Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EBIT $ 600,000 g 0.0% r 10.0% Shares o/s 200,000 Taxes 25.0% NI $ 450,000 Before Recapitalization: Value of Ops $ 4,500,000 Value per share

| EBIT | $ 600,000 | |

| g | 0.0% | |

| r | 10.0% | |

| Shares o/s | 200,000 | |

| Taxes | 25.0% | |

| NI | $ 450,000 | |

| Before Recapitalization: | ||

| Value of Ops | $ 4,500,000 | |

| Value per share | $ 22.50 | |

| EPS | $ 2.25 | |

| 1:13 sthn 1h dialexh | ||

| Recap: | ||

| New debt | 30.0% | $ - |

| Rate on new debt | 7.00% | |

| Shares repurchased | - | |

| New shares o/s | ||

| New interest exp | $ - | |

| New NI: | ||

| EBIT | $ 600,000 | |

| Interest exp | $ - | |

| EBT | $ 600,000 | |

| Taxes | $ (150,000) | |

| New NI | $ 450,000 | |

| New EPS | #DIV/0! | |

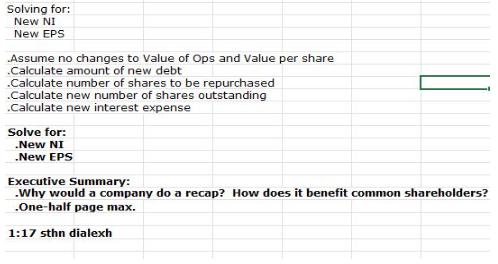

Solving for: New NI New EPS Assume no changes to Value of Ops and Value per share .Calculate amount of new debt .Calculate number of shares to be repurchased .Calculate new number of shares outstanding .Calculate new interest expense Solve for: .New NI .New EPS Executive Summary: .Why would a company do a recap? How does it benefit common shareholders? .One-half page max. 1:17 sthn dialexh

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Recap Assignment Solving for New NI New EPS Assume no changes to Value of Ops and Value per share Calculate amount of new debt The company should take ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started