Question: W pographis please explain.. WEEK 2 Week 2 lecture summa Chego - Save up to 90% on te Question 2: In a paragraph please explain

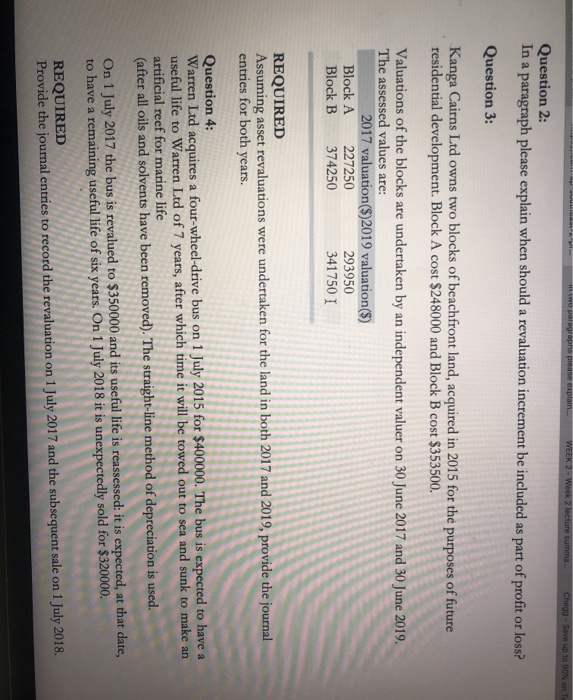

W pographis please explain.. WEEK 2 Week 2 lecture summa Chego - Save up to 90% on te Question 2: In a paragraph please explain when should a revaluation increment be included as part of profit or loss? Question 3: Kanga Cairns Ltd owns two blocks of beachfront land, acquired in 2015 for the purposes of future residential development. Block A cost $248000 and Block B cost $353500. Valuations of the blocks are undertaken by an independent valuer on 30 June 2017 and 30 June 2019. The assessed values are: 2017 valuation($)2019 valuation($) Block A 227250 293950 Block B 374250 341750 I REQUIRED Assuming asset revaluations were undertaken for the land in both 2017 and 2019, provide the journal entries for both years. Question 4: Warren Ltd acquires a four-wheel-drive bus on 1 July 2015 for $400000. The bus is expected to have a useful life to Warren Ltd of 7 years, after which time it will be towed out to sea and sunk to make an artificial reef for marine life (after all oils and solvents have been removed). The straight-line method of depreciation is used. On 1 July 2017 the bus is revalued to $350000 and its useful life is reassessed: it is expected, at that date, to have a remaining useful life of six years. On 1 July 2018 it is unexpectedly sold for $320000. REQUIRED Provide the journal entries to record the revaluation on 1 July 2017 and the subsequent sale on 1 July 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts