Question: w2] Online ?Q Accounting 2 . Chapter 2 Assignment/takeAssignmentMain.do?invoker assignments&takeAssignmentSessionLocator-assignment-take&linprogress-false /e Mighty Safe Fire Alarm : Calculator Brunette Company is contemplating investing in a new

![w2] Online ?Q Accounting 2 . Chapter 2 Assignment/takeAssignmentMain.do?invoker assignments&takeAssignmentSessionLocator-assignment-take&linprogress-false /e](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e7cb4f897cd_89566e7cb4f10fd9.jpg)

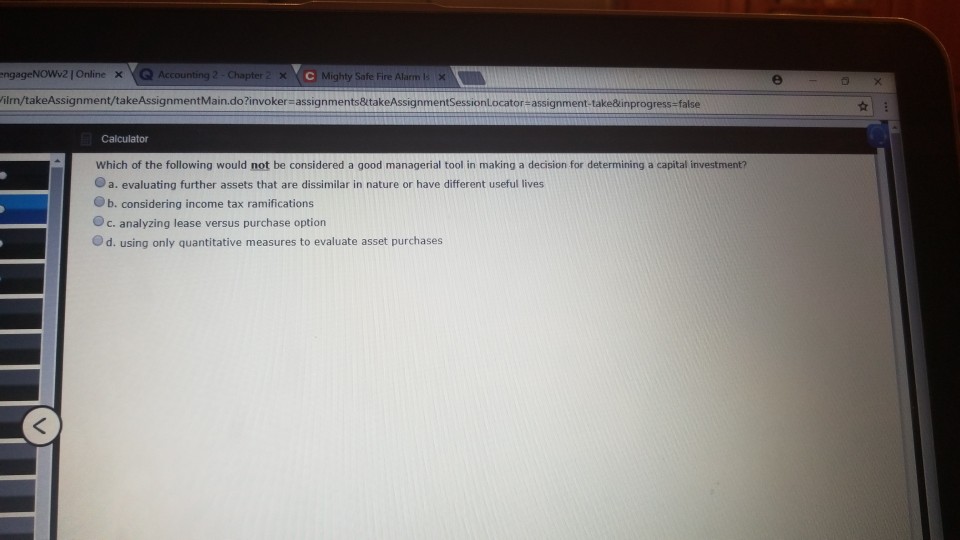

w2] Online ?Q Accounting 2 . Chapter 2 Assignment/takeAssignmentMain.do?invoker assignments&takeAssignmentSessionLocator-assignment-take&linprogress-false /e Mighty Safe Fire Alarm : Calculator Brunette Company is contemplating investing in a new piece of manufacturing machinery. The amount to be invested is $180,000. The present value of the future cash flows generated by the project is $163,000. Should they invest in this project? because the rate of return on the project exceeds the desired rate of return used to calculate the present value of the future Ob. no, because the rate of return on the project is less than the desired rate of return Oc. yes, because the rate of return on the project is equal to the de Od. no, because net present value is +$17,000 used to calculate the present value of the future cash flows sired rate of return used to calculate the present value of the future cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts