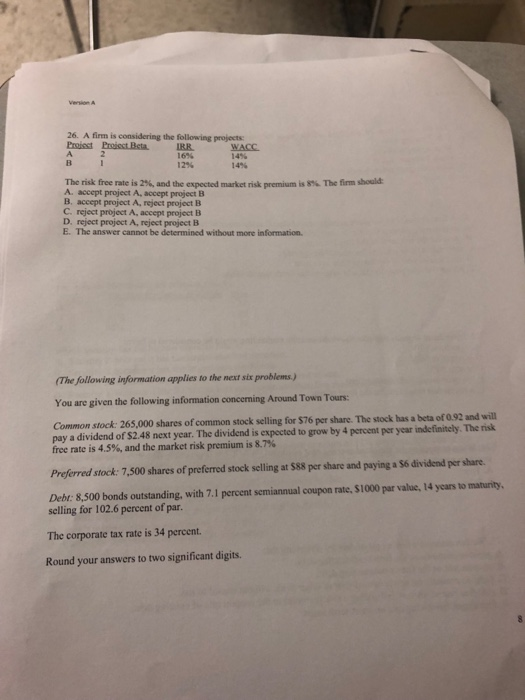

Question: version A 26. A firm is considering the following projects 16% 12% WACC 14% 14% The risk free rate is 2%, and the expected market

version A 26. A firm is considering the following projects 16% 12% WACC 14% 14% The risk free rate is 2%, and the expected market risk premium is 8% The firm should A. accept project A, accept project B B. accept project A, reject project B C. reject project A, accept project B D. reject project A, reject project HB E. The answer cannot be determined without more information l b) You are given the following information concerming Around Town Tours: Common stock: 265,000 shares of common stock selling for $76 per share. The stock has a beta of 0.92 and will a dividend of $248 next year. The dividend is expected to grow by 4 percent per year indefinitely: The risk free rate is 4.5%, and the market nsk premium is 8.7% Preferred stock: 7,500 shares of preferred stock selling at $88 per share and paying a s6 dividend per share Debt: 8,500 bonds outstanding, with 7.1 percent semiannual coupon rate, $1000 par value, 14 years to maturity, selling for 102.6 percent of par The corporate tax rate is 34 percent Round your answers to two significant digits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts