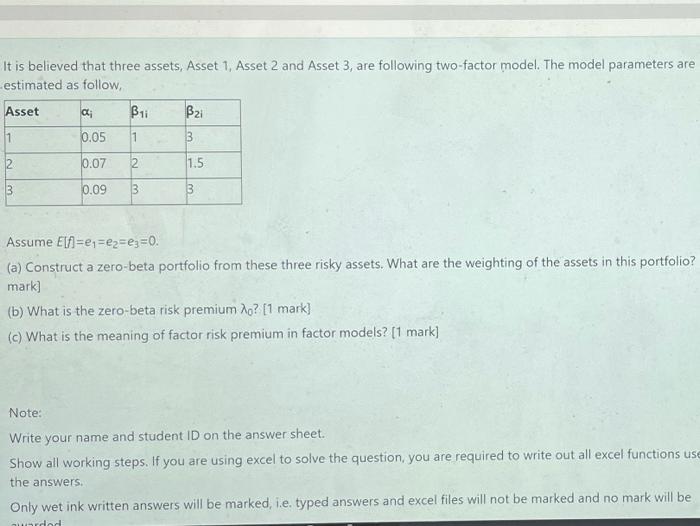

Question: vanswer on paper please It is believed that three assets, Asset 1, Asset 2 and Asset 3, are following two-factor model. The model parameters are

It is believed that three assets, Asset 1, Asset 2 and Asset 3, are following two-factor model. The model parameters are estimated as follow, Asset B11 Bzi 1 0.05 3 a; 1 2 0.07 2 1.5 3 0.09 3 B Assume Elf=e,=ez=e3=0. (a) Construct a zero-beta portfolio from these three risky assets. What are the weighting of the assets in this portfolio? mark) (b) What is the zero-beta risk premium 10? [1 mark] (c) What is the meaning of factor risk premium in factor models? [1 mark] Note: Write your name and student ID on the answer sheet. Show all working steps. If you are using excel to solve the question, you are required to write out all excel functions use the answers Only wet ink written answers will be marked, i.e. typed answers and excel files will not be marked and no mark will be ndod

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts