Question: Variable Costing Using Excel for Variable Costing Fremont Cookies incurs the following costs for its cookies in 2 0 2 4 . table [

Variable Costing

Using Excel for Variable Costing

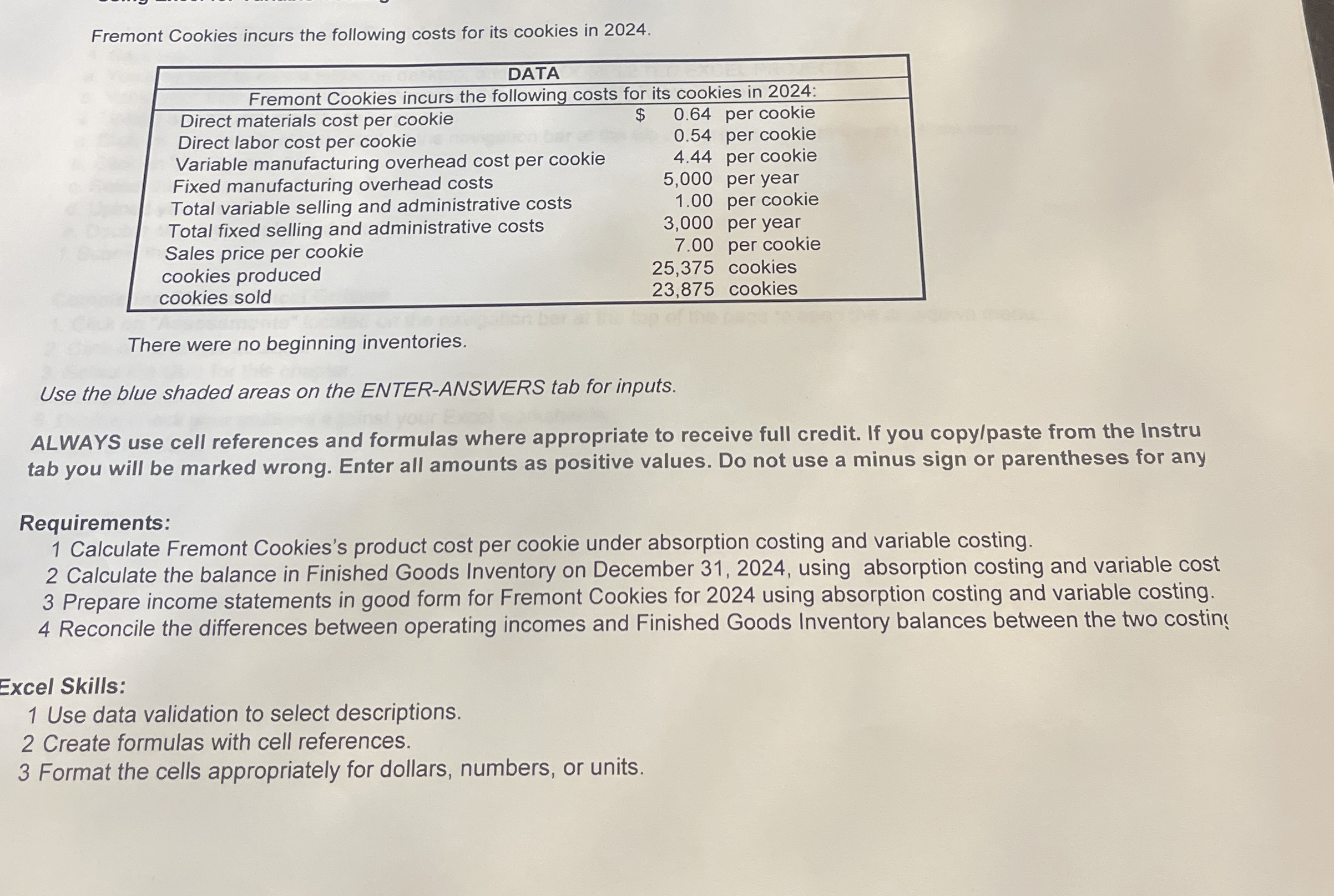

Fremont Cookies incurs the following costs for its cookies in

tableDATAFremont Cookies incurs the following costs for its cookies in :Direct materials cost per cookie,$ per cookieDirect labor cost per cookie, per cookie per cookieVariable manufacturing overhead cost per cookie, per yearFixed manufacturing overhead costs, per cookieTotal variable selling and administrative cos per yearTotal fixed selling and administrative costs, per cookieSales price per cookie, cookiescookies produced, cookies

There were no beginning inventories.

Use the blue shaded areas on the ENTERANSWERS tab for inputs.

ALWAYS use cell references and formulas where appropriate to receive full credit. If you copypaste from the Instru tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any

Requirements:

Calculate Fremont Cookies's product cost per cookie under absorption costing and variable costing.

Calculate the balance in Finished Goods Inventory on December using absorption costing and variable cost

Prepare income statements in good form for Fremont Cookies for using absorption costing and variable costing.

Reconcile the differences between operating incomes and Finished Goods Inventory balances between the two costin

Excel Skills:

Use data validation to select descriptions.

Create formulas with cell references.

Format the cells appropriately for dollars, numbers, or units.

Fremont Cookies incurs the following costs for its cookies in

tableDATAFremont Cookies incurs the following costs for its cookies in :Direct materials cost per cookie,$ per cookieDirect labor cost per cookie, per cookieVariable manufacturing overhead cost per cookie, per cookieFixed manufacturing overhead costs, per yearTotal variable selling and administrative costs, per cookieTotal fixed selling and administrative costs, per yearSales price per cookie, per cookiecookies produced, cookiescookies sold, cookies

There were no beginning inventories.

Use the blue shaded areas on the ENTERANSWERS tab for inputs.

ALWAYS use cell references and formulas where appropriate to receive full credit. If you copylpaste from the Instru tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any

Requirements:

Calculate Fremont Cookies's product cost per cookie under absorption costing and variable costing.

Calculate the balance in Finished Goods Inventory on December using absorption costing and variable cost

Prepare income statements in good form for Fremont Cookies for using absorption costing and variable costing.

Reconcile the differences between operating incomes and Finished Goods Inventory balances between the two costin

Excel Skills:

Use data validation to select descriptions.

Create formulas with cell references.

Format the cells appropriately for dollars, numbers, or units.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock