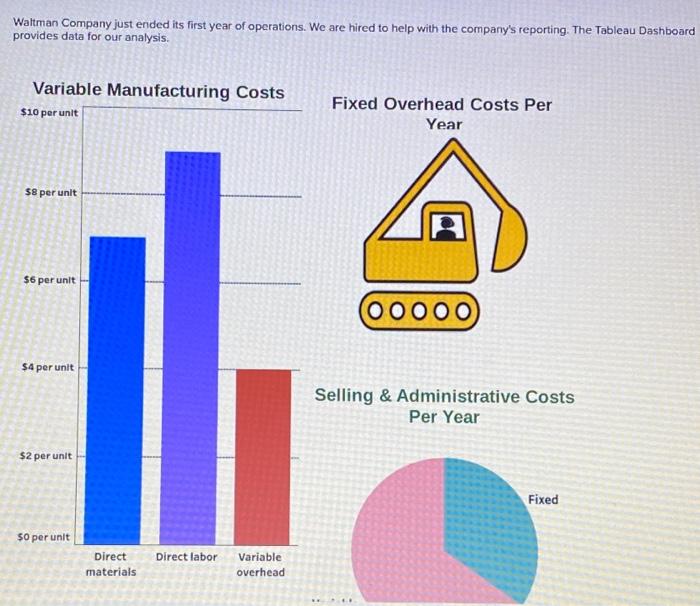

Question: (Variable Manufacturing Costs) Direct Materials: $7 Per Unit Direct Labor: $9 Per unit Variable Overhead: $4 Per Unit Fixed Manufacturing Overhead: $100,000 per year Selling

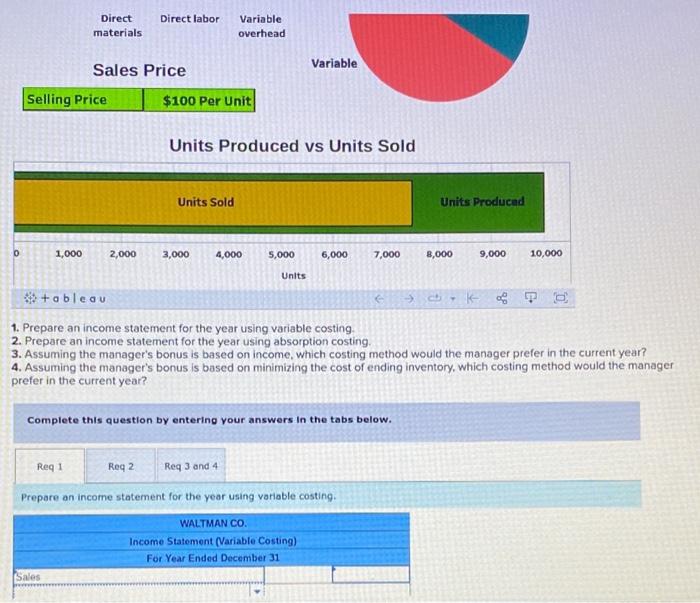

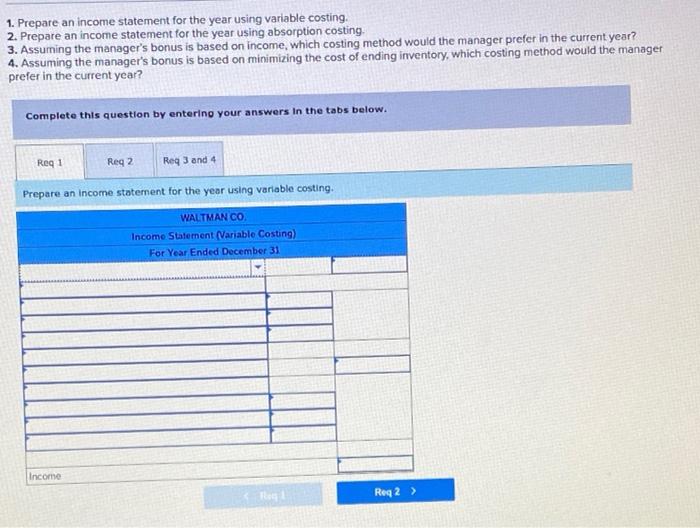

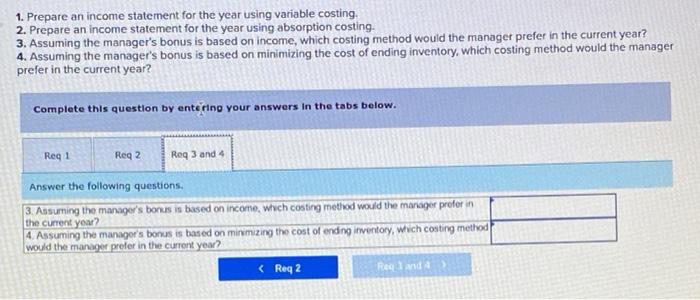

Waltman Company just ended its first year of operations. We are hired to help with the company's reporting. The Tableau Dashboard provides data for our analysis. Units Produced vs Units Sold 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Assuming the manager's bonus is based on income, which costing method would the manager prefer in the current year? 4. Assuming the manager's bonus is based on minimizing the cost of ending inventory, which costing method would the manager prefer in the current year? Complete this question by entering your answers In the tabs below. Prepare an income statement for the year using variable costing. 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Assuming the manager's bonus is based on income, which costing method would the manager prefer in the current year? 4. Assuming the manager's bonus is based on minimizing the cost of ending ifventory, which costing method would the manager prefer in the current year? Complete this question by entering your answers in the tabs below. Prepare an income statement for the year using variable costing. 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Assuming the manager's bonus is based on income, which costing method would the manager prefer in the current year? 4. Assuming the managar's bonus is based on minimizing the cost of ending inventory, which costing method would the manager prefer in the current year? Complete this question by entering your answers in the tabs below. Prepare an income statement for the year using absorption costing. 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. 3. Assuming the manager's bonus is based on income, which costing method would the manager prefer in the current year? 4. Assuming the manager's bonus is based on minimizing the cost of ending inventory, which costing method would the manager prefer in the current year? Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts