Question: View Policies Current Attempt in Progress At December 31, 2019, Pina Colada Corporation had a deferred tax asset of $825,000, resulting from future deductible amounts

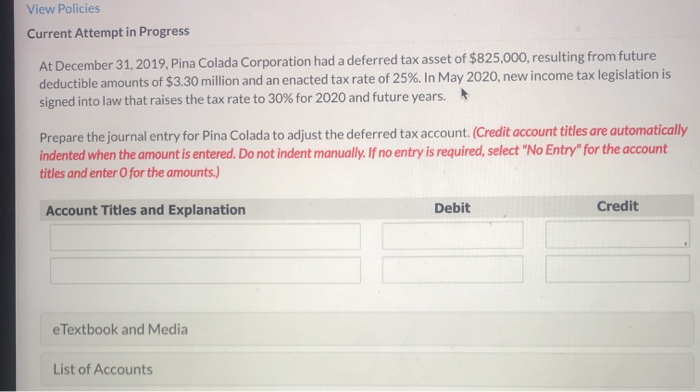

View Policies Current Attempt in Progress At December 31, 2019, Pina Colada Corporation had a deferred tax asset of $825,000, resulting from future deductible amounts of $3.30 million and an enacted tax rate of 25%. In May 2020, new income tax legislation is signed into law that raises the tax rate to 30% for 2020 and future years. Prepare the journal entry for Pina Colada to adjust the deferred tax account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts