Question: W Table Window Help Insert Format Tools so- Draw Design 2 Document1 Insert Layout References Mailings Review View Tell me Share Times 12 A A

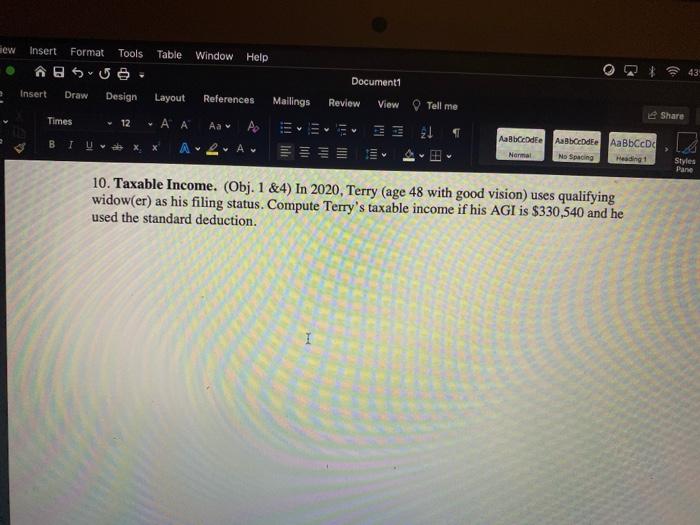

W Table Window Help Insert Format Tools so- Draw Design 2 Document1 Insert Layout References Mailings Review View Tell me Share Times 12 A A Aa 2 Asbende Aabende Normal AaBbccd No Spacing Styles Pane 10. Taxable Income. (Obj. 1 &4) In 2020, Terry (age 48 with good vision) uses qualifying widow(er) as his filing status. Compute Terry's taxable income if his AGI is $330,540 and he used the standard deduction. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts