Question: VI. (16 points) Consider a forward contract on some asset A, with a delivery date of T years from now. Let to be the current

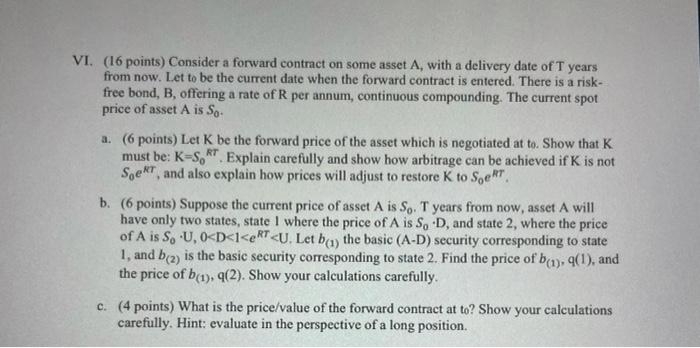

VI. (16 points) Consider a forward contract on some asset A, with a delivery date of T years from now. Let to be the current date when the forward contract is entered. There is a risk- free bond, B, offering a rate of R per annum, continuous compounding. The current spot price of asset A is So a. (6 points) Let K be the forward price of the asset which is negotiated at to. Show that K must be: K=S,RT. Explain carefully and show how arbitrage can be achieved if K is not SERT and also explain how prices will adjust to restore k to Soek b. (6 points) Suppose the current price of asset A is So. T years from now, asset A will have only two states, state I where the price of A is S, D, and state 2, where the price of A is SU, 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts