Question: Ver PRINTER VERSION 4 BACK NEX Brief Exercise 4-07 On January 1, 2020, Sheridan Company had cash and common shares of $70,000. At that date,

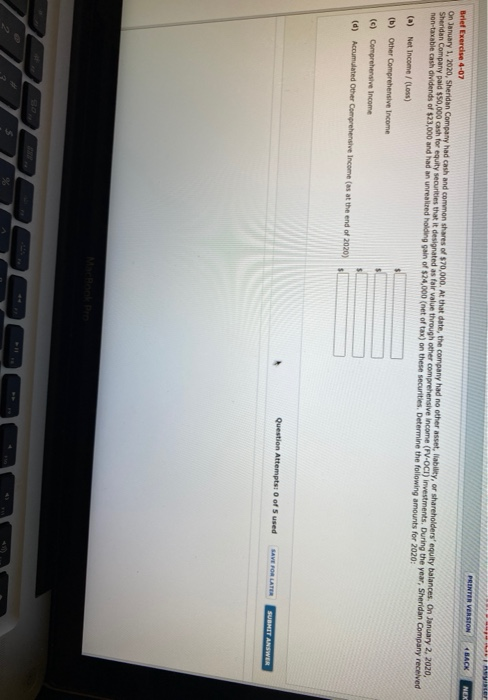

Ver PRINTER VERSION 4 BACK NEX Brief Exercise 4-07 On January 1, 2020, Sheridan Company had cash and common shares of $70,000. At that date, the company had no other asset, liability, or shareholders' equity balances. On January 2, 2020, Sheridan Company paid $50,000 cash for equity securities that it designated as fair value through other comprehensive income (FV-OCI) investments. During the year, Sheridan Company received non-taxable cash dividends of $23,000 and had a realized holding gain of $24,000 (net of tax) on these securities. Determine the following amounts for 2020: (a) Net Income (Loss) (b) Other Comprehensive Income (c) Comprehensive Income (d) Accumulated Other Comprehensive Income (as at the end of 2020) 5 Question Attempts: 0 of Sused SAVERS LATER SUBMIT ANSWER S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts