Question: W G BS. FILE HOME Paste E Cut Copy Format Painter G Clipboard INSERT PAGE 10 OF 12 t A Assignment 1 - Word (Product

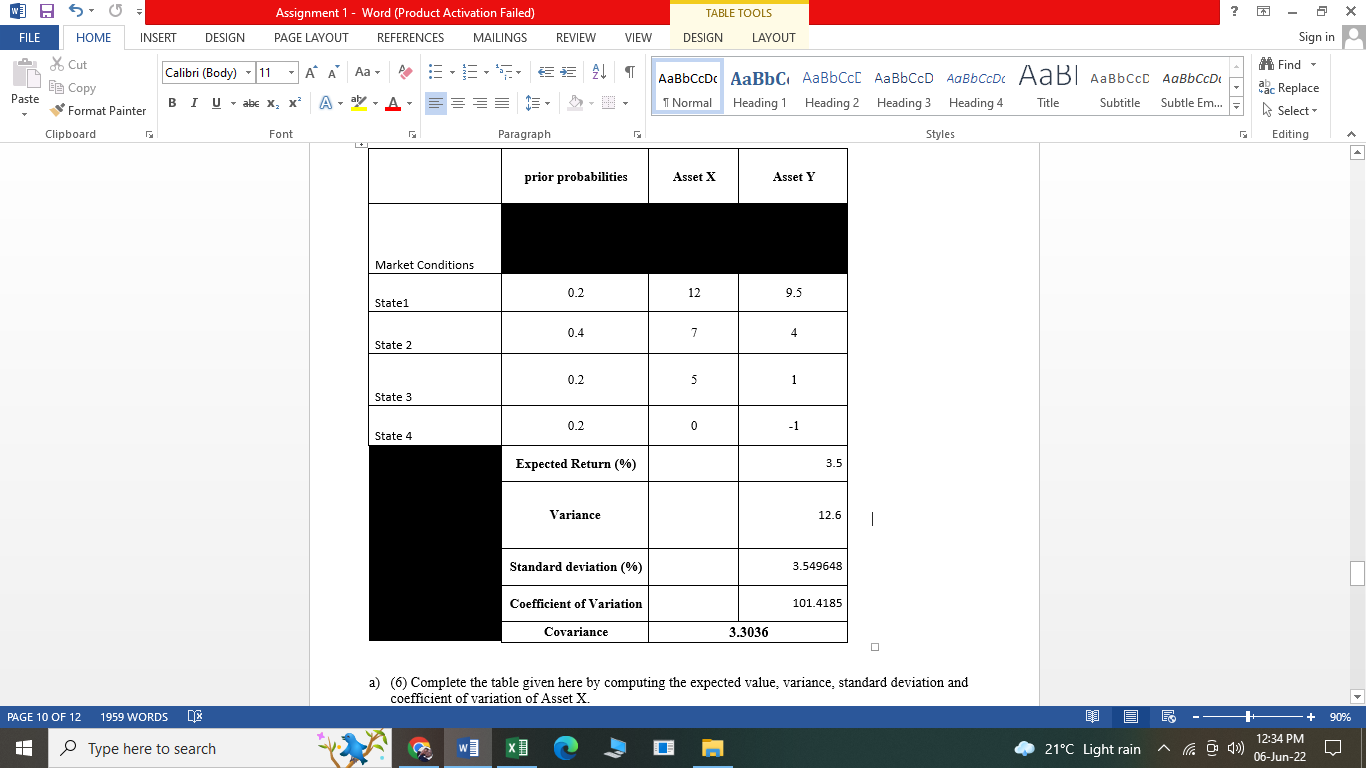

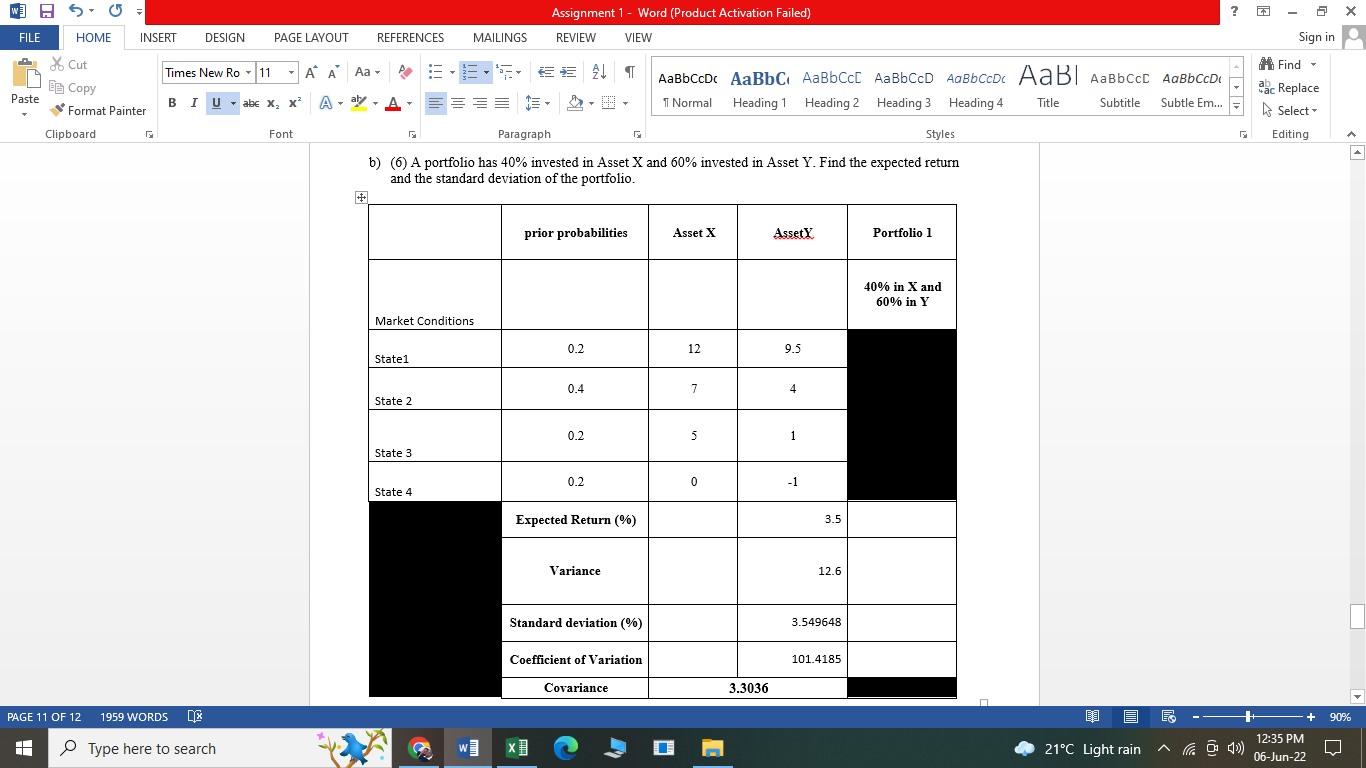

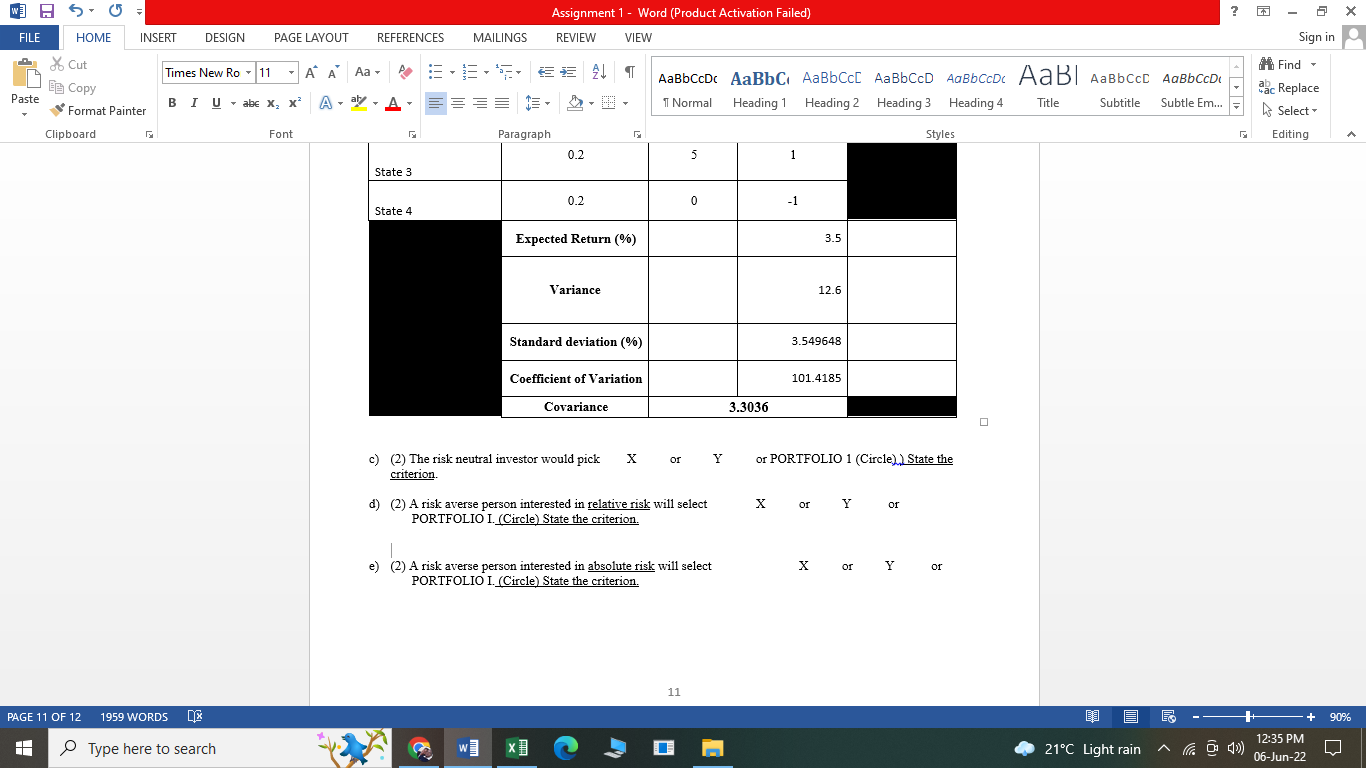

W G BS. FILE HOME Paste E Cut Copy Format Painter G Clipboard INSERT PAGE 10 OF 12 t A Assignment 1 - Word (Product Activation Failed) PAGE LAYOUT REFERENCES MAILINGS DESIGN Calibri (Body) 11 BIU abe X, X Font 1959 WORDS Type here to search A A Aa A. . A ? TABLE TOOLS REVIEW VIEW DESIGN LAYOUT Find == 2 AaBbccD AaBbC AaBbCc[ AaBbCcD AaBbCcDc AaBI AaBbcct AaBbCcD ab ac Replace Select Normal Heading 1 Subtitle Subtle Em... Heading 2 Heading 3 Heading 4 Title Styles Editing G Asset X 12 7 5 0 ES Paragraph G prior probabilities Market Conditions 0.2 State1 0.4 State 2 0.2 State 3 0.2 State 4 Expected Return (%) 3.5 Variance 12.6 Standard deviation (%) 3.549648 101.4185 Coefficient of Variation Covariance 3.3036 a) (6) Complete the table given here by computing the expected value, variance, standard deviation and coefficient of variation of Asset X. W X Asset Y 9.5 4 1 -1 I 21C Light rain ^ (4) 8 Sign in 12:34 PM 06-Jun-22 X + 90% WS G FILE HOME Paste Cut Copy Format Painter EE Clipboard INSERT DESIGN PAGE 11 OF 12 HH A G Times New Ro 11 BIUabe X X Font 1959 WORDS Type here to search PAGE LAYOUT REFERENCES P A A Aa A-al-A ? MAILINGS REVIEW VIEW AaBbccDc AaBbC AaBbCc[ AaBbCcD AaBbCcDc AaBI AaBbcct AaBbCcD A === Normal Heading 1 Subtitle Subtle Em... Heading 2 Heading 3 Heading 4 Title Styles Paragraph b) (6) A portfolio has 40% invested in Asset X and 60% invested in Asset Y. Find the expected return and the standard deviation of the portfolio. + prior probabilities Asset X Assety Portfolio 1 40% in X and 60% in Y Market Conditions 0.2 12 9.5 Statel 0.4 7 4 State 2 0.2 5 State 3 0.2 0 State 4 Expected Return (%) Variance Standard deviation (%) Coefficient of Variation Covariance W Assignment 1 - Word (Product Activation Failed) 5. ** 2 X 3.3036 1 -1 3.5 12.6 3.549648 101.4185 21C Light rain ^ (4) 8 Sign in Find ab ac Replace Select Editing 12:35 PM 06-Jun-22 X + 90% WS G FILE HOME Paste Cut Copy Format Painter EE Clipboard INSERT DESIGN PAGE LAYOUT PAGE 11 OF 12 HH A G REFERENCES Times New Ro 11 A A Aa BIU abe X, X Font 1959 WORDS Type here to search MAILINGS Assignment 1 - Word (Product Activation Failed) REVIEW VIEW ? Find AaBbccDc AaBbC AaBbCc[ AaBbCcD AaBbCcDc AaBI AaBbcct AaBbCcD ab Normal Heading 1 Heading 2 Heading 2 Heading Heading 3 Heading 4 Title 3 Subtitle Subtle Em... ac Replace Select Editing Styles 5 1 0 -1 SEN A-ay-A- ==== Paragraph 0.2 State 3 0.2 State 4 Expected Return (%) Variance Standard deviation (%) Coefficient of Variation Covariance or Y c) (2) The risk neutral investor would pick X criterion d) (2) A risk averse person interested in relative risk will select PORTFOLIO I. (Circle) State the criterion. e) (2) A risk averse person interested in absolute risk will select PORTFOLIO I. (Circle) State the criterion. 11 W X 3.5 12.6 3.549648 101.4185 or PORTFOLIO 1 (Circle)) State the X or Y or X or Y or 3.3036 0 21C Light rain ^ (4) 8 Sign in 12:35 PM 06-Jun-22 X A + 90% W G BS. FILE HOME Paste E Cut Copy Format Painter G Clipboard INSERT PAGE 10 OF 12 t A Assignment 1 - Word (Product Activation Failed) PAGE LAYOUT REFERENCES MAILINGS DESIGN Calibri (Body) 11 BIU abe X, X Font 1959 WORDS Type here to search A A Aa A. . A ? TABLE TOOLS REVIEW VIEW DESIGN LAYOUT Find == 2 AaBbccD AaBbC AaBbCc[ AaBbCcD AaBbCcDc AaBI AaBbcct AaBbCcD ab ac Replace Select Normal Heading 1 Subtitle Subtle Em... Heading 2 Heading 3 Heading 4 Title Styles Editing G Asset X 12 7 5 0 ES Paragraph G prior probabilities Market Conditions 0.2 State1 0.4 State 2 0.2 State 3 0.2 State 4 Expected Return (%) 3.5 Variance 12.6 Standard deviation (%) 3.549648 101.4185 Coefficient of Variation Covariance 3.3036 a) (6) Complete the table given here by computing the expected value, variance, standard deviation and coefficient of variation of Asset X. W X Asset Y 9.5 4 1 -1 I 21C Light rain ^ (4) 8 Sign in 12:34 PM 06-Jun-22 X + 90% WS G FILE HOME Paste Cut Copy Format Painter EE Clipboard INSERT DESIGN PAGE 11 OF 12 HH A G Times New Ro 11 BIUabe X X Font 1959 WORDS Type here to search PAGE LAYOUT REFERENCES P A A Aa A-al-A ? MAILINGS REVIEW VIEW AaBbccDc AaBbC AaBbCc[ AaBbCcD AaBbCcDc AaBI AaBbcct AaBbCcD A === Normal Heading 1 Subtitle Subtle Em... Heading 2 Heading 3 Heading 4 Title Styles Paragraph b) (6) A portfolio has 40% invested in Asset X and 60% invested in Asset Y. Find the expected return and the standard deviation of the portfolio. + prior probabilities Asset X Assety Portfolio 1 40% in X and 60% in Y Market Conditions 0.2 12 9.5 Statel 0.4 7 4 State 2 0.2 5 State 3 0.2 0 State 4 Expected Return (%) Variance Standard deviation (%) Coefficient of Variation Covariance W Assignment 1 - Word (Product Activation Failed) 5. ** 2 X 3.3036 1 -1 3.5 12.6 3.549648 101.4185 21C Light rain ^ (4) 8 Sign in Find ab ac Replace Select Editing 12:35 PM 06-Jun-22 X + 90% WS G FILE HOME Paste Cut Copy Format Painter EE Clipboard INSERT DESIGN PAGE LAYOUT PAGE 11 OF 12 HH A G REFERENCES Times New Ro 11 A A Aa BIU abe X, X Font 1959 WORDS Type here to search MAILINGS Assignment 1 - Word (Product Activation Failed) REVIEW VIEW ? Find AaBbccDc AaBbC AaBbCc[ AaBbCcD AaBbCcDc AaBI AaBbcct AaBbCcD ab Normal Heading 1 Heading 2 Heading 2 Heading Heading 3 Heading 4 Title 3 Subtitle Subtle Em... ac Replace Select Editing Styles 5 1 0 -1 SEN A-ay-A- ==== Paragraph 0.2 State 3 0.2 State 4 Expected Return (%) Variance Standard deviation (%) Coefficient of Variation Covariance or Y c) (2) The risk neutral investor would pick X criterion d) (2) A risk averse person interested in relative risk will select PORTFOLIO I. (Circle) State the criterion. e) (2) A risk averse person interested in absolute risk will select PORTFOLIO I. (Circle) State the criterion. 11 W X 3.5 12.6 3.549648 101.4185 or PORTFOLIO 1 (Circle)) State the X or Y or X or Y or 3.3036 0 21C Light rain ^ (4) 8 Sign in 12:35 PM 06-Jun-22 X A + 90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts