Question: View Policies Current Attempt in Progress On January 1 , 2 0 2 0 , Phantom Company acquires $ 2 0 0 , 0 0

View Policies

Current Attempt in Progress

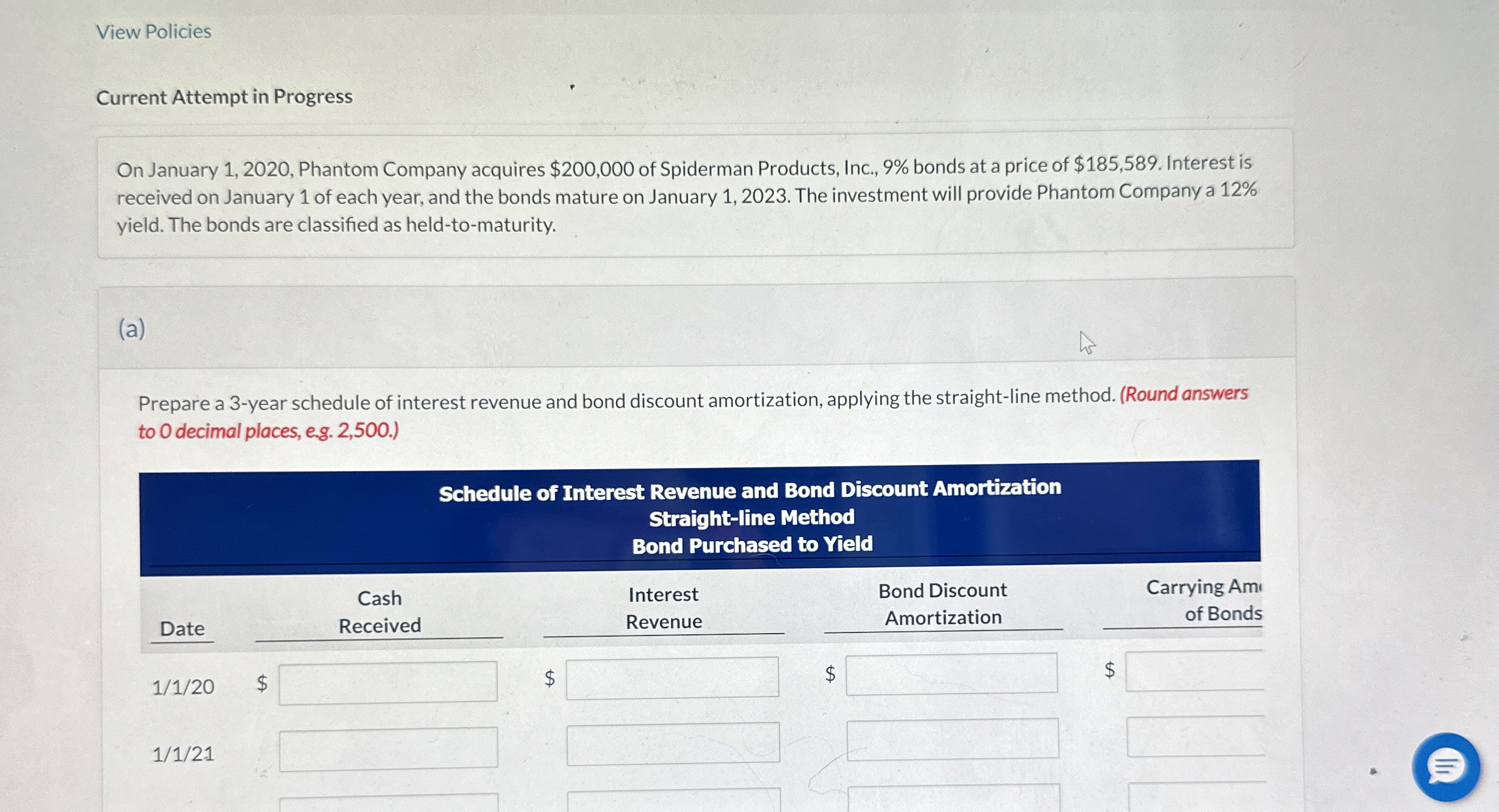

On January Phantom Company acquires $ of Spiderman Products, Inc., bonds at a price of $ Interest is received on January of each year, and the bonds mature on January The investment will provide Phantom Company a yield. The bonds are classified as heldtomaturity.

a

Prepare a year schedule of interest revenue and bond discount amortization, applying the straightline method. Round answers to decimal places, eg

tabletableSchedule of Interest Revenue and Bond Discount AmortizationStraightline MethodBond Purchased to YieldDatetableCashReceivedtableInterestRevenuetableBond DiscountAmortizationtableCarrying Amof Bonds$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock