Question: W WC Homework ( a. The future value in three years of $8,900 invested today in a certificate of deposit with interest compounded annually at

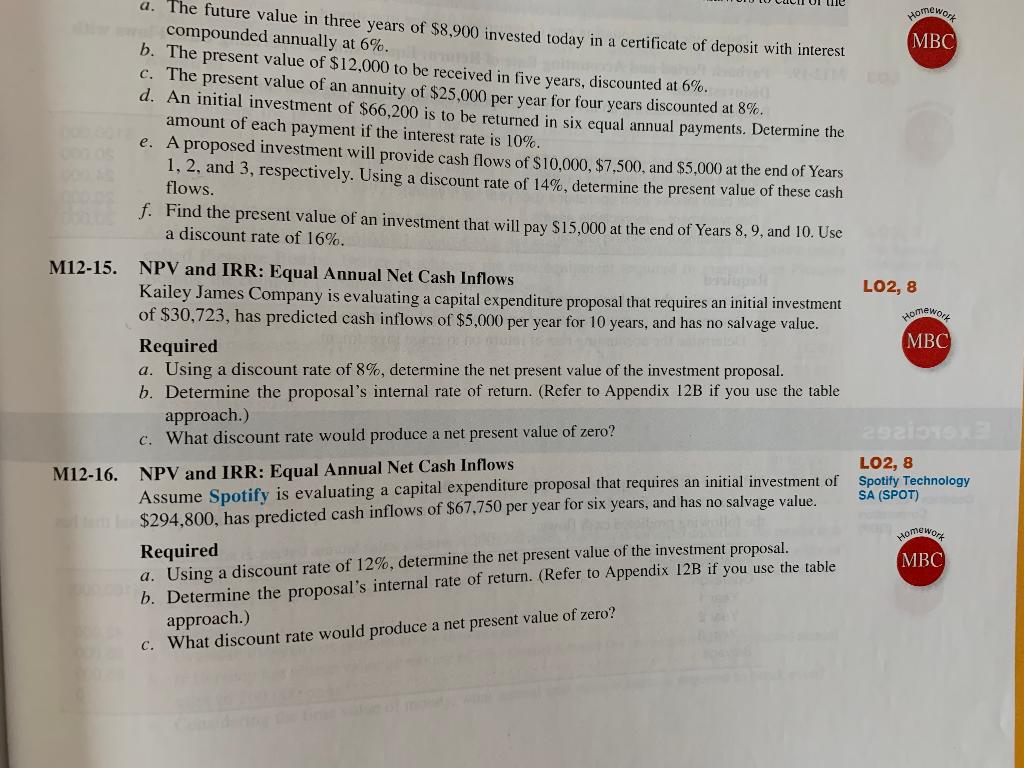

W WC Homework ( a. The future value in three years of $8,900 invested today in a certificate of deposit with interest compounded annually at 6%. b. The present value of $12,000 to be received in five years, discounted at 6%. c. The present value of an annuity of $25,000 per year for four years discounted at 8%. d. An initial investment of $66,200 is to be returned in six equal annual payments. Determine the amount of each payment if the interest rate is 10%. e. A proposed investment will provide cash flows of $10,000, $7,500, and $5,000 at the end of Years 1, 2, and 3, respectively. Using a discount rate of 14%, determine the present value of these cash flows. f. Find the present value of an investment that will pay $15,000 at the end of Years 8.9, and 10. Use a discount rate of 16%. M12-15. LO2, 8 Homework ( NPV and IRR: Equal Annual Net Cash Inflows Kailey James Company is evaluating a capital expenditure proposal that requires an initial investment of $30,723, has predicted cash inflows of $5,000 per year for 10 years, and has no salvage value. Required a. Using a discount rate of 8%, determine the net present value of the investment proposal. b. Determine the proposal's internal rate of return. (Refer to Appendix 12B if you use the table approach.) c. What discount rate would produce a net present value of zero? 2920 LO2,8 Spotify Technology SA (SPOT) M12-16. NPV and IRR: Equal Annual Net Cash Inflows Assume Spotify is evaluating a capital expenditure proposal that requires an initial investment of $294,800, has predicted cash inflows of $67,750 per year for six years, and has no salvage value. Required a. Using a discount rate of 12%, determine the net present value of the investment proposal. b. Determine the proposal's internal rate of return. (Refer to Appendix 12B if you use the table approach.) c. What discount rate would produce a net present value of zero? Home Wort (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts