Question: View Policies Current Attempt in Progress Riverbed Supply does not segregate sales and sales taxes at the time of sale. The register total for March

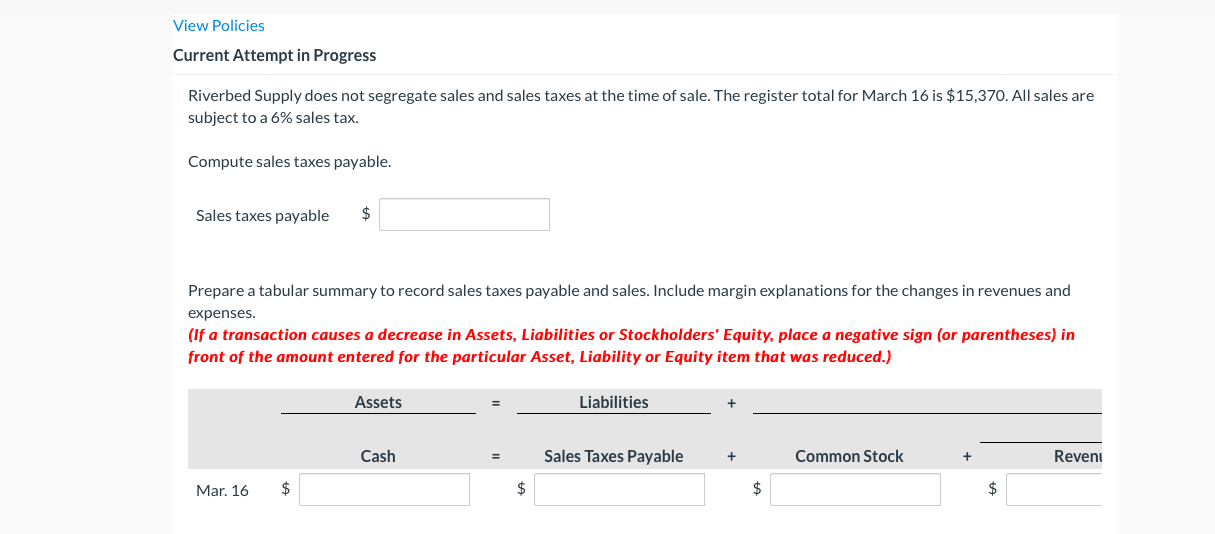

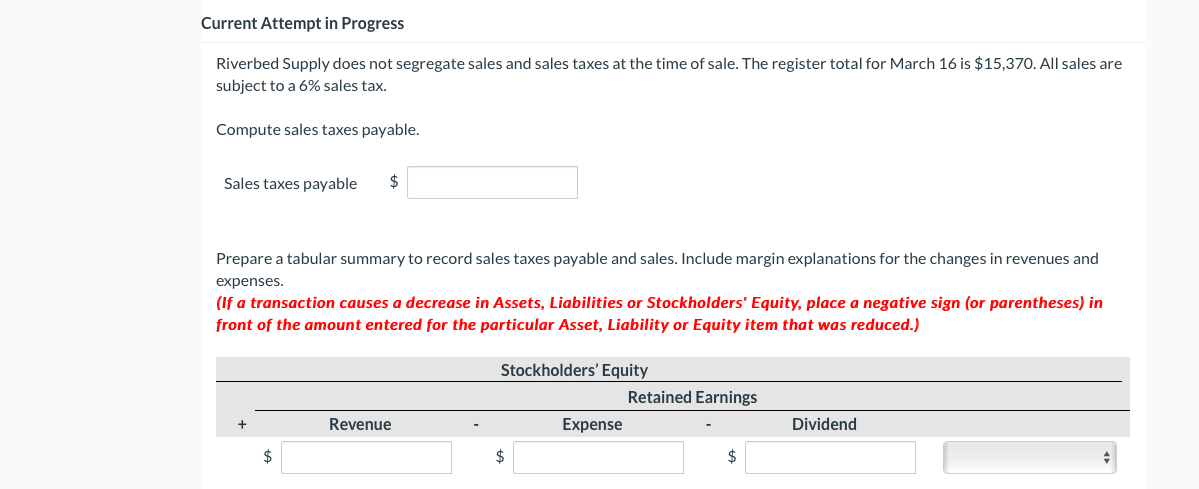

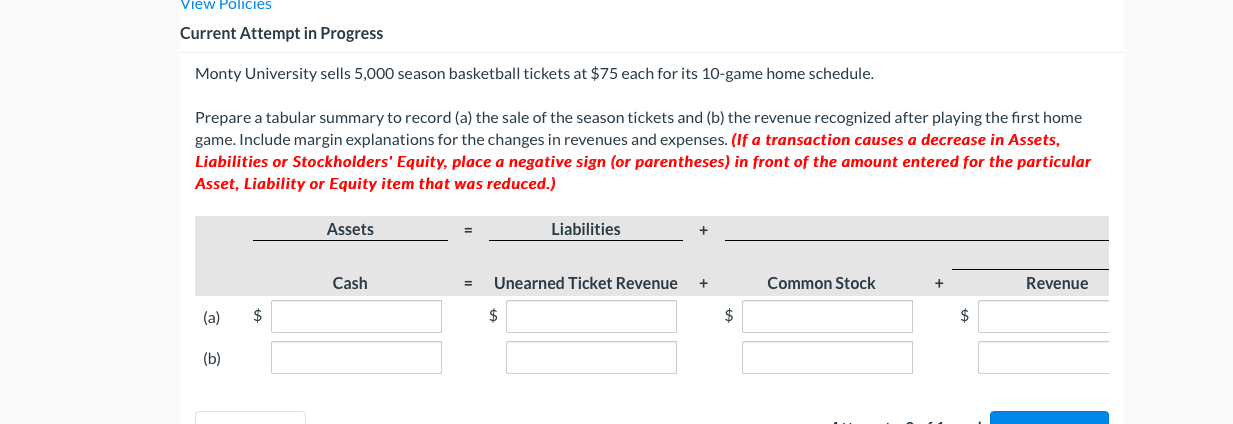

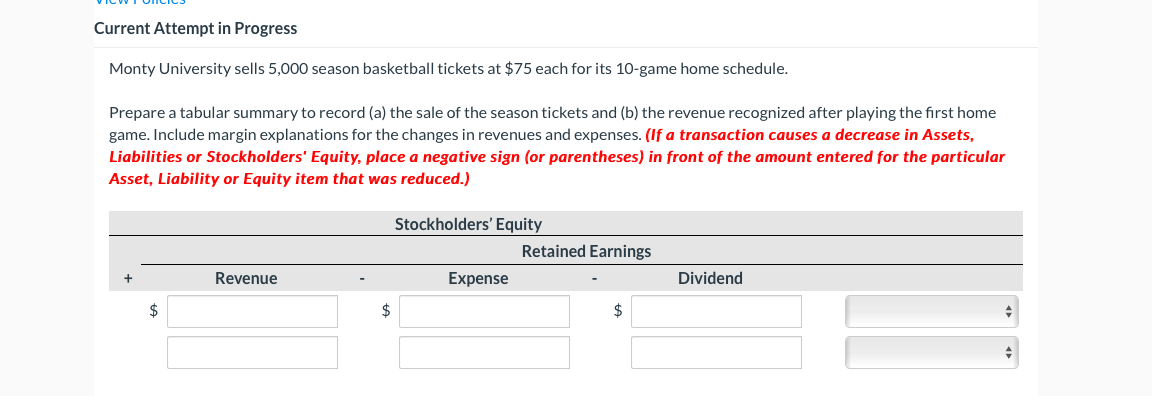

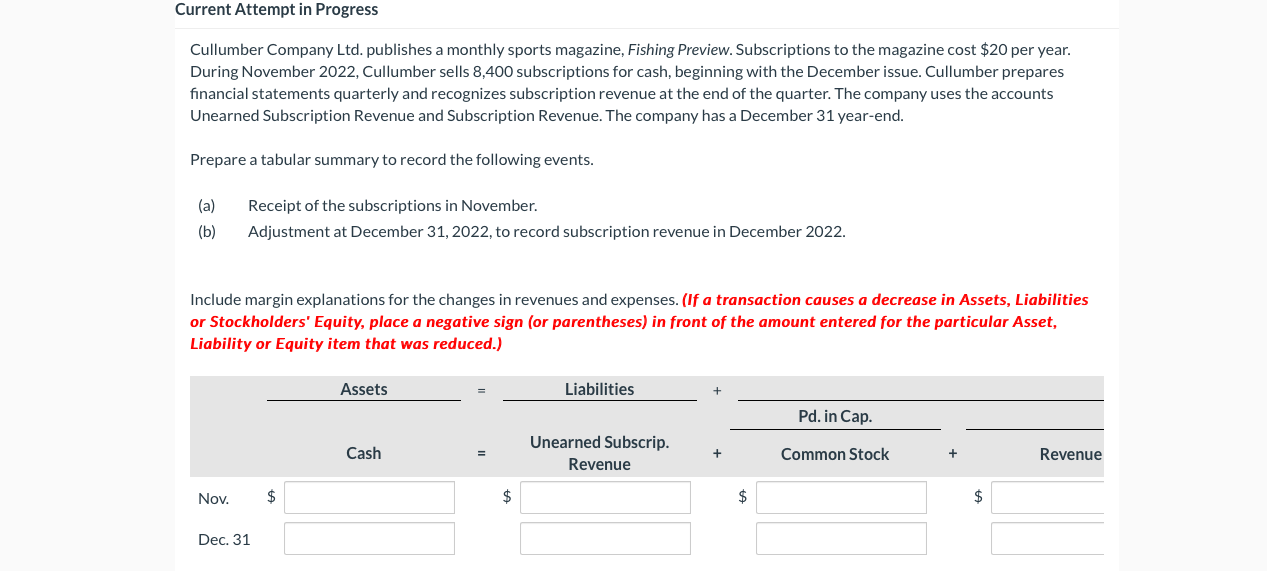

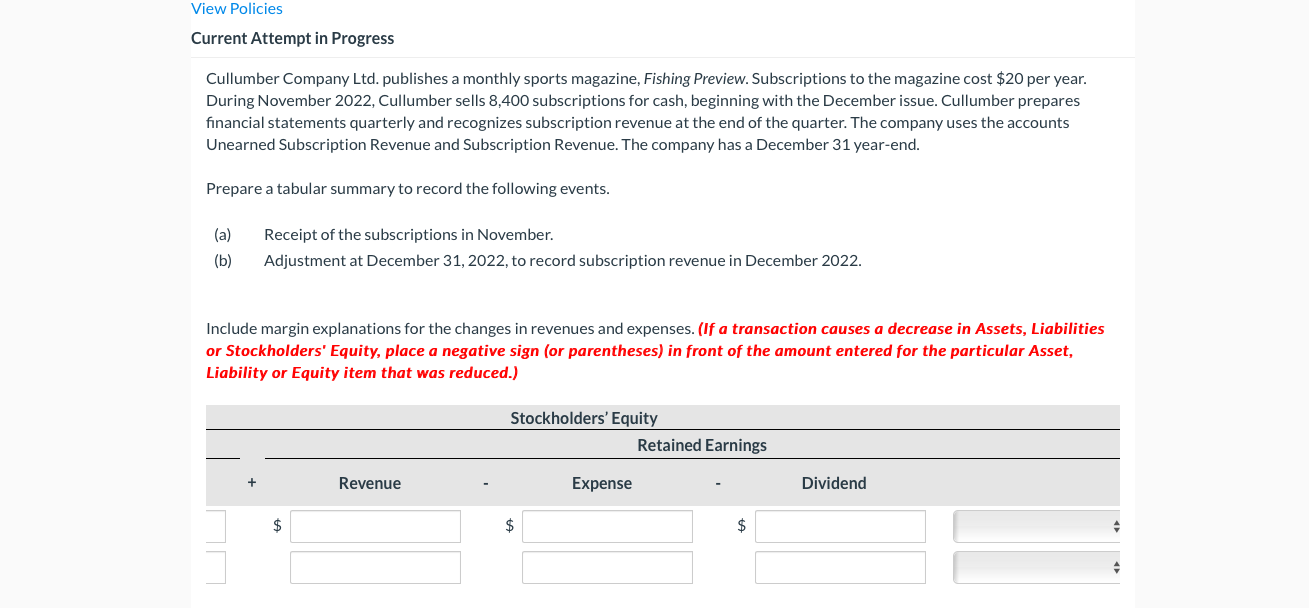

View Policies Current Attempt in Progress Riverbed Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $15,370. All sales are subject to a 6% sales tax. Compute sales taxes payable. Sales taxes payable $ Prepare a tabular summary to record sales taxes payable and sales. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Cash Sales Taxes Payable Common Stock Reveni Mar. 16 $ $ $ $ Current Attempt in Progress Riverbed Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $15,370. All sales are subject to a 6% sales tax. Compute sales taxes payable. Sales taxes payable $ Prepare a tabular summary to record sales taxes payable and sales. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings + Revenue Expense Dividend $ $ $ View Policies Current Attempt in Progress Monty University sells 5,000 season basketball tickets at $75 each for its 10-game home schedule. Prepare a tabular summary to record (a) the sale of the season tickets and (b) the revenue recognized after playing the first home game. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Cash Unearned Ticket Revenue + Common Stock + Revenue (a) $ $ $ (b) Current Attempt in Progress Monty University sells 5,000 season basketball tickets at $75 each for its 10-game home schedule. Prepare a tabular summary to record (a) the sale of the season tickets and (b) the revenue recognized after playing the first home game. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Expense + Revenue Dividend $ $ $ Current Attempt in Progress Cullumber Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $20 per year. During November 2022, Cullumber sells 8,400 subscriptions for cash, beginning with the December issue. Cullumber prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare a tabular summary to record the following events. (a) (b) Receipt of the subscriptions in November. Adjustment at December 31, 2022, to record subscription revenue in December 2022. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Pd. in Cap. Cash Unearned Subscrip. Revenue Common Stock Revenue Nov. $ $ $ $ Dec. 31 View Policies Current Attempt in Progress Cullumber Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $20 per year. During November 2022, Cullumber sells 8,400 subscriptions for cash, beginning with the December issue. Cullumber prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end. Prepare a tabular summary to record the following events. (a) Receipt of the subscriptions in November. Adjustment at December 31, 2022, to record subscription revenue in December 2022. (b) Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Retained Earnings Revenue Expense Dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts