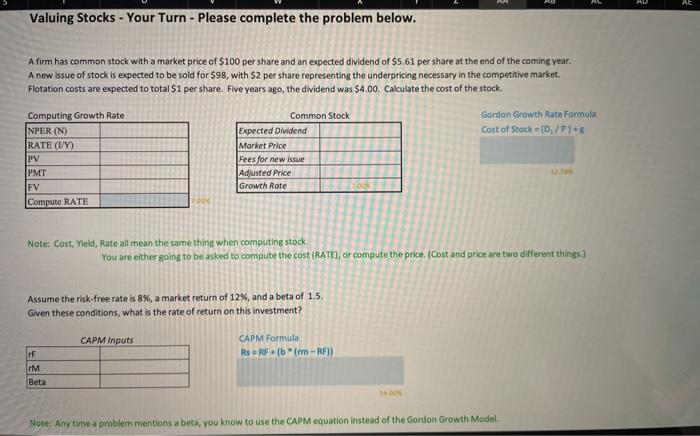

AD Valuing Stocks - Your Turn - Please complete the problem below. A firm has common stock with a market price of $100 per share and an expected dividend of $5,61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive market. Flotation costs are expected to total $1 per share. Five years ago, the dividend was $4.00. Calculate the cost of the stock. Gordon Growth Rate Formula Cost of Stock: (D/P)+ Computing Growth Rate NPER (N). RATE (VY PV PMT FV Compute RATE Common Stock Expected Dividend Market Price Fees for new issue Adjusted Price Growth Rate Note: Cost, Yield, Rate all mean the same thing when computing stock You are either going to be asked to compute the cost (RATE), or compute the price. (Cost and price are two different things) Assume the risk-free rate is 8%, a market return of 12%, and a beta of 1.5. Given these conditions, what is the rate of return on this investment? CAPM Inputs CAPM Formula R$ = RF (birm - RF) F IM Beta 18 Note: Any timea problem mentions a beta, you know to use the CAPM equation instead of the Gordon Growth Model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts