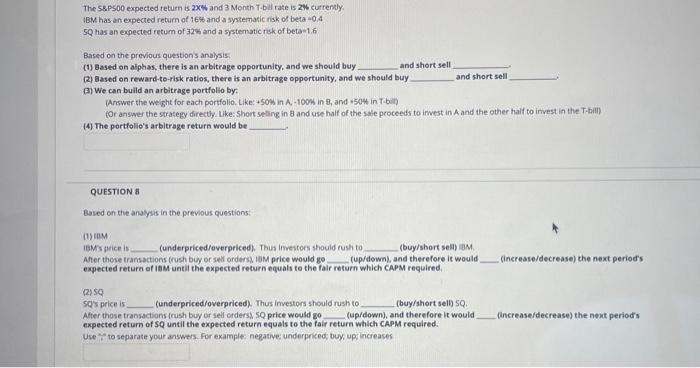

Question: variables = 6 The S&P500 expected return is 2x% and 3 Month T-bil rate is 2% currently IBM has an expected return of 16% and

The S&P500 expected return is 2x% and 3 Month T-bil rate is 2% currently IBM has an expected return of 16% and a systematic risk of beta-04 SQ has an expected return of 32% and a systematic risk of beta 16 Based on the previous questions analysis (1) Based on alphas, there is an arbitrage opportunity, and we should buy and short sell 2) Based on reward-to-risk ratios, there is an arbitrage opportunity, and we should buy and short sell 3) We can build an arbitrage portfolio by: (Answer the weight for each portfolio. Like: 50% In A 100% in B, and sow in Tbi) for answer the strategy directly. Like: Short selling in and use half of the sale proceeds to invest in A and the other half to invest in the Tbili) (4) The portfolio's arbitrage return would be QUESTIONS Based on the analysis in the previous questions COM IBM's prices (underpriced/overpriced). Thus Investors should rush to (buy/shortselt) After those transactions (rush buy or sell orders, 10M price would go cup/down, and therefore it would expected return of IBM until the expected return equals to the fair return which CAPM required (increase/decrease the next period's (2) SQ so's price is (underpriced/overpriced). Thus Investors should rush to (buy/short sell) SQ After those transactions crush buy or sell orders SQ price would go (up/down), and therefore it would expected return of SQ until the expected return equals to the fair return which CAPM required. Use to separate your answers. For example: negative underpriced buy, up increases (increase/decrease) the next period's The S&P500 expected return is 2x% and 3 Month T-bil rate is 2% currently IBM has an expected return of 16% and a systematic risk of beta-04 SQ has an expected return of 32% and a systematic risk of beta 16 Based on the previous questions analysis (1) Based on alphas, there is an arbitrage opportunity, and we should buy and short sell 2) Based on reward-to-risk ratios, there is an arbitrage opportunity, and we should buy and short sell 3) We can build an arbitrage portfolio by: (Answer the weight for each portfolio. Like: 50% In A 100% in B, and sow in Tbi) for answer the strategy directly. Like: Short selling in and use half of the sale proceeds to invest in A and the other half to invest in the Tbili) (4) The portfolio's arbitrage return would be QUESTIONS Based on the analysis in the previous questions COM IBM's prices (underpriced/overpriced). Thus Investors should rush to (buy/shortselt) After those transactions (rush buy or sell orders, 10M price would go cup/down, and therefore it would expected return of IBM until the expected return equals to the fair return which CAPM required (increase/decrease the next period's (2) SQ so's price is (underpriced/overpriced). Thus Investors should rush to (buy/short sell) SQ After those transactions crush buy or sell orders SQ price would go (up/down), and therefore it would expected return of SQ until the expected return equals to the fair return which CAPM required. Use to separate your answers. For example: negative underpriced buy, up increases (increase/decrease) the next period's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts