Question: View Policies Current Attempt in Progress Coronado Corbin's regular hourly wage rate is $18, and she receives an hourly rate of $27 for work in

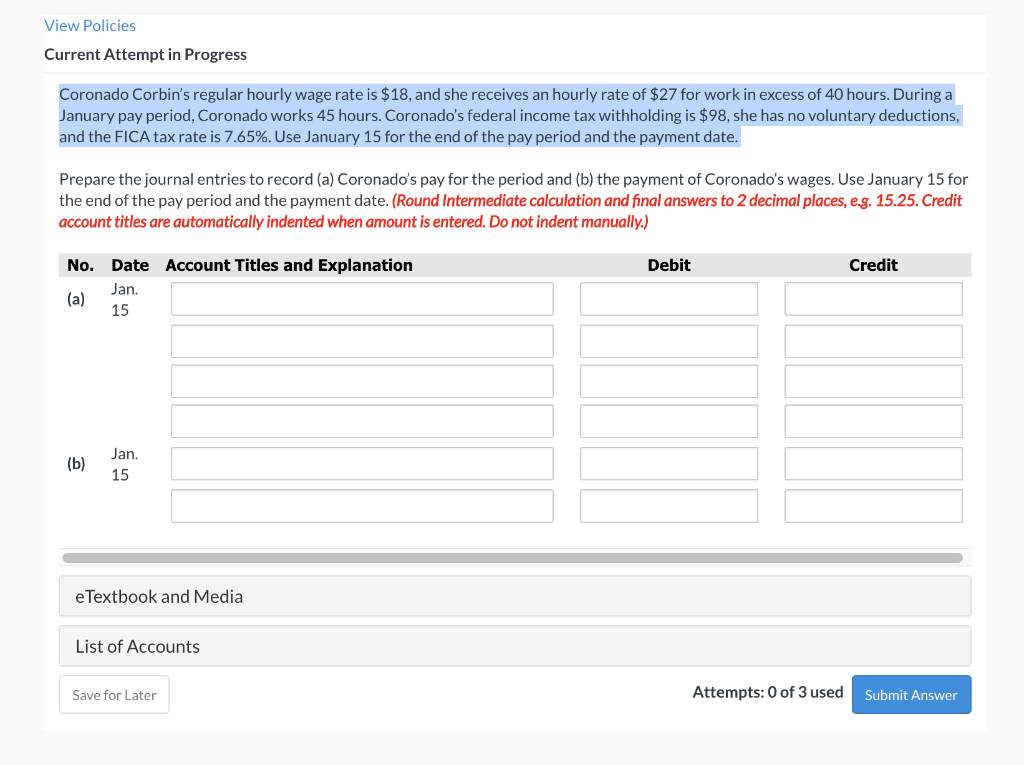

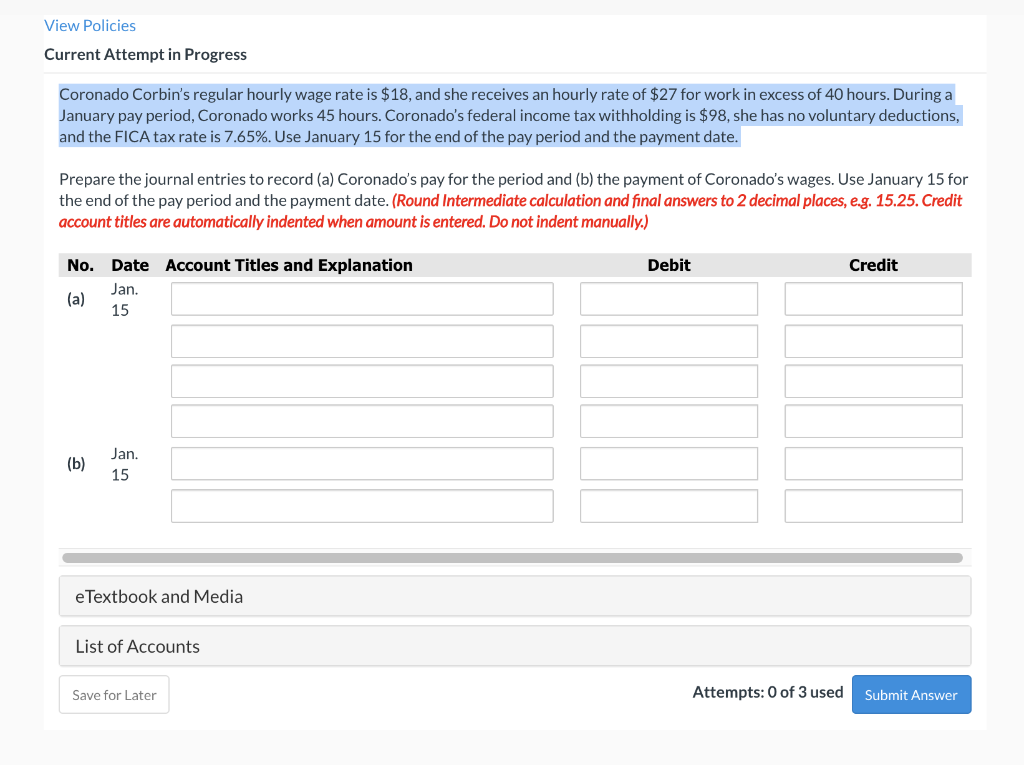

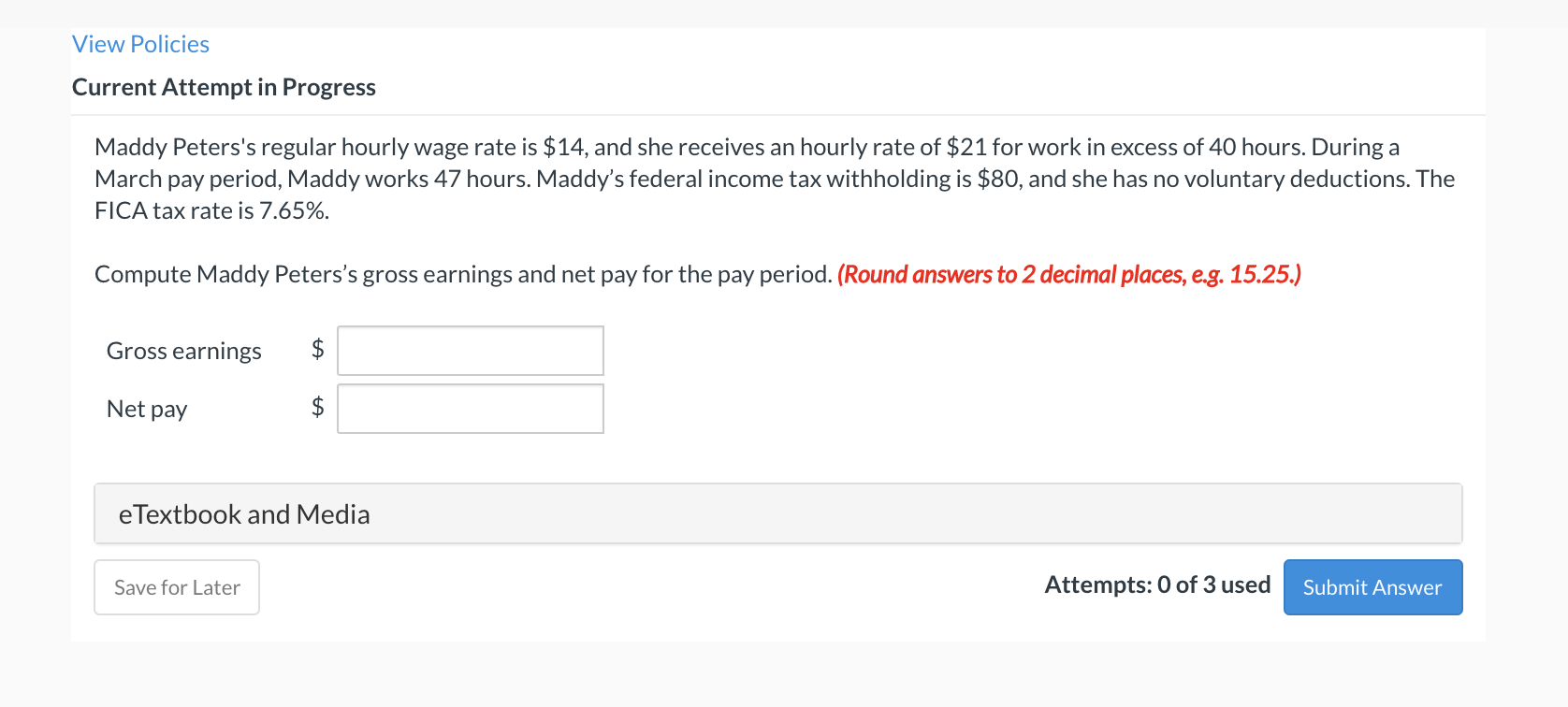

View Policies Current Attempt in Progress Coronado Corbin's regular hourly wage rate is $18, and she receives an hourly rate of $27 for work in excess of 40 hours. During a January pay period, Coronado works 45 hours. Coronado's federal income tax withholding is $98, she has no voluntary deductions, and the FICA tax rate is 7.65%. Use January 15 for the end of the pay period and the payment date. Prepare the journal entries to record (a) Coronado's pay for the period and (b) the payment of Coronado's wages. Use January 15 for the end of the pay period and the payment date. (Round Intermediate calculation and final answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Debit Credit Date Account Titles and Explanation Jan. 15 (a) (b) Jan. 15 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer View Policies Current Attempt in Progress Coronado Corbin's regular hourly wage rate is $18, and she receives an hourly rate of $27 for work in excess of 40 hours. During a January pay period, Coronado works 45 hours. Coronado's federal income tax withholding is $98, she has no voluntary deductions, and the FICA tax rate is 7.65%. Use January 15 for the end of the pay period and the payment date. Prepare the journal entries to record (a) Coronado's pay for the period and (b) the payment of Coronado's wages. Use January 15 for the end of the pay period and the payment date. (Round Intermediate calculation and final answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Debit Credit Date Account Titles and Explanation Jan. 15 (a) (b) Jan. 15 e Textbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answer View Policies Current Attempt in Progress Maddy Peters's regular hourly wage rate is $14, and she receives an hourly rate of $21 for work in excess of 40 hours. During a March pay period, Maddy works 47 hours. Maddy's federal income tax withholding is $80, and she has no voluntary deductions. The FICA tax rate is 7.65%. Compute Maddy Peters's gross earnings and net pay for the pay period. (Round answers to 2 decimal places, e.g. 15.25.) Gross earnings $ Net pay $ e Textbook and Media Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts