Question: View Insert Format Tools Table Window Help AutoSave Save ECON 3800 OL Discussion Qs Ch 8 (1) - Compatibility Mode - Saved to my Mac

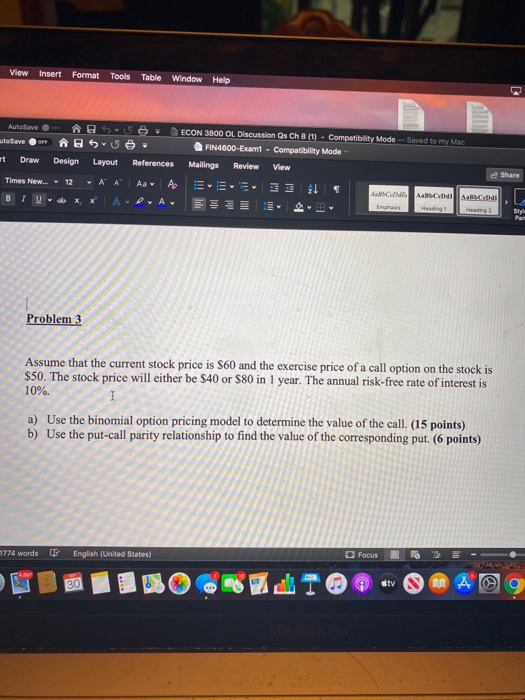

View Insert Format Tools Table Window Help AutoSave Save ECON 3800 OL Discussion Qs Ch 8 (1) - Compatibility Mode - Saved to my Mac FIN4600-Examt - Compatibility Mode OFF rt Draw Design Layout References Mailings Review View Times New.. 12 Share A A Aaw A APA 1 A1 BIU ACADdi ABC di Heading Head 2 G X Style Par Problem 3 Assume that the current stock price is $60 and the exercise price of a call option on the stock is $50. The stock price will either be $40 or $80 in 1 year. The annual risk-free rate of interest is 10%. a) Use the binomial option pricing model to determine the value of the call. (15 points) b) Use the put-call parity relationship to find the value of the corresponding put. (6 points) 1774 words English (United States) Focus 30 tv ANA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts