Question: The aggregate quantity demanded AQD is equal to the sum of a. Real GDP, C, I, G, and X net of Mp b. The

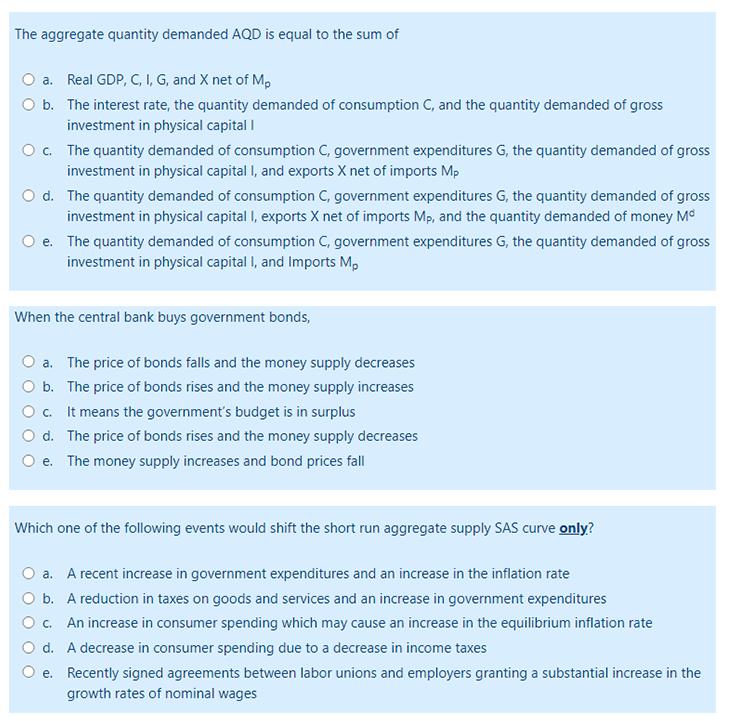

The aggregate quantity demanded AQD is equal to the sum of a. Real GDP, C, I, G, and X net of Mp b. The interest rate, the quantity demanded of consumption C, and the quantity demanded of gross investment in physical capital I O c. The quantity demanded of consumption C, government expenditures G, the quantity demanded of gross investment in physical capital I, and exports X net of imports Mp d. The quantity demanded of consumption C, government expenditures G, the quantity demanded of gross investment in physical capital I, exports X net of imports Mp, and the quantity demanded of money Mc e. The quantity demanded of consumption C, government expenditures G, the quantity demanded of gross investment in physical capital I, and Imports Mp When the central bank buys government bonds, a. The price of bonds falls and the money supply decreases b. The price of bonds rises and the money supply increases c. It means the government's budget is in surplus d. The price of bonds rises and the money supply decreases e. The money supply increases and bond prices fall Which one of the following events would shift the short run aggregate supply SAS curve only? a. A recent increase in government expenditures and an increase in the inflation rate b. A reduction in taxes on goods and services and an increase in government expenditures c. An increase in consumer spending which may cause an increase in the equilibrium inflation rate d. A decrease in consumer spending due to a decrease in income taxes e. Recently signed agreements between labor unions and employers granting a substantial increase in the growth rates of nominal wages

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below 1 The sum of quantity demanded of consu... View full answer

Get step-by-step solutions from verified subject matter experts