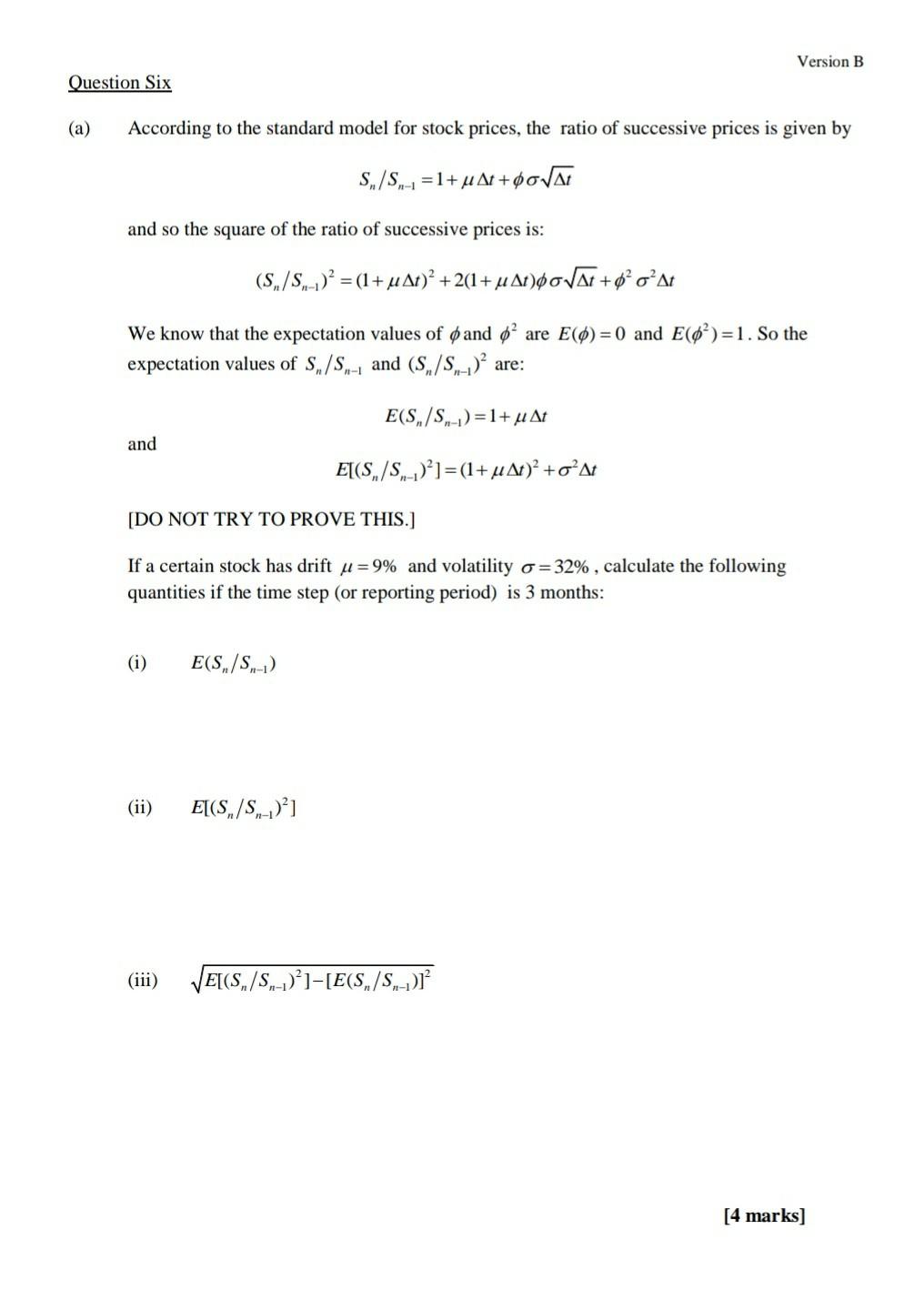

Question: Version B Question Six (a) According to the standard model for stock prices, the ratio of successive prices is given by S/S - = 1+

Version B Question Six (a) According to the standard model for stock prices, the ratio of successive prices is given by S/S - = 1+ u At+ OVA n-1 and so the square of the ratio of successive prices is: (S,/S -.)? = (1+ u At)? + 2(1+ u Atho/At + oAt = We know that the expectation values of and 6 are E(0)=0) and E(0)=1. So the expectation values of S/S.,- and (S/S) are: E(S/S)-1)=1+u At and E[(S/S -.)?] =(1+ Af)? + oAt [DO NOT TRY TO PROVE THIS.] If a certain stock has drift u = 9% and volatility o =32%, calculate the following quantities if the time step (or reporting period) is 3 months: (i) E(S/S,-) (ii) E[(S,/S,-)?1 (iii) E[(S./S.--)1-[E(S,/S.-) [4 marks] Version B (b) If is a random variable taken from the standard normal distribution, and n is a positive integer, the expectation value of 6" is given by the integral 1 E(6") = $"e* d (i) Use the Product Rule to calculate the derivative d d el) (ii) Use the result of part (i) to show that E(0"+l) = nE(0"-4) e/2 [Hint: You may assume that lim- positive integer k.] = 0 and lime */2 =0 for any (iii) Use the result of part (ii) and the fact that E(0)=0 and E()=1 to calculate the following expectation values: E(0)= E(0)= E(0)= E(0%)= (iv) Calculate Ecz?) if z = 3 20+02 + 40. [7 marks] Version B Question Six (a) According to the standard model for stock prices, the ratio of successive prices is given by S/S - = 1+ u At+ OVA n-1 and so the square of the ratio of successive prices is: (S,/S -.)? = (1+ u At)? + 2(1+ u Atho/At + oAt = We know that the expectation values of and 6 are E(0)=0) and E(0)=1. So the expectation values of S/S.,- and (S/S) are: E(S/S)-1)=1+u At and E[(S/S -.)?] =(1+ Af)? + oAt [DO NOT TRY TO PROVE THIS.] If a certain stock has drift u = 9% and volatility o =32%, calculate the following quantities if the time step (or reporting period) is 3 months: (i) E(S/S,-) (ii) E[(S,/S,-)?1 (iii) E[(S./S.--)1-[E(S,/S.-) [4 marks] Version B (b) If is a random variable taken from the standard normal distribution, and n is a positive integer, the expectation value of 6" is given by the integral 1 E(6") = $"e* d (i) Use the Product Rule to calculate the derivative d d el) (ii) Use the result of part (i) to show that E(0"+l) = nE(0"-4) e/2 [Hint: You may assume that lim- positive integer k.] = 0 and lime */2 =0 for any (iii) Use the result of part (ii) and the fact that E(0)=0 and E()=1 to calculate the following expectation values: E(0)= E(0)= E(0)= E(0%)= (iv) Calculate Ecz?) if z = 3 20+02 + 40. [7 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts