Question: View History Bookmarks Develop 80% O Wed 3:18 PM Rasheeda Williams a E Safari File Edit Window Help G B mybusinesscourse.com/platform/mod/quiz/attempt.php?attempt=35 = myRutgers Portal Dashboard

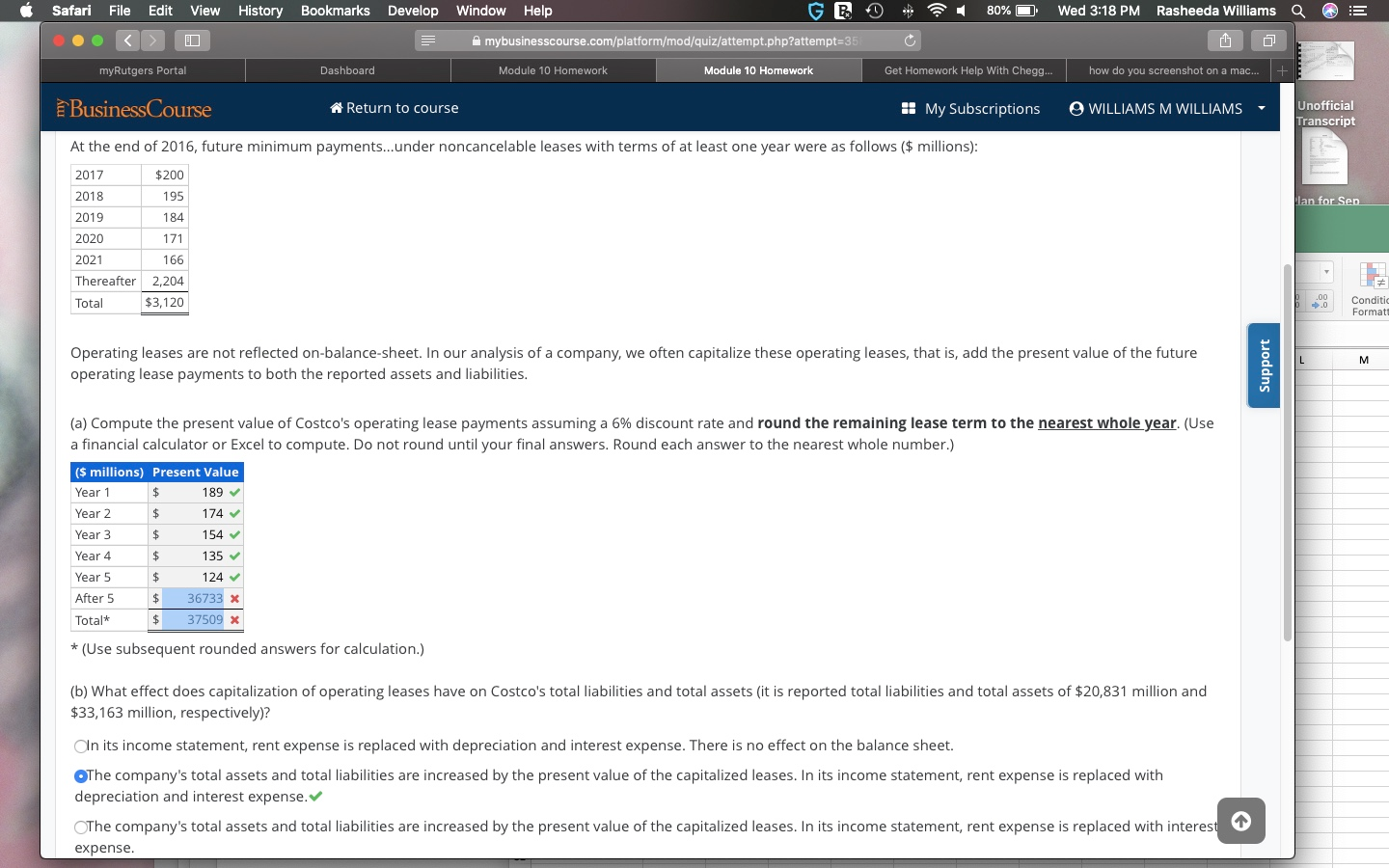

View History Bookmarks Develop 80% O Wed 3:18 PM Rasheeda Williams a E Safari File Edit Window Help G B mybusinesscourse.com/platform/mod/quiz/attempt.php?attempt=35 = myRutgers Portal Dashboard Module 10 Homework Module 10 Homework Get Homework Help With Chegg... how do you screenshot on a mac... + Business Course Return to course My Subscriptions WILLIAMS M WILLIAMS Y Unofficial Transcript At the end of 2016, future minimum payments...under noncancelable leases with terms of at least one year were as follows ($ millions): $200 195 lan for Sen 184 2017 2018 2019 2020 2021 Thereafter Total 171 166 2,204 $3,120 1 LIE Conditio Formatt M Operating leases are not reflected on-balance-sheet. In our analysis of a company, we often capitalize these operating leases, that is, add the present value of the future operating lease payments to both the reported assets and liabilities. Support (a) Compute the present value of Costco's operating lease payments assuming a 6% discount rate and round the remaining lease term to the nearest whole year. (Use a financial calculator or Excel to compute. Do not round until your final answers, Round each answer to the nearest whole number.) ($ millions) Present Value Year 1 189 Year 2 $ 174 Year 3 154 Year 4 $ 135 Year 5 $ 124 After 5 $ 36733 x Total* $ 37509 X * (Use subsequent rounded answers for calculation.) (b) What effect does capitalization of operating leases have on Costco's total liabilities and total assets (it is reported total liabilities and total assets of $20,831 million and $33,163 million, respectively)? On its income statement, rent expense is replaced with depreciation and interest expense. There is no effect on the balance sheet. The company's total assets and total liabilities are increased by the present value of the capitalized leases. In its income statement, rent expense is replaced with depreciation and interest expense. The company's total assets and total liabilities are increased by the present value of the capitalized leases. In its income statement, rent expense is replaced with interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts